An action to recover on an open account is one usually based on an implied or oral contract. Ordinarily, it is not necessary to specify all the individual items that make up the account balance due. Some jurisdictions authorize a short form of pleading that allows a copy of the written statement to be attached, specifying only that a certain sum is due the plaintiff from the defendant. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

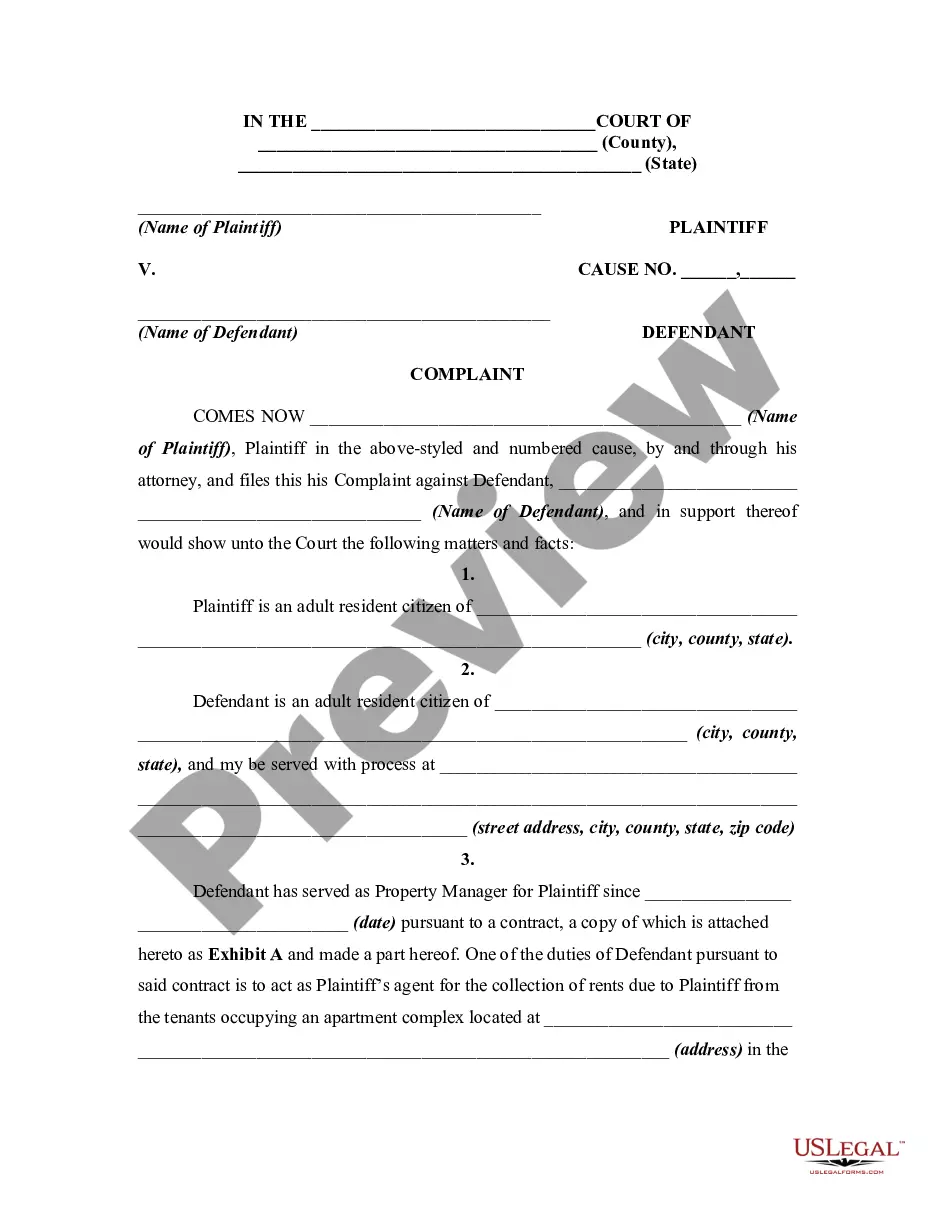

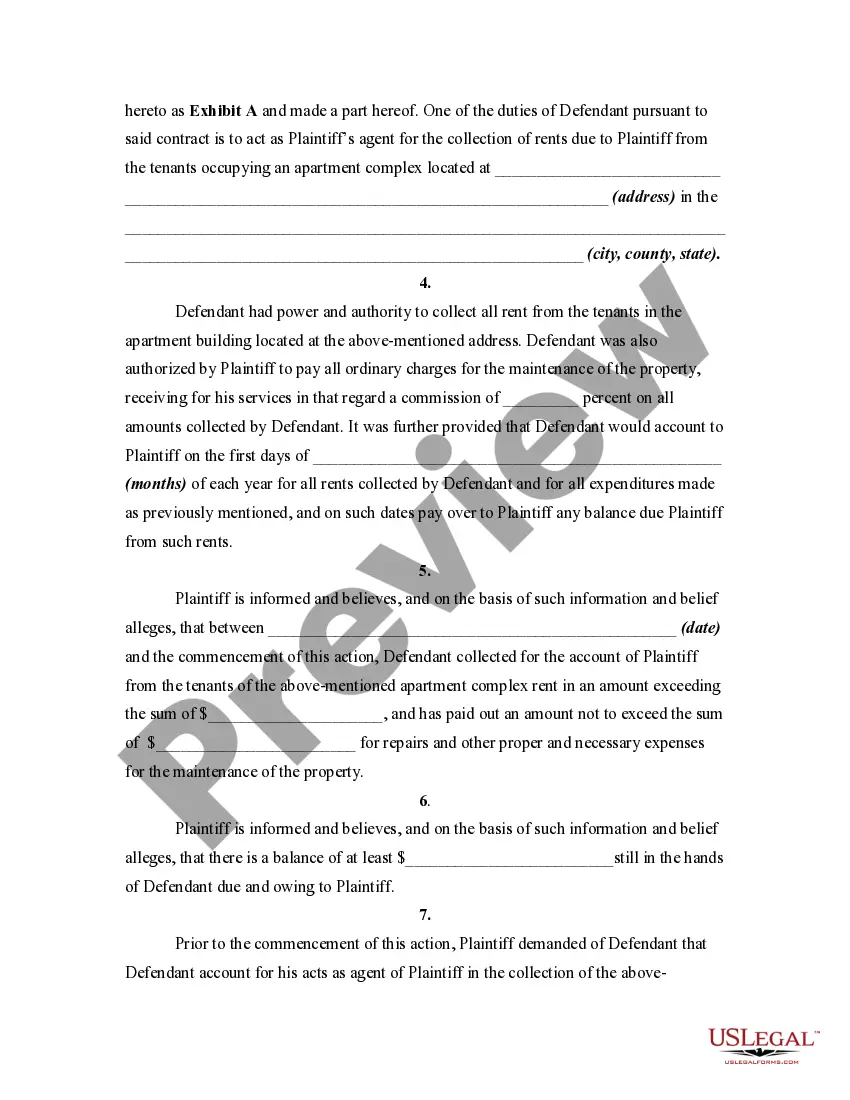

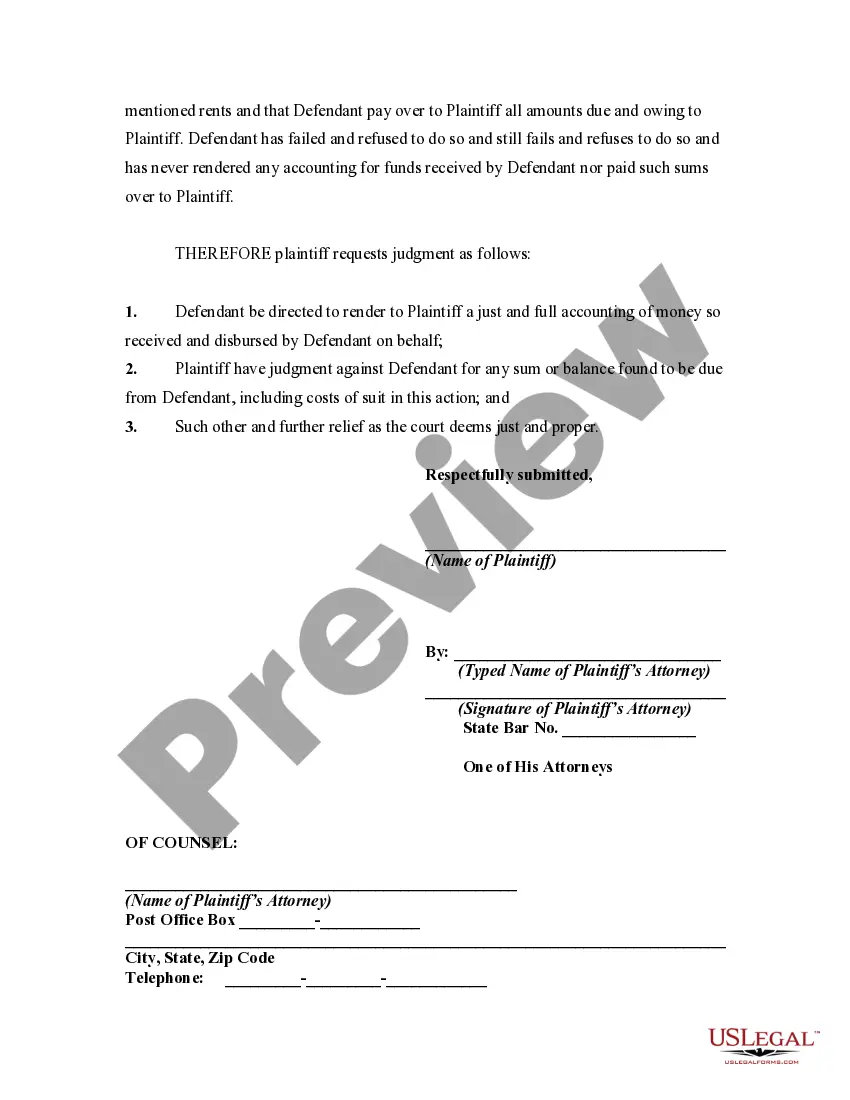

Title: Understanding Utah Complaint by Owner of Real Estate for Accounting and Payment of Amount Due from Property Manager Keywords: Utah complaint, owner of real estate, accounting, payment, amount due, property manager, types Introduction: In Utah, property owners entrust the management of their real estate investments to property managers. While most property managers fulfill their obligations diligently, occasional disputes may arise regarding the accounting and payment of the amount due to property owners. In such cases, property owners can file a formal complaint with the relevant authorities in Utah. This comprehensive guide aims to shed light on the various types of Utah complaints by owners of real estate for accounting and payment of amount due from property managers. Types of Utah Complaints by Owner of Real Estate for Accounting and Payment: 1. Failure to Provide Accurate Financial Statements: Property owners may file a complaint when property managers fail to provide accurate and transparent financial statements, making it difficult for owners to track income, expenses, and overall profitability accurately. These grievances might involve missing or incorrect records, questionable transactions, or unexplained discrepancies. 2. Delays in Remitting Payments: Property owners can file a complaint if property managers fail to remit the collected rents or other income in a timely manner. Delays can seriously impact a property owner's cash flow and hinder financial planning. This type of complaint usually focuses on property managers not adhering to agreed-upon payment schedules or neglecting to transfer funds altogether. 3. Misappropriation of Funds: Whenever there is evidence of property managers misusing or misappropriating the collected funds, property owners have the right to file a complaint. This type of complaint often indicates fraudulent practices or unauthorized withdrawals by property managers, which can severely harm the property owner's financial interests. 4. Inadequate Record-Keeping: Property owners may file a complaint when property managers fail to maintain proper records or provide incomplete financial documentation. Inadequate record-keeping makes it difficult for owners to gain a clear understanding of their property's financial status and might lead to suspicion of mismanagement or malpractice. 5. Failure to Deduct Personal Expenses: In some cases, property owners may complain that property managers have failed to deduct agreed-upon personal expenses from their management fees. Failure to accurately account for personal expenses might result in property owners paying more for management services than originally agreed upon. Conclusion: Utah complaints by owners of real estate for accounting and payment of amount due from property managers provide a legal recourse for property owners facing problems with their property managers. It is essential for property owners to gather all necessary evidence and documentation before filing a complaint, ensuring a strong case against the property manager. By seeking resolution through the complaint process, property owners can protect their financial interests and maintain transparency and accountability in their real estate investments.Title: Understanding Utah Complaint by Owner of Real Estate for Accounting and Payment of Amount Due from Property Manager Keywords: Utah complaint, owner of real estate, accounting, payment, amount due, property manager, types Introduction: In Utah, property owners entrust the management of their real estate investments to property managers. While most property managers fulfill their obligations diligently, occasional disputes may arise regarding the accounting and payment of the amount due to property owners. In such cases, property owners can file a formal complaint with the relevant authorities in Utah. This comprehensive guide aims to shed light on the various types of Utah complaints by owners of real estate for accounting and payment of amount due from property managers. Types of Utah Complaints by Owner of Real Estate for Accounting and Payment: 1. Failure to Provide Accurate Financial Statements: Property owners may file a complaint when property managers fail to provide accurate and transparent financial statements, making it difficult for owners to track income, expenses, and overall profitability accurately. These grievances might involve missing or incorrect records, questionable transactions, or unexplained discrepancies. 2. Delays in Remitting Payments: Property owners can file a complaint if property managers fail to remit the collected rents or other income in a timely manner. Delays can seriously impact a property owner's cash flow and hinder financial planning. This type of complaint usually focuses on property managers not adhering to agreed-upon payment schedules or neglecting to transfer funds altogether. 3. Misappropriation of Funds: Whenever there is evidence of property managers misusing or misappropriating the collected funds, property owners have the right to file a complaint. This type of complaint often indicates fraudulent practices or unauthorized withdrawals by property managers, which can severely harm the property owner's financial interests. 4. Inadequate Record-Keeping: Property owners may file a complaint when property managers fail to maintain proper records or provide incomplete financial documentation. Inadequate record-keeping makes it difficult for owners to gain a clear understanding of their property's financial status and might lead to suspicion of mismanagement or malpractice. 5. Failure to Deduct Personal Expenses: In some cases, property owners may complain that property managers have failed to deduct agreed-upon personal expenses from their management fees. Failure to accurately account for personal expenses might result in property owners paying more for management services than originally agreed upon. Conclusion: Utah complaints by owners of real estate for accounting and payment of amount due from property managers provide a legal recourse for property owners facing problems with their property managers. It is essential for property owners to gather all necessary evidence and documentation before filing a complaint, ensuring a strong case against the property manager. By seeking resolution through the complaint process, property owners can protect their financial interests and maintain transparency and accountability in their real estate investments.