Utah Contract with Employee to Work in a Foreign Country: A Utah contract with an employee to work in a foreign country is a legally binding agreement between an employer based in Utah and an employee to carry out work or services outside the United States. This contract establishes the terms and conditions under which the employee will provide their services while operating in a foreign jurisdiction. It is essential to draft this contract in compliance with both Utah state employment laws and the laws of the foreign country where the employee will be working. Keywords: Utah, contract, employee, work, foreign country, agreement, terms and conditions, services, United States, jurisdiction, compliance, employment laws. Types of Utah Contract with Employee to Work in a Foreign Country: 1. Fixed-Term Contract: This type of contract specifies a predetermined period during which the employee will be engaged in work overseas. It outlines the start and end dates of the employment, ensuring that the employee is aware of the temporal nature of the agreement. 2. Open-Ended Contract: An open-ended contract provides greater flexibility as it does not have a specified end date. Instead, it typically includes provisions for termination with notice or upon the occurrence of certain events, allowing the employer or employee to end the contract on reasonable grounds. 3. Project-Based Contract: In certain situations where an employee is sent abroad to work on a specific project, a project-based contract can be utilized. This type of contract outlines the objectives, deliverables, and timeline of the project, ensuring that both the employer and employee are aligned on the scope of work. 4. Expat Assignment Contract: An expat assignment contract is applicable when an employee is relocated to a foreign country to work for a fixed period on behalf of their Utah-based employer. This contract usually includes provisions related to relocation assistance, housing, tax implications, and compensation packages, recognizing the unique circumstances of international assignments. 5. Secondment Contract: A secondment contract is relevant when an employee is temporarily assigned to work in a subsidiary or affiliate of their Utah employer in the foreign country. This contract clarifies the duration, responsibilities, and reporting structure during the assignment, maintaining a connection between the employee and the Utah company. It is important to consult legal counsel familiar with employment laws both in Utah and the foreign country in question to ensure that the specific terms and conditions of these contracts align with all relevant regulations and provide adequate protection for both parties involved.

Utah Contract with Employee to Work in a Foreign Country

Description

How to fill out Utah Contract With Employee To Work In A Foreign Country?

Are you in a situation where you often need documents for potential business or specific objectives nearly every day.

There are numerous legitimate form templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Utah Contract with Employee to Work in a Foreign Country, designed to meet state and federal requirements.

Select the pricing plan you prefer, provide the required information to create your account, and pay using your PayPal or Visa or Mastercard.

Choose a suitable format and download your copy. Access all the form templates you have purchased in the My documents menu. You can download another copy of the Utah Contract with Employee to Work in a Foreign Country at any time, if necessary. Simply select the form you need to download or print the document template. Use US Legal Forms, one of the largest repositories of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal form templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Contract with Employee to Work in a Foreign Country template.

- If you do not have an account and want to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

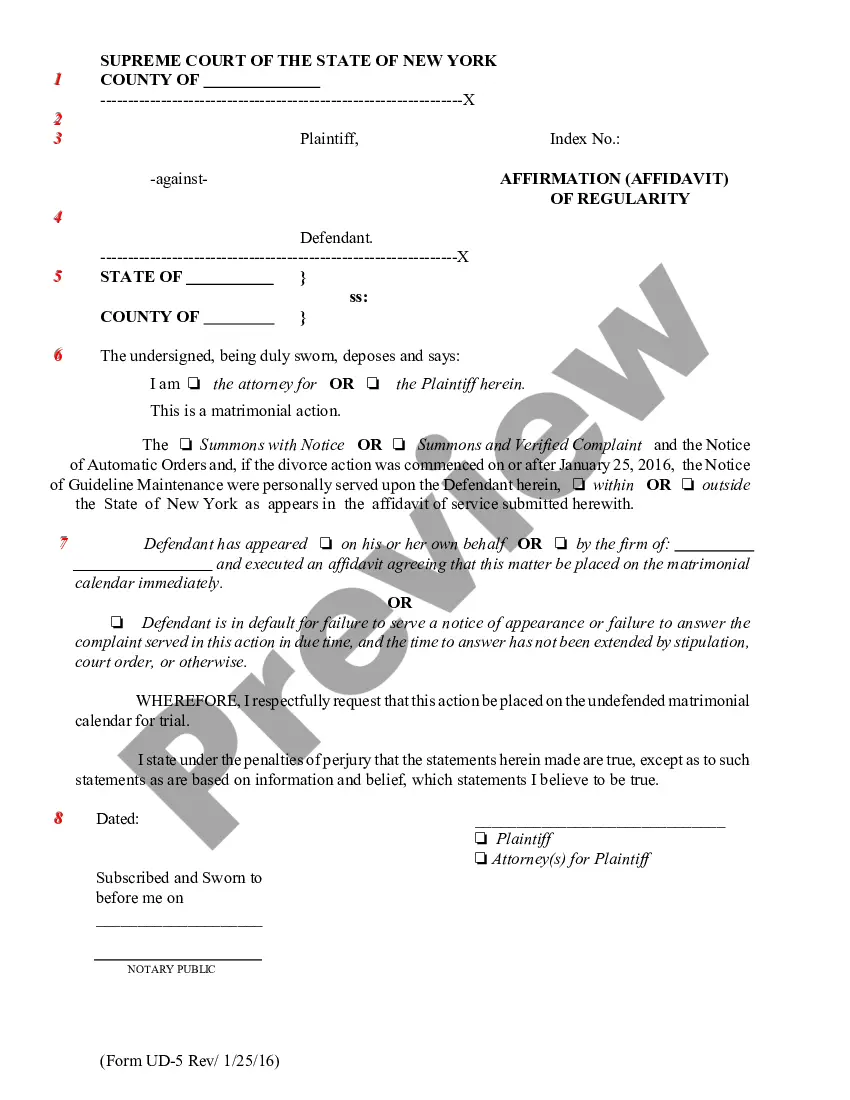

- Utilize the Preview button to review the form.

- Examine the description to confirm you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

- Once you find the appropriate form, click Get now.

Form popularity

FAQ

To amend your Utah tax return, you would use Form TC-40A, which allows for corrections to previously filed returns. If errors arise from your Utah Contract with Employee to Work in a Foreign Country, this form helps ensure your tax records are accurate and updated.

To file your Utah state taxes, you typically use Form TC-40. If you are working internationally under a Utah Contract with Employee to Work in a Foreign Country, ensure you have all necessary income details to complete this form accurately and on time.

The 183 day rule in Utah states that if you are in the state for 183 days or more during a tax year, you are considered a resident for tax purposes. This is particularly relevant in situations involving a Utah Contract with Employee to Work in a Foreign Country, as it can affect your tax liabilities significantly.

The TC 75 form in Utah is used for reporting sales and use tax. This form is crucial for businesses, and if you're engaging an international workforce via a Utah Contract with Employee to Work in a Foreign Country, understanding this aspect can enhance compliance and streamline your tax obligations.

For foreign independent contractors, you typically use Form W-8BEN to establish their foreign status. If you're employing someone under a Utah Contract with Employee to Work in a Foreign Country, ensure you complete this form, as it helps in avoiding unnecessary tax withholding.

Any corporation earning income in Utah must file a corporate tax return. This includes corporations with employees working under a Utah Contract with Employee to Work in a Foreign Country. Be sure to check the specifics of your situation, as various rules may apply.

Issuing a 1099 to an employee working from another country can be complicated. Generally, if they are classified as an independent contractor rather than an employee, you may be able to do so. However, ensure compliance with both Utah and federal guidelines when engaging in a Utah Contract with Employee to Work in a Foreign Country.

Yes, if you earn income in Utah, you may need to make estimated tax payments. This applies especially if you enter a Utah Contract with Employee to Work in a Foreign Country and anticipate a tax liability. It’s crucial to calculate your expected income accurately and make these payments on time to avoid penalties.

Contracts for international employees are legal agreements that outline the terms of employment for individuals working in a foreign country. These contracts can encompass various elements including salary, duration, and legal obligations. Implementing a Utah Contract with Employee to Work in a Foreign Country is vital for ensuring both compliance and understanding between the employer and the employee.

An overseas contract worker is someone contracted to work outside their home country for a specified period. This role can come with unique challenges, such as navigating different employment laws and cultural norms. Utilizing a Utah Contract with Employee to Work in a Foreign Country can facilitate compliance and clarify the working relationship.