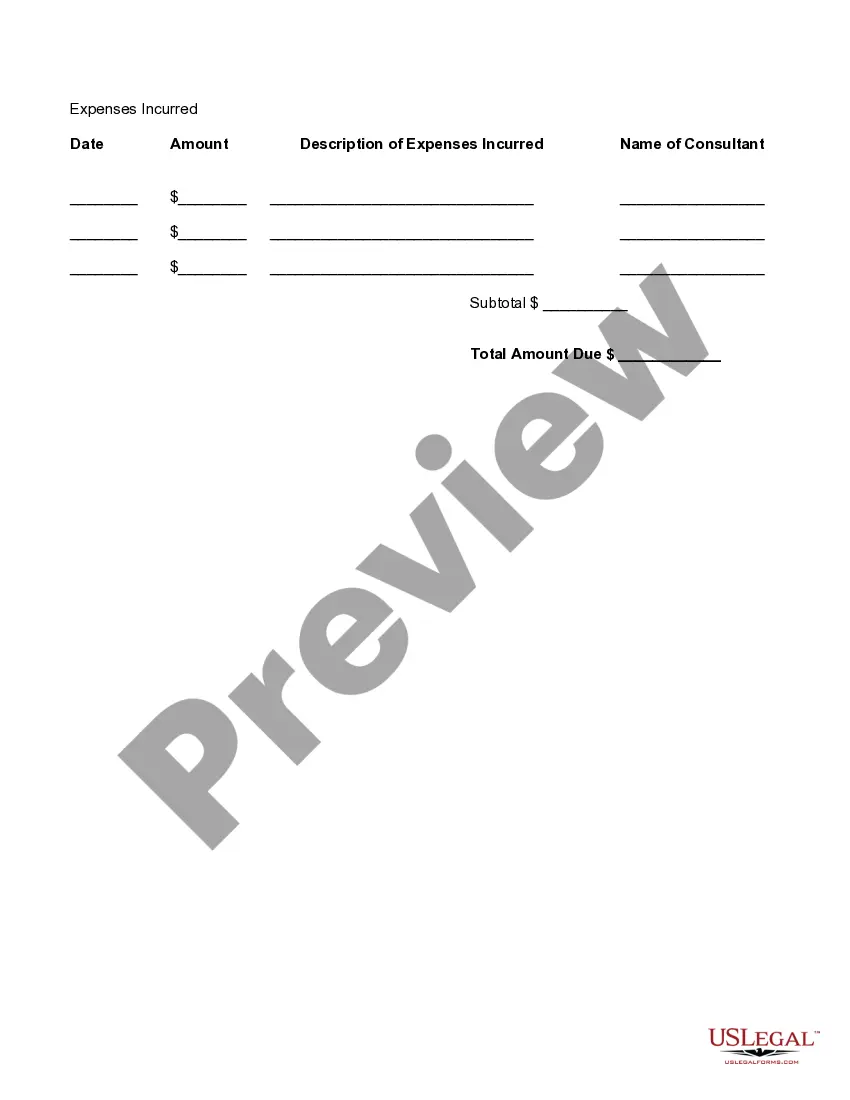

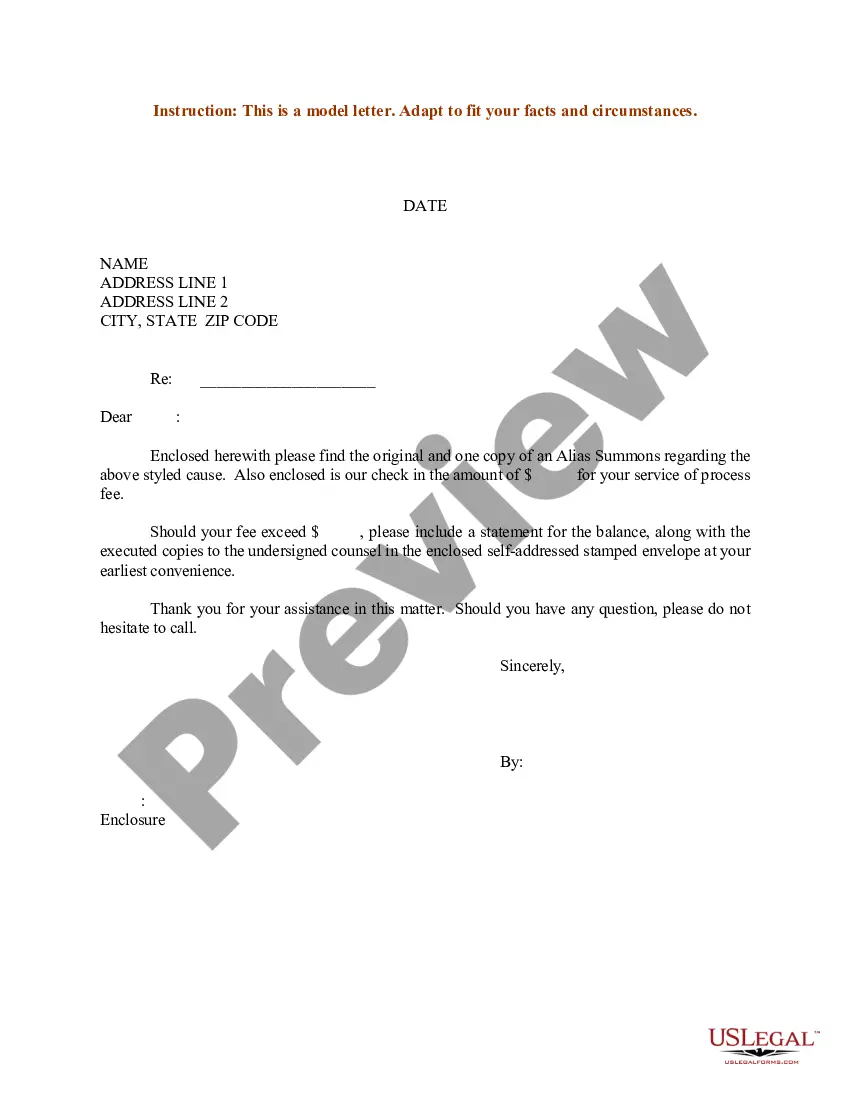

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah Detailed Consultant Invoice

Description

How to fill out Detailed Consultant Invoice?

If you need to obtain, procure, or generate legitimate document templates, utilize US Legal Forms, the foremost collection of legal documents, available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

A selection of templates for commercial and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You will have access to all forms you saved in your account. Click on the My documents section and select a form to print or download again.

Fill out and download, and print the Utah Detailed Consultant Invoice using US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- Utilize US Legal Forms to locate the Utah Detailed Consultant Invoice with just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and click on the Download button to retrieve the Utah Detailed Consultant Invoice.

- You can also access documents you have previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Utah Detailed Consultant Invoice.

Form popularity

FAQ

Filling out a contractor invoice involves listing your details, such as name and contact information, followed by the client's details. On a Utah Detailed Consultant Invoice, specify the services provided, hours worked, rates, and the total amount due. This structure ensures clients receive a comprehensive view of your work and what they owe.

The best format for an invoice is clean, organized, and easy to read. A Utah Detailed Consultant Invoice typically follows a straightforward structure, with your business information at the top, itemized service descriptions in the middle, and total payment information at the bottom. This clarity helps ensure prompt payment and reduces confusion.

The best wording on an invoice should be clear and professional. Use direct language on your Utah Detailed Consultant Invoice, such as 'Services Rendered' or 'Payment Due.' This approach not only clarifies the purpose of the invoice but also enhances your professionalism in the eyes of the recipient.

To write a consulting invoice, clearly state your business name and contact information, followed by the client's details. Include a description of services, the time spent, rates, and total due amount on a Utah Detailed Consultant Invoice. Ensure the language is clear and professional, making it easy for your clients to understand their charges.

A simple invoice layout includes your business name at the top, followed by the client's details. Use a clean structure to list services or products beneath these sections, with a clear total at the bottom. A Utah Detailed Consultant Invoice should be straightforward, making it easy for clients to process payments promptly.

To fill out invoice details for a Utah Detailed Consultant Invoice, start by including your business information at the top. Next, add the client's name and address, followed by the invoice number and date. Lastly, specify the services provided, quantities, rates, and total amount due, ensuring transparency for clear communication.

Deciding between weekly or monthly invoicing depends on your workflow and client needs. Weekly invoicing works well for active projects, especially if you have multiple tasks or hours to track. Conversely, monthly invoicing provides a comprehensive view of services delivered. Evaluate what best suits your consulting practice and communicate this clearly on your Utah Detailed Consultant Invoice.

Consultants typically bill on a regular cycle, which can vary widely. Many consultants prefer to bill clients monthly or after reaching certain project milestones. However, some may choose to invoice weekly, particularly for longer contracts. Whatever billing cycle you adopt, utilizing a clear Utah Detailed Consultant Invoice helps maintain transparency.

To create an invoice for consulting services, start by choosing an easy-to-use template. Include your business name, contact information, client details, specific services rendered, hours worked, and total amounts due. Using platforms like uslegalforms makes generating a polished Utah Detailed Consultant Invoice straightforward and ensures all crucial information is included.

Consultants often invoice based on their contract and the nature of the project. Some invoice weekly for ongoing services, while others opt for monthly billing. Invoicing frequency can also hinge on client preferences and project timelines. Whatever the decision, ensure your Utah Detailed Consultant Invoice reflects the agreed terms.