Title: Utah Checklist for Remedying Identity Theft of Deceased Persons — A Comprehensive Guide Introduction: Identity theft is a concerning issue that affects not only the living but also the deceased. In an effort to combat this growing problem, the state of Utah has established a Checklist for Remedying Identity Theft of Deceased Persons. This detailed guide outlines the necessary steps and precautions to help alleviate the impact of identity theft on deceased individuals. Types of Utah Checklists for Remedying Identity Theft of Deceased Persons: 1. Basic Checklist: — Reporting the identity theft to the appropriate authorities. — Gathering essential documents, such as the death certificate and proof of relationship to the deceased. — Contacting financial institutions, credit bureaus, and government agencies to inform them about the identity theft. — Freezing the deceased person's credit reports and monitoring for unauthorized activities. 2. Legal Checklist: — Consulting with an attorney to understand the legal aspects of identity theft for deceased individuals. — Initiating the probate process to ensure proper handling of the deceased person's estate and financial affairs. — Requesting a court order or power of attorney to access and manage the deceased person's accounts. — Collaborating with law enforcement agencies and prosecutors, if necessary, to build a case against the identity thief. 3. Estate Checklist: — Reviewing the deceased person's will, trusts, or estate plan to identify and address potential vulnerabilities to identity theft. — Notifying relevant estate representatives, such as executors or trustees, about the identity theft. — Taking necessary steps to safeguard the deceased person's assets, including changing account passwords and securing digital information. — Removing the deceased person's personal information from public directories and databases. 4. Documentation Checklist: — Keeping a detailed record of all communication, including dates, names, and copies of correspondence. — Creating an inventory of the deceased person's accounts, credit cards, and personal information. — Maintaining copies of all relevant documents, including police reports, court orders, and notifications sent to financial institutions. Conclusion: The Utah Checklist for Remedying Identity Theft of Deceased Persons is designed to help individuals navigate the complex process of addressing identity theft affecting deceased loved ones. By following these checklists, residents of Utah can take proactive measures to protect the deceased individual's identity, assets, and estate. Remember, timely reporting and collaboration with the appropriate authorities are crucial in successfully remedying such identity theft cases.

Utah Checklist for Remedying Identity Theft of Deceased Persons

Description

How to fill out Utah Checklist For Remedying Identity Theft Of Deceased Persons?

Choosing the right lawful record design could be a struggle. Of course, there are a lot of themes available online, but how can you discover the lawful kind you want? Make use of the US Legal Forms website. The services provides thousands of themes, like the Utah Checklist for Remedying Identity Theft of Deceased Persons, which can be used for organization and personal demands. All the types are checked by specialists and fulfill state and federal specifications.

Should you be currently signed up, log in to the accounts and click on the Acquire switch to get the Utah Checklist for Remedying Identity Theft of Deceased Persons. Use your accounts to appear throughout the lawful types you have purchased formerly. Visit the My Forms tab of the accounts and get an additional copy from the record you want.

Should you be a whole new user of US Legal Forms, listed below are easy directions so that you can stick to:

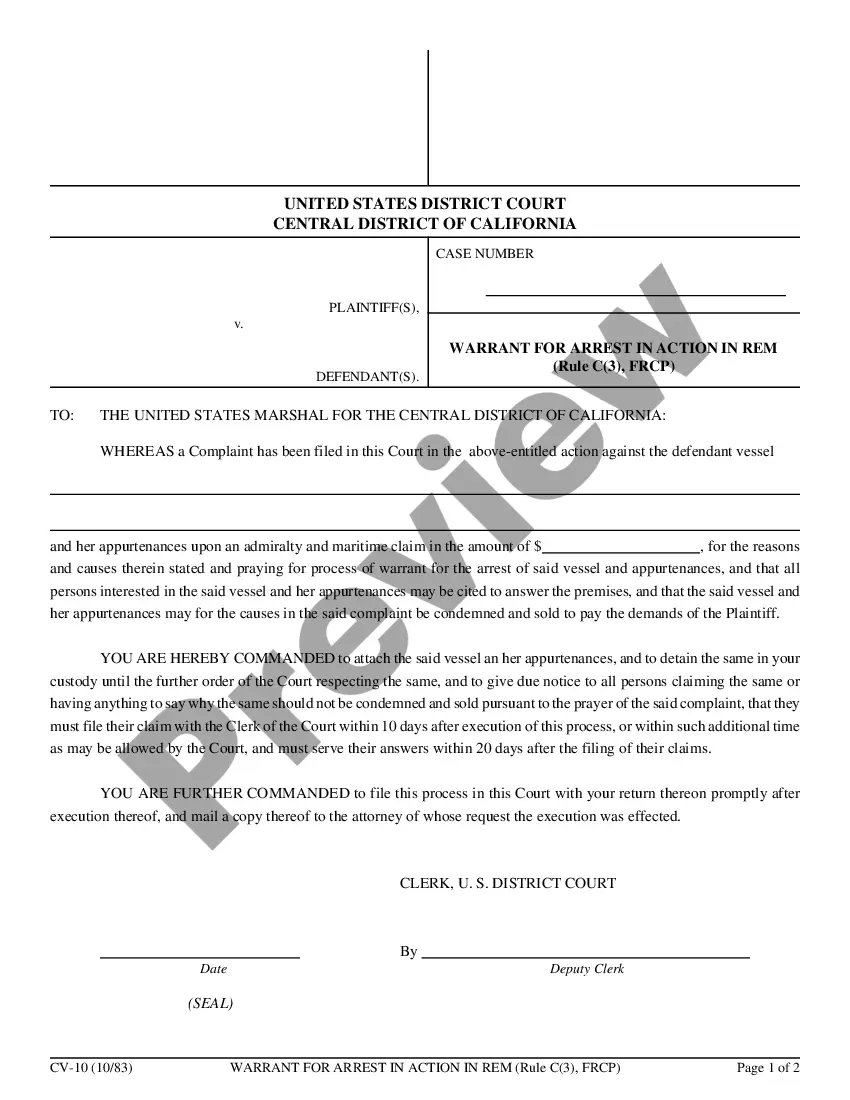

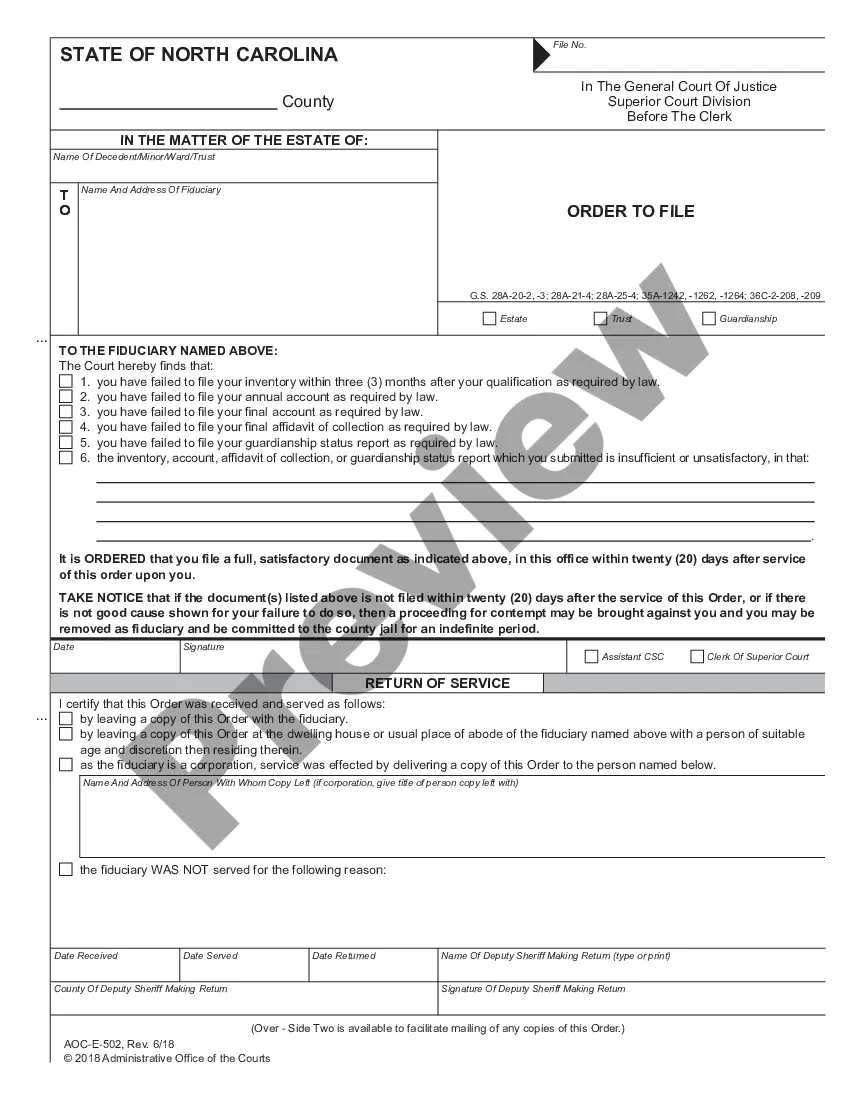

- Initially, make certain you have chosen the right kind for the city/county. You are able to look through the form using the Review switch and browse the form outline to guarantee this is the best for you.

- In the event the kind fails to fulfill your needs, use the Seach area to discover the right kind.

- Once you are sure that the form is proper, click the Purchase now switch to get the kind.

- Select the prices program you want and enter in the essential info. Create your accounts and pay money for your order with your PayPal accounts or charge card.

- Pick the data file format and download the lawful record design to the system.

- Full, change and printing and indication the received Utah Checklist for Remedying Identity Theft of Deceased Persons.

US Legal Forms is definitely the greatest catalogue of lawful types where you can see various record themes. Make use of the service to download expertly-manufactured papers that stick to state specifications.

Form popularity

FAQ

Scan credit card and bank statements for unauthorized charges. File a Claim With Your Identity Theft Insurance. ... Notify Companies of Your Stolen Identity. ... File a Report With the Federal Trade Commission. ... Contact Your Local Police Department. ... Place a Fraud Alert on Your Credit Reports. ... Freeze Your Credit.

Tools/Resources for Victims Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Avoid listing birth date, maiden name, or other personal identifiers in obituaries as they could be useful to ID thieves. Report the death to the Social Security Administration by calling 800-772-1213. Order multiple certified copies of the death certificate with and without cause of death.

There are five steps you should take right away if someone steals your identity: See if you have identity theft insurance. Contact the relevant companies. Report the theft to the FTC and the police. Add a fraud alert to your credit reports. Freeze your consumer reports.

The first step of your recovery plan is to call the credit bureaus. Ask the credit bureau for an initial fraud alert. It is free and lasts for 90 days. The fraud alert makes it harder for thieves to open accounts in your name.

What To Do If Your Identity Is Stolen: 11 Steps To Avoid Financial Ruin Contact your insurance provider. Freeze your credit. Check your credit reports. File an official identity theft report. Report the crime to local law enforcement. Notify your bank and credit card issuer. Secure your accounts with 2FA.

The Federal Trade Commission (FTC) estimates that it can take approximately six months and 200 hours of work to recover from an identity theft. This estimation is based on the amount of work needed to follow the necessary steps to ensure the victim is not responsible for the debt incurred.

To date, 453.7 million different numbers have been issued. Q20: Are Social Security numbers reused after a person dies? A: No. We do not reassign a Social Security number (SSN) after the number holder's death.