Utah Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

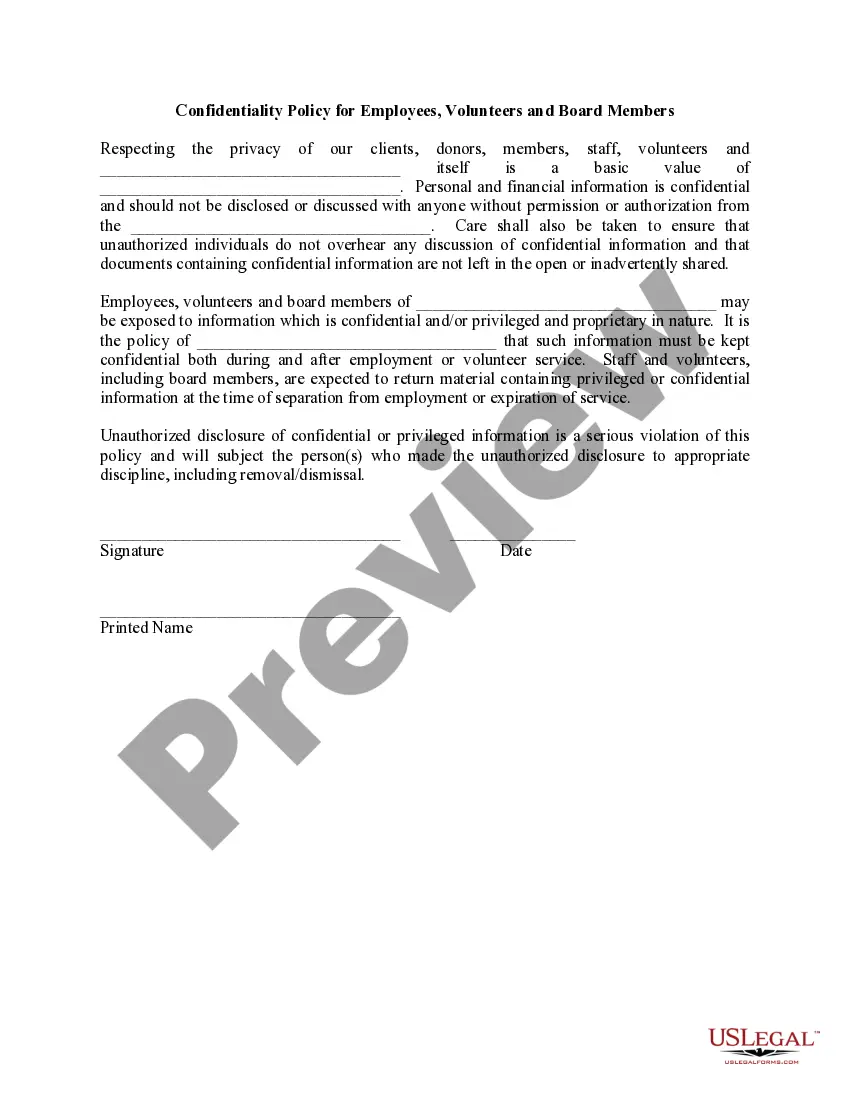

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Locating the appropriate legitimate document template may be challenging. Clearly, there are numerous templates available online, but how can you identify the correct type you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the Utah Sample Letter to City Clerk regarding Ad Valorem Tax Exemption, suitable for both business and personal purposes. All the forms are vetted by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and select the Acquire button to obtain the Utah Sample Letter to City Clerk regarding Ad Valorem Tax Exemption. Use your account to browse through the legal forms you may have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, make sure you have selected the correct form for your area/county. You can preview the document using the Review option and read the document details to confirm this is indeed the right choice for you. If the form does not meet your requirements, use the Search field to locate the appropriate form. Once you are confident that the document is suitable, click on the Acquire now button to purchase the form. Choose the pricing plan you prefer and input the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Fill out, edit, print, and sign the obtained Utah Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

By following these steps, you can efficiently obtain the legal documents you require from US Legal Forms.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to download properly crafted documents that adhere to state regulations.

- Ensure you have selected the correct form for your area/county.

- Use the Review option to preview the document details.

- If necessary, use the Search field to find the right form.

- Complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

FindLaw Newsletters Stay up-to-date with how the law affects your life Code SectionUtah Code 78B-5-501, et seq.: Utah Exemptions ActMax. Property Value That May Be Designated 'Homestead'$5,000 if property is not primary personal residence, $20,000 if property is primary personal residenceMaximum Acreage (Urban)-1 more row

Residential properties that serve as the property owner's or a tenant's primary residence for a minimum of 183 days per calendar year receive an exemption of 45% of fair market value. As a result, the primary residence is only assessed and taxed based on the remaining 55% of its fair market value.

Property Tax CB75+ Deferral: If you are 75 or older and qualify for property tax deferral, you won't need to pay the tax each year, but it will accrue with interest.

Most homeowners in Utah receive a 45% exemption from property tax on their home (primary residence). A primary residence is defined as a home that serves as someone's primary domicile and is occupied for at least 183 consecutive days in a year.

The primary residential exemption is a 45% property tax exemption on most homes in Utah. This means you only pay property taxes on 55% of your home's fair market value. You may be eligible for the primary residential exemption if you occupy your home for 183 consecutive days or more in a calendar year.

General Information. The Utah State Constitution, Article XIII, § 3, allows County Assessors to exempt from taxation 45% of the fair market value of residential property and up to one acre of land. Statute defines residential property, for purposes of the exemption, to be a primary residence.