Utah Sample Letter for Motion to Dismiss in Referenced Bankruptcy

Description

How to fill out Sample Letter For Motion To Dismiss In Referenced Bankruptcy?

It is possible to invest hours on the Internet searching for the lawful record design that fits the state and federal requirements you require. US Legal Forms provides thousands of lawful kinds which are reviewed by professionals. It is possible to download or print out the Utah Sample Letter for Motion to Dismiss in Referenced Bankruptcy from my support.

If you already have a US Legal Forms accounts, it is possible to log in and click the Obtain key. Afterward, it is possible to comprehensive, modify, print out, or indicator the Utah Sample Letter for Motion to Dismiss in Referenced Bankruptcy. Every single lawful record design you purchase is your own property for a long time. To obtain an additional duplicate of the purchased develop, check out the My Forms tab and click the corresponding key.

Should you use the US Legal Forms site the very first time, follow the simple instructions below:

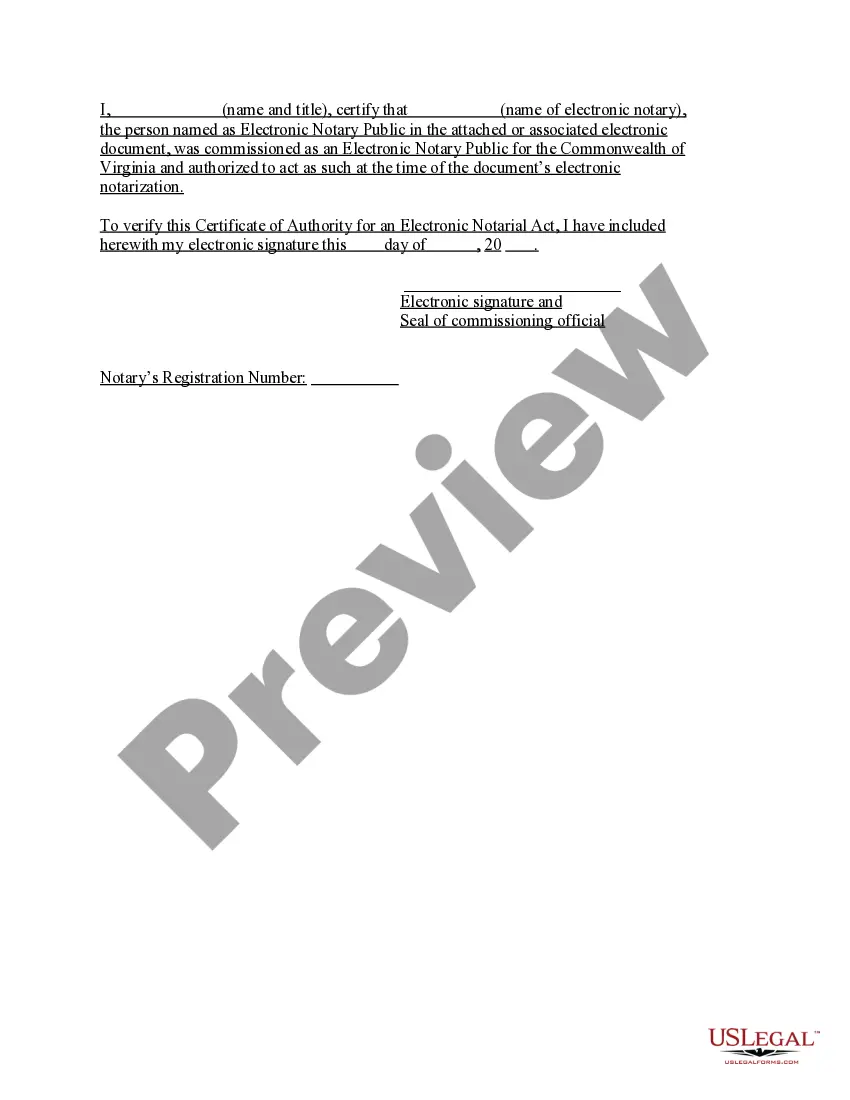

- Very first, be sure that you have selected the correct record design for the county/town that you pick. Browse the develop description to make sure you have chosen the appropriate develop. If accessible, take advantage of the Review key to search from the record design also.

- If you want to locate an additional version from the develop, take advantage of the Research area to get the design that meets your needs and requirements.

- Upon having located the design you need, just click Buy now to proceed.

- Choose the rates plan you need, type in your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal accounts to cover the lawful develop.

- Choose the format from the record and download it to the product.

- Make changes to the record if required. It is possible to comprehensive, modify and indicator and print out Utah Sample Letter for Motion to Dismiss in Referenced Bankruptcy.

Obtain and print out thousands of record templates making use of the US Legal Forms website, that offers the largest variety of lawful kinds. Use specialist and state-distinct templates to tackle your business or individual demands.

Form popularity

FAQ

Key Elements to Include in the Letter It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed. It should also provide information about the bankruptcy trustee and the meeting of creditors.

The Chapter 13 Trustee communicates by mail with Chapter 13 debtors. The Trustee sends out financial information, notices and legal pleadings using the debtor's mailing address maintained in the Bankruptcy Court records.

At the meeting, the Chapter 13 trustee will ask you questions, under oath, about what you owe, what you own, your income, and your Chapter 13 Plan.

People might look you up if you are applying for a job to see if you have filed for bankruptcy, although they can't discriminate against you because you filed for bankruptcy. These records will remain available to the public for a period of almost 10 years.

Case Closure at Trustee's Office After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were received, the Chapter 13 Trustee will file a Certificate of Final Payment with the Bankruptcy Court.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.