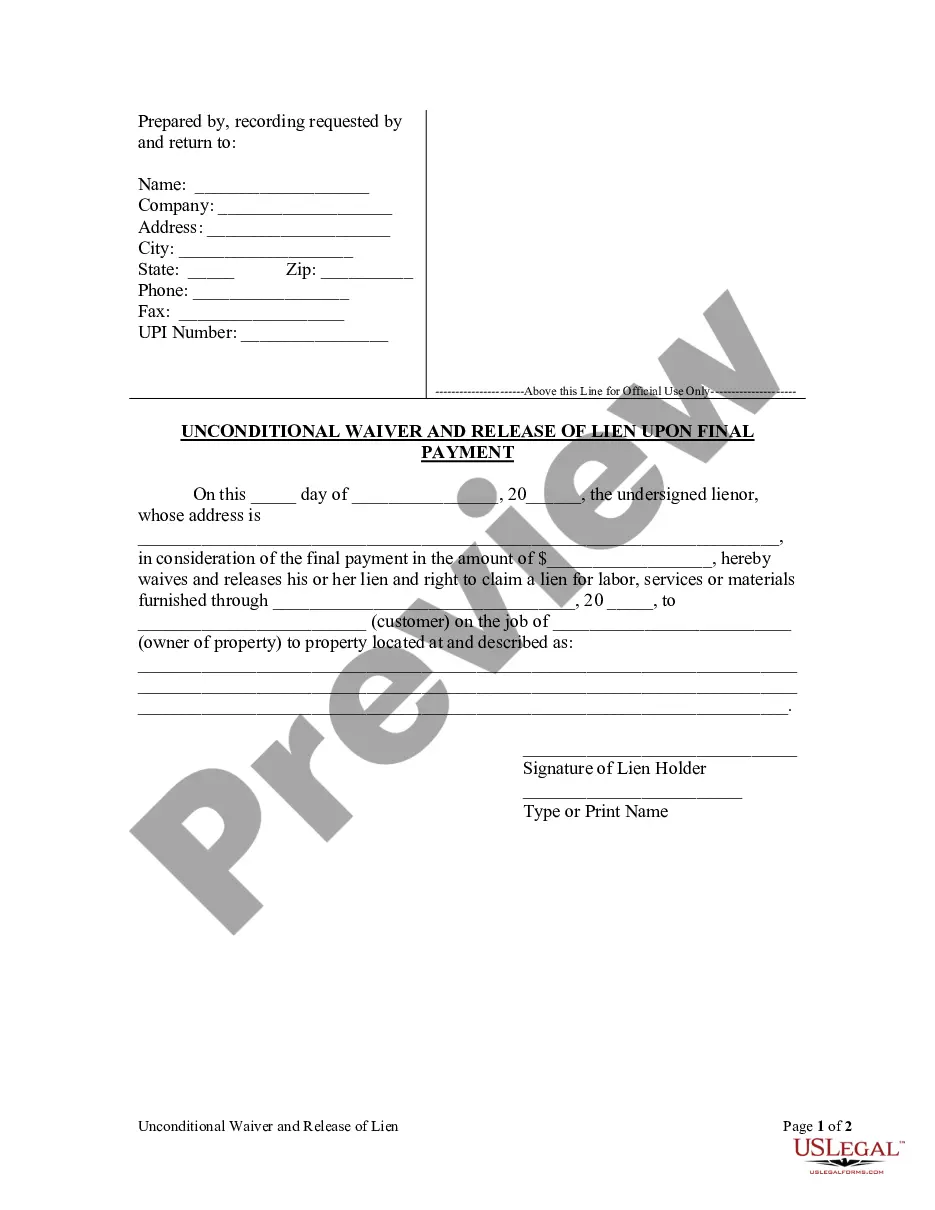

Utah Receipt as Payment in Full

Description

How to fill out Receipt As Payment In Full?

Are you presently in a location where you might require documents for business or personal reasons almost daily.

There is a range of valid document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers thousands of form templates, such as the Utah Receipt as Payment in Full, designed to comply with state and federal standards.

Choose the pricing plan you want, complete the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

Select a convenient document format and download your copy. Retrieve all the document templates you have purchased in the My documents section. You can obtain another copy of the Utah Receipt as Payment in Full at any time if desired. Just select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Utah Receipt as Payment in Full template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and verify that it is for the correct city/state.

- Use the Review button to check the form.

- Read the description to ensure that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to locate the form that meets your needs.

- Once you find the right form, click Buy now.

Form popularity

FAQ

Utah does not impose a gross receipts tax on businesses. However, certain taxes may apply based on specific transactions and types of businesses. Understanding the nuances of tax obligations can be complex, especially regarding payments and receipts. Utilizing services like US Legal Forms can help clarify these responsibilities and ensure you can manage your obligations efficiently, including understanding how a Utah Receipt as Payment in Full fits into your overall tax strategy.

The TC 75 is a legal document in Utah that relates to the use of a receipt as payment in full. When parties agree that a payment will settle any debt, a TC 75 serves as proof of this arrangement. This form helps individuals protect their rights by clarifying that no further claims can be made once the payment is accepted. Utilizing the TC 75 reinforces the importance of a Utah Receipt as Payment in Full, ensuring all parties understand their obligations.

Yes, Utah does require estimated tax payments for certain taxpayers. If you expect to owe more than a specified amount in taxes, making estimated payments ensures you stay compliant and avoid underpayment penalties. It is beneficial to track your income and expenses closely. For detailed guidance, consider resources available on uslegalforms for calculating and submitting estimated payments.

The Utah TC 65 form should be filed with the Utah State Tax Commission. You can choose to file it online or by mailing a paper copy to their office. It is important to check for any specific requirements based on your situation. Using platforms like uslegalforms can help streamline the process and ensure accuracy.

You can file your Utah TC 40 form with the Utah State Tax Commission. Make sure to submit it by the tax deadline to avoid penalties. Filing online through the state's e-services portal is an efficient option. Always keep a copy for your records to ensure you have proof of filing and compliance.

Yes, if your business sells goods or services subject to sales tax in Utah, you are required to obtain a sales tax account. This account allows you to collect the appropriate sales tax from customers and remit it to the state. Failure to register can lead to penalties and back taxes, so it’s crucial to comply. When managing your sales tax, using a Utah Receipt as Payment in Full can help document transactions effectively.

Receiving a letter from the Utah State Tax Commission usually indicates there is an issue or a need for clarification regarding your tax filings. This could concern discrepancies in reported income, outstanding payments, or changes to tax laws. It’s important to respond promptly and thoroughly to any correspondence. Keeping records, including a Utah Receipt as Payment in Full, can help clarify your situation.

In Utah, the statute of limitations for tax assessments is typically three years from the due date of the return. However, this period can extend if certain conditions are met, such as underreporting income. It is advisable to keep thorough records, including any Utah Receipt as Payment in Full, to defend against potential issues. By maintaining these records, you can better understand your obligations and any potential audit situations.

Yes, Utah follows the 183-day rule, which affects how residents are taxed. This rule generally applies to those who spend a significant number of days in the state and can impact their tax obligations. Understanding this rule is important for anyone considering residency or working in Utah. Ensure you keep track of your days to avoid complications with your tax responsibilities, potentially using a Utah Receipt as Payment in Full as documentation.