Utah Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

You have the ability to allocate time online searching for the legal document format that meets the state and federal requirements you desire.

US Legal Forms offers thousands of legal templates that have been assessed by experts.

You can easily download or print the Utah Bill of Transfer to a Trust from the service.

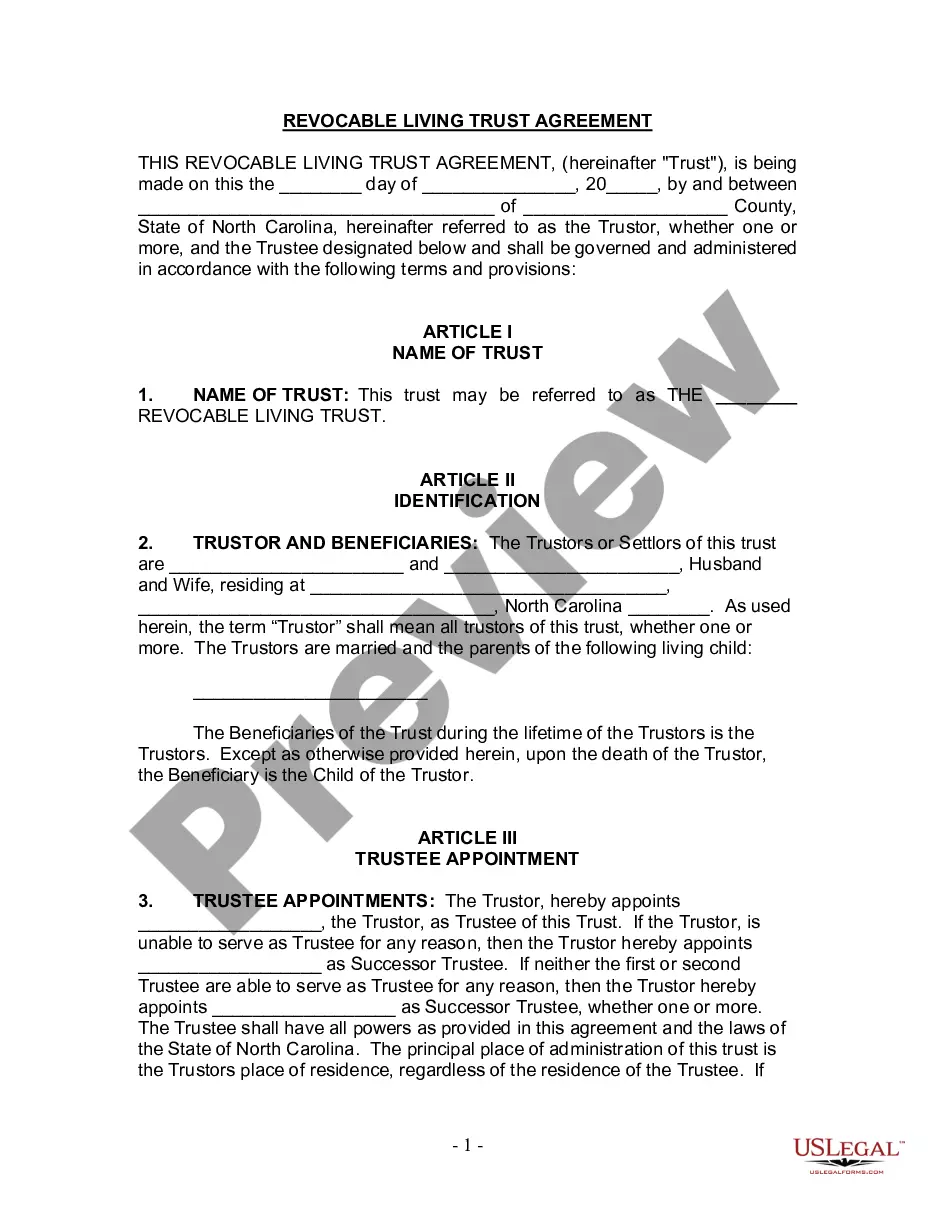

First, ensure you have chosen the correct document format for the area/town of your selection. Review the document description to confirm you have selected the appropriate form. If available, utilize the Preview button to view the document format as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Utah Bill of Transfer to a Trust.

- Every legal document format you purchase is yours indefinitely.

- To obtain another copy of the acquired form, navigate to the My documents section and select the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

Form popularity

FAQ

The bill of transfer for a trust refers to the legal documentation required to formally transfer assets into a trust. In Utah, this often involves creating a specific form that details the assets being included in the trust. Using a Utah Bill of Transfer to a Trust ensures that the process is handled correctly and expediently, helping you achieve peace of mind regarding your estate planning.

To transfer assets from one trust to another, you typically need to execute a formal transfer document that outlines the assets being moved. This process may require adherence to specific state requirements, including potentially using the Utah Bill of Transfer to a Trust. Ensuring the proper documentation can streamline this transition while effectively protecting your assets.

Generally, transfers from a trust to beneficiaries are not considered taxable events. However, there may be exceptions based on the type of trust and the nature of the assets. It's essential to communicate with a tax advisor to understand potential tax implications fully. The Utah Bill of Transfer to a Trust can facilitate these transfers smoothly and transparently.

The decision between a transfer on death (TOD) designation and a trust really depends on your individual circumstances. A trust offers more comprehensive management of assets and can provide ongoing support for your beneficiaries. In contrast, a TOD is a simpler option that may work for certain assets. Assessing your needs with the help of a Utah Bill of Transfer to a Trust can guide you in making the right choice.

To transfer your property into a trust in Utah, you typically need to complete a deed that officially re-titles the property in the name of the trust. This process may involve filling out a Utah Bill of Transfer to a Trust form, which is a crucial step in the asset transfer process. Consulting with a legal expert can ensure that all details are correctly handled, avoiding any future complications.

A common mistake parents make when setting up a trust fund is failing to properly fund it. While creating the trust is a crucial step, not transferring assets into it undermines its purpose. Careful planning is necessary to ensure that the trust functions as intended for your beneficiaries. Utilizing the Utah Bill of Transfer to a Trust can help you effectively move assets into the trust.

Transferring assets to a trust is generally not a taxable event in Utah. This means you typically do not owe tax when you move your property into a trust. However, it is important to understand how this transfer may affect your estate tax situation down the line. Consulting with a legal professional can give you clarity on the implications of the Utah Bill of Transfer to a Trust.

Transferring assets to a trust after death typically involves following the terms outlined in the deceased's estate plan, including the Utah Bill of Transfer to a Trust. The trustee manages this process, which may include preparing the necessary documents to officially transfer ownership. Engaging with a legal professional can simplify this transfer, ensuring all assets are distributed according to the deceased's wishes. Utilizing platforms like US Legal Forms can assist in streamlining this process by providing necessary legal documents.

Transfers to a trust generally do not trigger taxes under the Utah Bill of Transfer to a Trust. This process allows individuals to move assets without immediate tax implications. However, it's crucial to consult with a tax advisor to understand any potential liabilities. By doing so, you can ensure compliance with tax laws and maximize your benefits.

A bill of transfer in a trust, particularly in Utah, is a legal document that facilitates the transfer of assets into the trust. This document helps establish the trust's ownership and control over the assets, ensuring they are managed according to your wishes. Using the appropriate Utah Bill of Transfer to a Trust simplifies this process and protects your estate.