Title: Comprehensive Guide to Utah Letter to Creditors Notifying Them of Identity Theft Introduction: In the wake of growing identity theft cases, it is crucial for victims in Utah to respond promptly and protect themselves. One significant step towards this is notifying creditors about the identity theft issue. This article will provide a detailed description of what a Utah Letter to Creditors notifying them of Identity Theft entails. We will cover the essential components, key information to include, and various types of letters that can be used. Keywords: Utah Letter, Creditors, Identity Theft, Notify, Key Information, Types 1. Basic Components of a Utah Letter to Creditors: — Clear and concise header: Begin with a professional address including your name, contact information, and the date. — Recipient details: Address the letter to the specific creditor or their designated fraud department. — Subject line: Clearly state "Identity Theft Notification" or a similar phrase to grab attention. — Opening paragraph: Politely and clearly explain that the purpose of the letter is to report identity theft-related fraudulent activity. — Fraudulent accounts/information: Provide a detailed list of any fraudulent accounts or personal information that have been compromised. — Supporting documents: Enclose copies of any relevant documents such as police reports, fraud affidavits, or identity theft reports. — Request for investigation: Ask the creditor to investigate the matter and provide a prompt response. — Further steps: Suggest that they contact you to resolve the issue, and emphasize the importance of freezing or closing the fraudulent accounts. — Closing paragraph: Express appreciation for their cooperation and provide your contact details for further communication. — Sincerely, your name: End the letter with a proper closing and your signature. 2. Sample Utah Letter to Creditors Types: — Initial Letter: An initial letter is the first official communication to creditors, notifying them about identity theft and requesting immediate action to rectify the issue. — Follow-Up Letter: If the initial letter fails to yield a response or satisfactory resolution, a follow-up letter is sent to reiterate the urgency of the matter and stress the potential legal consequences of inaction. — Cease and Desist Letter: If a creditor continues to hold you responsible for fraudulent accounts or persistent debt collection efforts, a cease and desist letter demands the immediate cessation of such activities or warns of potential legal action. — Satisfaction Letter: Once the creditor has properly resolved the identity theft issue, you can send a satisfaction letter expressing gratitude for their cooperation and confirming that the matter has been satisfactorily resolved. Keywords: Initial Letter, Follow-Up Letter, Cease and Desist Letter, Satisfaction Letter, Prompt Response, Legal Consequences, Cooperation, Resolved Conclusion: Utah residents dealing with identity theft must act swiftly and notify creditors to mitigate further damage. Crafting a well-constructed Utah Letter to Creditors that includes all pertinent information is essential. Whether it is the initial letter, follow-up letter, cease and desist letter, or satisfaction letter, following the appropriate steps helps victims protect their rights and finances. Keywords: Utah residents, Craft, Pertinent Information, Protect, Rights, Finances.

Utah Letter to Creditors notifying them of Identity Theft

Description

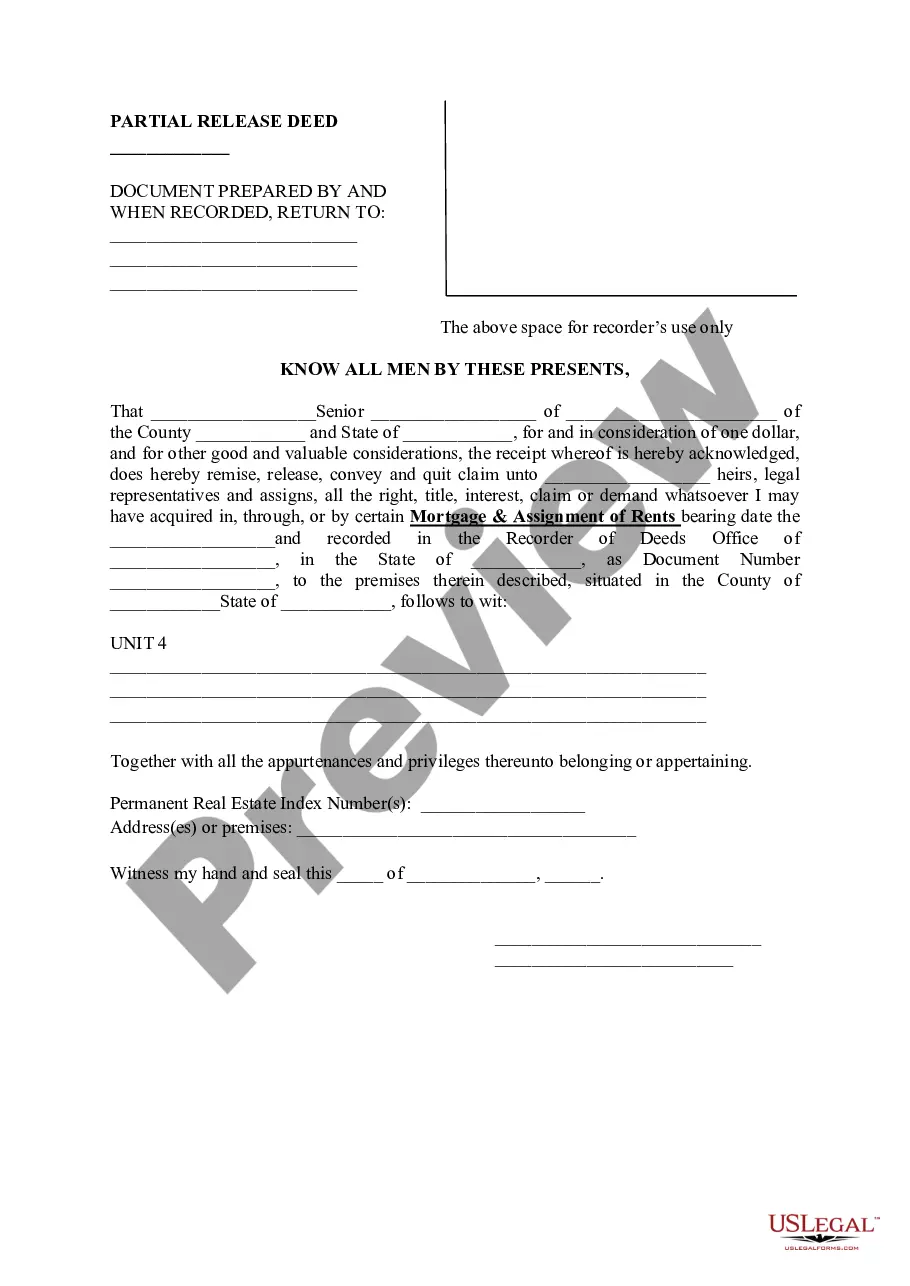

How to fill out Utah Letter To Creditors Notifying Them Of Identity Theft?

US Legal Forms - one of many biggest libraries of authorized forms in the USA - gives a wide array of authorized papers templates it is possible to obtain or produce. While using web site, you will get 1000s of forms for organization and personal uses, sorted by groups, states, or key phrases.You can get the latest variations of forms like the Utah Letter to Creditors notifying them of Identity Theft in seconds.

If you already possess a membership, log in and obtain Utah Letter to Creditors notifying them of Identity Theft through the US Legal Forms collection. The Acquire option can look on each and every kind you look at. You have access to all in the past acquired forms from the My Forms tab of your accounts.

In order to use US Legal Forms the very first time, allow me to share simple recommendations to help you started:

- Be sure to have picked the proper kind for the city/county. Click the Preview option to review the form`s information. Read the kind description to ensure that you have chosen the proper kind.

- In the event the kind doesn`t suit your demands, make use of the Research discipline on top of the monitor to obtain the the one that does.

- In case you are content with the shape, validate your decision by clicking the Get now option. Then, choose the pricing strategy you want and provide your qualifications to sign up for an accounts.

- Approach the transaction. Use your Visa or Mastercard or PayPal accounts to complete the transaction.

- Find the file format and obtain the shape in your device.

- Make modifications. Fill up, revise and produce and signal the acquired Utah Letter to Creditors notifying them of Identity Theft.

Every single format you included in your money does not have an expiry day and is also yours eternally. So, if you would like obtain or produce yet another version, just check out the My Forms portion and click about the kind you will need.

Get access to the Utah Letter to Creditors notifying them of Identity Theft with US Legal Forms, one of the most extensive collection of authorized papers templates. Use 1000s of specialist and state-distinct templates that meet your company or personal requires and demands.

Form popularity

FAQ

Under California law, you can report identity theft to your local police department. Ask the police to issue a police report of identity theft. Give the police as much information on the theft as possible. One way to do this is to provide copies of your credit reports showing the items related to identity theft.

Reporting Identity Theft to the Police Step 1: Obtain a Copy of Your FTC Identity Theft Report. After filing a report with the FTC, give the police a copy when you file a police report. ... Step 2: Provide a Photo ID. ... Step 3: Provide Your Address. ... Step 4: Provide Proof of Identity Theft.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Then visit IdentityTheft.gov or call 1-877-438-4338. Answer questions about what happened to you. Get a recovery plan that's just for you. You can create an account on the website.

What to do. The Utah Attorney General's Office is responsible for investigating and prosecuting identity theft crimes in Utah. If you are a Utah victim of identity theft, visit the Attorney General's ID Theft Central website: .

Class A Misdemeanor ? if the perpetrator stole less than $1,000, they can be sentenced to one year in jail and fined up to $2,500. Third-Degree Felony ? if the perpetrator stole more than $1,000 but less than $5,000, they can be sentenced to up to five years in prison and fined up to $5,000.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.