Selling alcoholic beverages is a privilege subject to both state and federal control. Each state has some sort of department of alcoholic beverage control. Most states regulate the liquor industry largely by means of licensing. Licenses may be denied for failure to meet specified qualifications on citizenship, residence, and moral character. Licenses may, on application to the liquor board, be transferred.

The Bureau of Alcohol, Tobacco and Firearms (ATF) within the Treasury Department exercises federal control over the liquor industry under the Liquor Enforcement Act of 1936 (18 U.S.C.A. §§ 1261 et seq.). These statutes authorize the ATF to enforce state statutes affecting the interstate liquor trade.

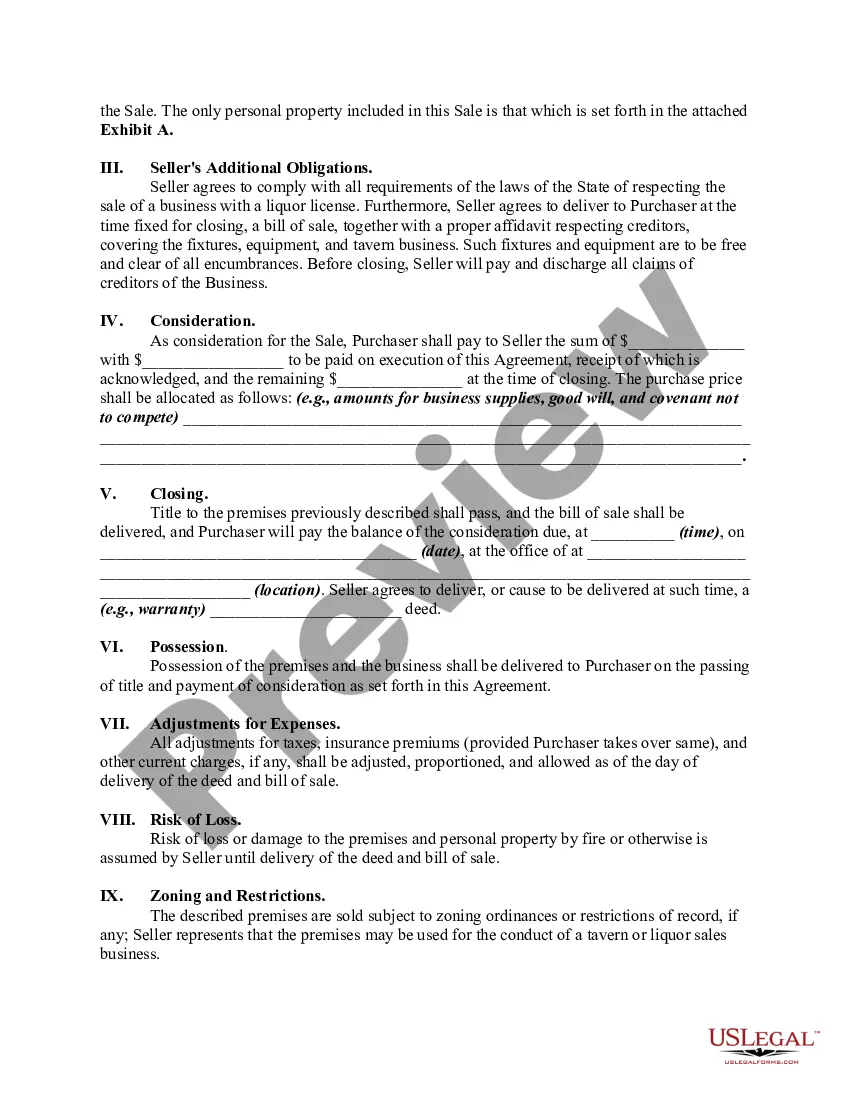

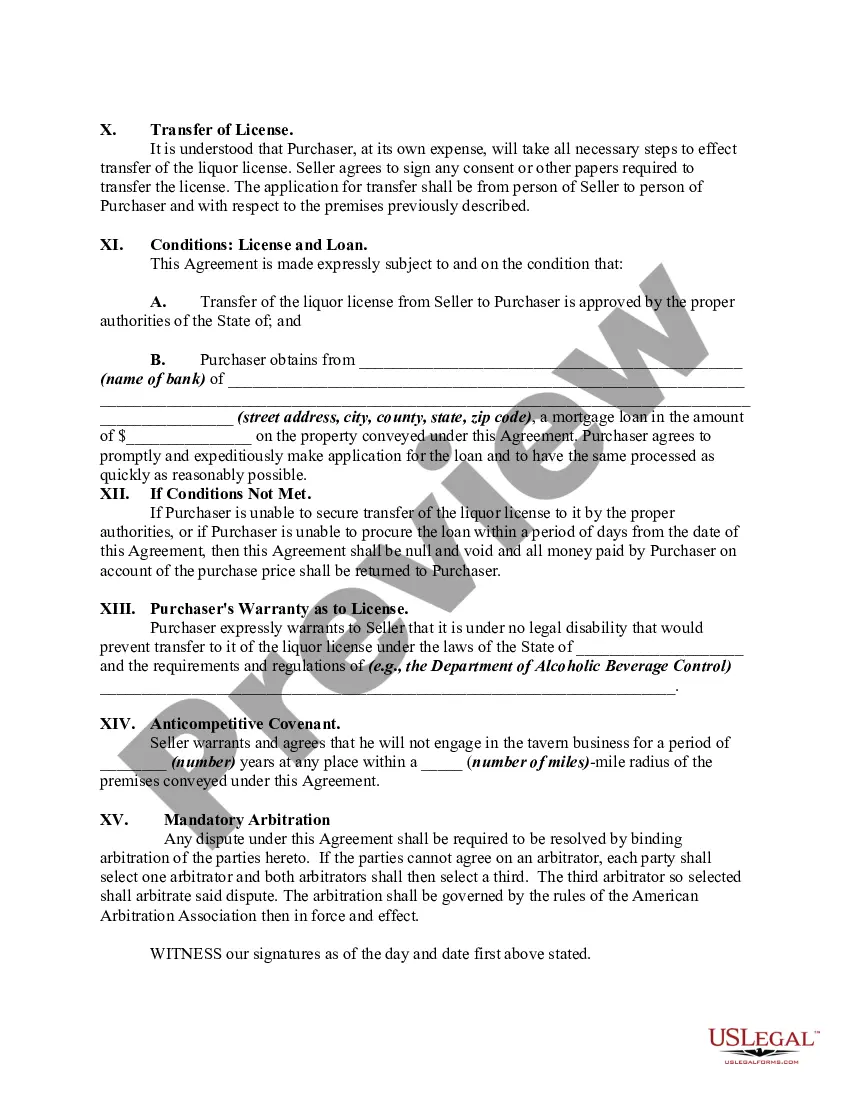

The following form seeks to transfer a tavern business and the liquor license governing the tavern (subject to the approval of the state liquor licensing board).

The Utah Agreement for Sale of a Tavern Business is a legal document that outlines the terms and conditions for the sale and purchase of a tavern business in the state of Utah. This agreement is considered a vital tool to ensure clarity, transparency, and legal protection for both the seller and buyer involved in the transaction. Keywords: Utah Agreement, Sale of Tavern Business, legal document, terms and conditions, purchase, seller, buyer, transaction. There are various types of Utah Agreement for Sale of a Tavern Business, each specifically tailored to accommodate various scenarios or specific details of the transaction. Some common types include: 1. Utah Agreement for Sale of a Tavern Business with Property: This type of agreement accommodates the sale of a tavern business along with the property it occupies. It encompasses additional clauses regarding the property's ownership, transfer, and any special considerations tied to the real estate involved. 2. Utah Agreement for Sale of a Tavern Business Only: This type of agreement focuses solely on the sale of the tavern business itself, without any inclusion of the property it operates in. It is typically used when the seller is leasing the property or when the buyer only wishes to acquire the business operations. 3. Utah Agreement for Sale of a Franchised Tavern Business: In cases where the tavern business operates as a franchise, this type of agreement is utilized. It incorporates specific clauses related to the franchise agreement, obligations, and requirements set forth by the franchisor. 4. Utah Agreement for Sale of a Tavern Business Assets: This agreement focuses on the sale of specific assets of the tavern business rather than the entire business itself. It can include items like equipment, inventory, licenses, or intellectual property. 5. Utah Agreement for Sale of a Partial Ownership Interest in a Tavern Business: When the sale involves the transfer of only a portion of the ownership of a tavern business, this type of agreement is employed. It outlines the details, rights, and responsibilities of the buyer as a partial owner. In any case, it is crucial to customize the agreement according to the specific details of the transaction to ensure that all parties are protected and that all necessary legal aspects are adequately addressed. It is advisable to consult with a lawyer experienced in business sales to assist in drafting and reviewing the agreement.