In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

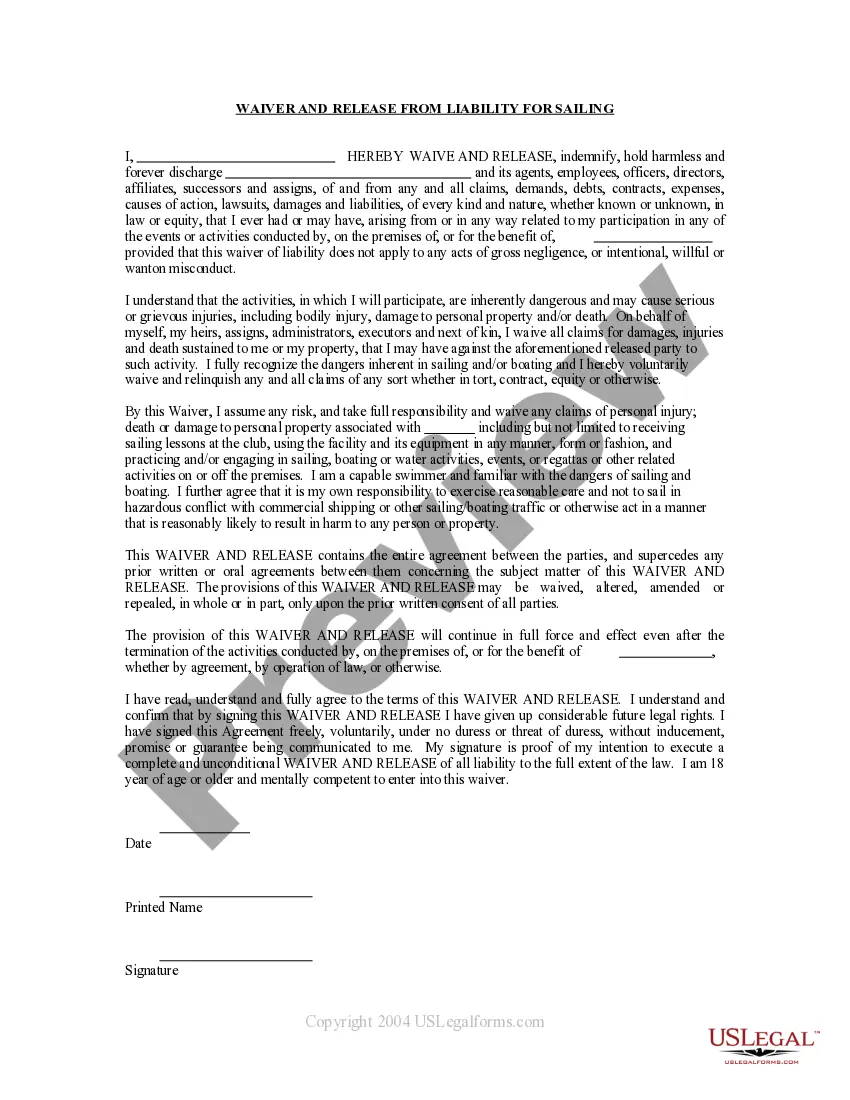

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

You might dedicate hours online searching for the legal document template that meets the federal and state specifications you require.

US Legal Forms offers a vast selection of legal documents that can be reviewed by experts.

It's straightforward to obtain or create the Utah Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary from the service.

If available, use the Preview button to browse the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Next, you can complete, modify, create, or sign the Utah Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

- Every legal document template you acquire is yours to keep indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form summary to ensure you have chosen the right template.

Form popularity

FAQ

Disbursing funds from a trust involves the trustee transferring assets according to the trust's instructions. The trustee first reviews the trust terms and prepares any required documentation for beneficiaries. It is essential for the trustee to ensure compliance during this process, especially when dealing with the Utah termination of trust by trustee and acknowledgment of receipt of trust funds by beneficiary. Utilizing a platform like uslegalforms can facilitate this process, offering the necessary forms and guidance.

To release funds from a trust, the trustee must follow specific procedures outlined in the trust document. Typically, the trustee needs to gather all relevant information, such as the trust's rules and the beneficiaries' details. Once the necessary evaluations are complete, the trustee must execute a formal acknowledgment of receipt of trust funds by the beneficiaries. This process plays an integral role in the Utah termination of trust by trustee and acknowledgment of receipt of trust funds by beneficiary.

Generally, a trustee holds more power in managing the trust assets and making decisions regarding their distribution. However, beneficiaries have rights that can offer them protection, especially in cases involving the Utah Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. It is beneficial for both parties to understand their rights and obligations clearly, and legal guidance can aid in navigating these relationships effectively.

A trust acknowledgment refers to a document that verifies a beneficiary's receipt of their designated trust funds. This process is crucial during the Utah Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, as it ensures beneficiaries are formally recognizing the transfer of their assets. Having this acknowledgment protects both the trustee and the beneficiaries in the event of future disputes.

A trustee holds a fiduciary duty to act in the best interests of the beneficiaries. Therefore, any deceitful actions by a trustee can be considered a breach of that duty. If you suspect malpractice regarding Utah Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, seeking advice from a legal expert can help you address potential issues.

In most situations, a trustee cannot unilaterally remove beneficiaries from a trust without cause. The terms of the trust, created by the grantor, define beneficiary rights and obligations. If you are navigating a situation involving the Utah Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, it may be wise to consult with a legal professional to understand your rights.

To stop being a trustee, you must formally resign by sending a resignation letter to the trust's beneficiaries. Be sure to adhere to the terms stated in the trust document regarding resignation. It is also vital to document the Acknowledgment of Receipt of Trust Funds By Beneficiary to confirm the completion of the process. For comprehensive support, USLegalForms offers useful resources and templates.

Withdrawing from your role as a trustee involves formally resigning by submitting a written notice to the trust's beneficiaries. Review the trust's terms to ensure that you follow any specified procedures. Additionally, it's beneficial to facilitate an Acknowledgment of Receipt of Trust Funds By Beneficiary to confirm the transition of responsibilities. Consider leveraging USLegalForms for assistance throughout this process.

Changing a trustee can vary in difficulty based on the trust's terms and the specific circumstances involved. Typically, it requires the consent of beneficiaries and adherence to the stipulations outlined in the trust document. It's important to follow the correct protocol to avoid complications related to the Utah Termination of Trust By Trustee. USLegalForms can provide useful templates and guidance for this process.

To terminate a trust in Utah, the trustee must ensure compliance with the trust agreement and state law. This often includes gathering all beneficiaries for consent and executing the distribution of trust assets. After assets are distributed, obtaining an Acknowledgment of Receipt of Trust Funds By Beneficiary helps confirm the termination. For detailed instructions and legal forms, consider visiting USLegalForms.