Utah Owner Financing Contract for Car: An Overview In Utah, an Owner Financing Contract for Car is a legal agreement between a vehicle seller and a buyer, offering an alternative method of purchasing a car without conventional financing from a bank or traditional lender. This arrangement allows the buyer to make installment payments to the seller, who acts as the financier, enabling individuals with less-than-perfect credit or limited financial resources to acquire a vehicle. There are several types of Owner Financing Contracts for Cars commonly found in Utah, each with its own distinct features and conditions. These variations include: 1. Conditional Sale Agreement: This type of agreement specifies that the car's ownership is transferred to the buyer upon fulfilling all contractual obligations, such as making all agreed-upon payments, maintaining the vehicle adequately, and adhering to any additional stipulations outlined in the contract. 2. Contract for Deed: Also known as a Land Contract or Installment Sale Agreement, this type of contract allows the buyer to possess and use the vehicle while making regular payments to the seller. However, legal ownership of the vehicle remains with the seller until the full payment is made, upon which the title is transferred to the buyer. 3. Lease-to-Own Agreement: In this arrangement, the buyer leases the vehicle for a fixed period, typically with the intention of eventually owning it. A portion of the lease payments is typically applied towards the vehicle's purchase price, enabling the buyer to acquire ownership at the end of the lease term. Regardless of the type of Owner Financing Contract for Car, it is crucial to ensure that all essential terms and conditions are explicitly listed within the agreement. These may include the purchase price, down payment, interest rate (if applicable), repayment schedule, duration of the contract, consequences of default, and any other specific conditions deemed necessary by both parties. It is recommended to engage the services of a qualified legal professional to draft or review the contract to ensure compliance with Utah state laws. In conclusion, Utah Owner Financing Contracts for Cars offer an attractive alternative to traditional auto financing, providing individuals with limited financial means or imperfect credit histories an opportunity to purchase a vehicle. With various options available, prospective buyers should thoroughly understand the terms and conditions within each contract type to make an informed decision.

Utah Owner Financing Contract for Car

Description

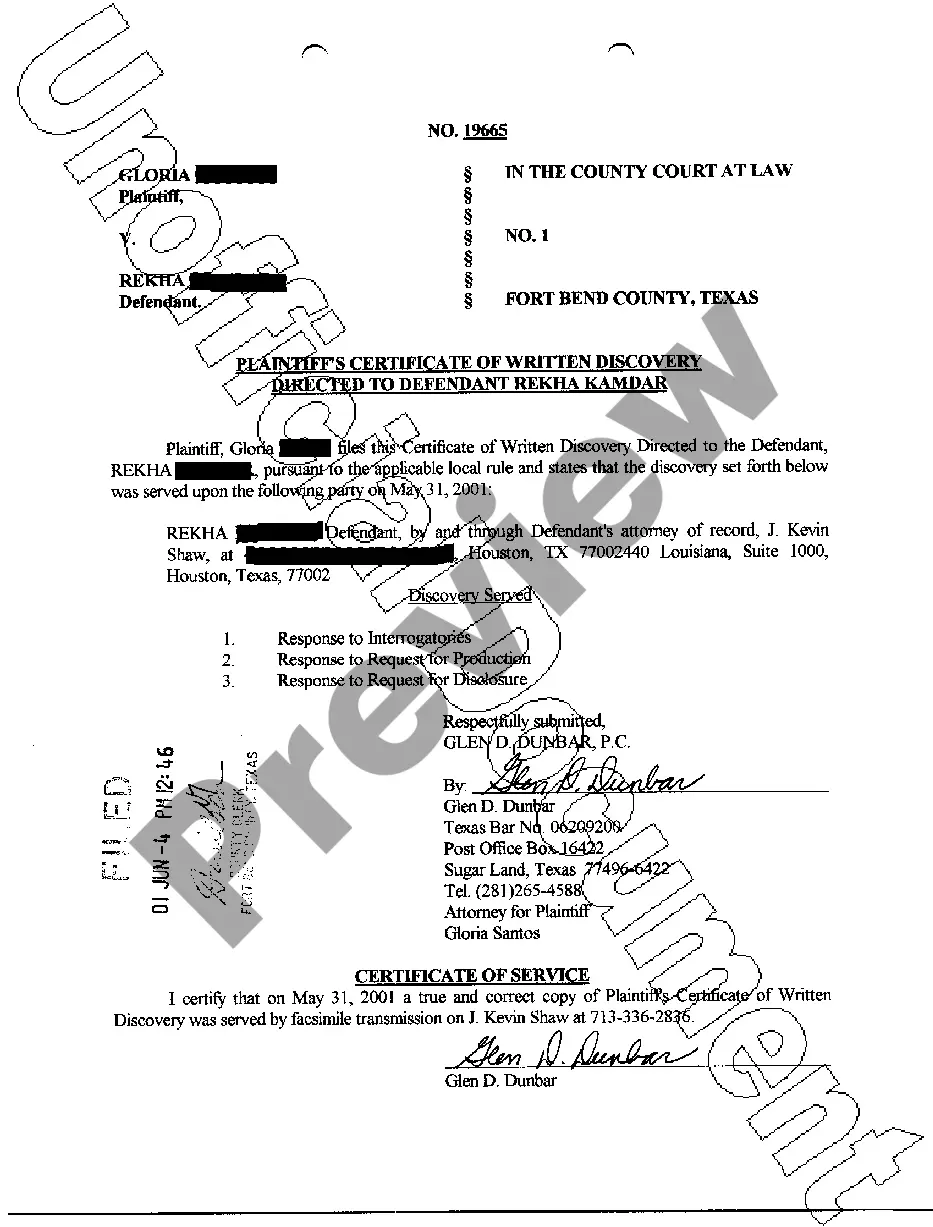

How to fill out Utah Owner Financing Contract For Car?

If you have to full, download, or print lawful record themes, use US Legal Forms, the most important collection of lawful varieties, that can be found on the web. Make use of the site`s basic and practical look for to find the papers you require. Numerous themes for company and person functions are categorized by groups and claims, or search phrases. Use US Legal Forms to find the Utah Owner Financing Contract for Car with a few mouse clicks.

If you are previously a US Legal Forms client, log in in your account and click the Down load button to obtain the Utah Owner Financing Contract for Car. Also you can gain access to varieties you in the past saved in the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that proper area/region.

- Step 2. Use the Preview method to examine the form`s content. Do not neglect to read through the outline.

- Step 3. If you are unsatisfied using the type, take advantage of the Look for industry towards the top of the monitor to locate other versions in the lawful type web template.

- Step 4. Once you have identified the shape you require, go through the Purchase now button. Choose the pricing prepare you like and include your qualifications to sign up for an account.

- Step 5. Process the transaction. You may use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Select the format in the lawful type and download it on your product.

- Step 7. Comprehensive, revise and print or indication the Utah Owner Financing Contract for Car.

Every single lawful record web template you buy is the one you have for a long time. You may have acces to each type you saved within your acccount. Select the My Forms area and choose a type to print or download again.

Contend and download, and print the Utah Owner Financing Contract for Car with US Legal Forms. There are thousands of expert and condition-certain varieties you may use to your company or person demands.

Form popularity

FAQ

You can set up an owner financing contract by drafting a clear agreement that includes essential details like payment terms, interest rates, and responsibilities. Utilizing a Utah Owner Financing Contract for Car from uslegalforms can streamline this process, ensuring all legal requirements are met. This document provides a solid framework, protecting both buyer and seller during the transaction.

To get your own financing for a car, you can consider various options like traditional loans, credit unions, or owner financing. Each method has its advantages; for instance, a Utah Owner Financing Contract for Car allows flexibility and potentially fewer criteria than traditional lenders. Ensure to compare offers and terms to find the best fit for your needs.

The IRS has specific rules regarding owner financing, particularly concerning interest income and reporting requirements. Sellers must report interest received from the financing as taxable income. Adhering to these rules is crucial, so consulting a tax professional can help navigate the complexities involved with a Utah Owner Financing Contract for Car.

In most cases, the seller sets up owner financing. The seller defines the terms and conditions, creating a Utah Owner Financing Contract for Car that both parties accept. However, buyers can influence the agreement by negotiating specific terms that suit their financial situations.

One downside of owner financing, especially when using a Utah Owner Financing Contract for Car, is the higher interest rates compared to traditional loans. Additionally, if the borrower defaults, the seller may face challenges in recovering the vehicle. It's important to weigh these risks before proceeding with owner financing.

To fill out the Utah certificate of title, start by providing the vehicle details, including the VIN, make, model, and year. Next, fill in the owner's information, ensuring accuracy in your name and address. Finally, sign the form and include the date. Remember, a properly filled title is crucial when creating the Utah Owner Financing Contract for Car.

To sell your financed car privately, start by contacting your lender for a payoff amount and review any specific conditions. After finding a buyer, use a Utah Owner Financing Contract for Car to structure the deal, ensuring both parties are protected. Completing all necessary paperwork and considering legal advice can ensure a smooth transaction.

Closing costs for owner financing can vary based on factors like property value and local fees. Typically, you should anticipate costs ranging from a few hundred dollars to a couple of thousand dollars. Using a Utah Owner Financing Contract for Car can help you clearly outline these expenses upfront, making sure both parties understand their financial obligations.

Yes, a handwritten bill of sale is legal in Utah as long as it includes essential details like both parties' names, the vehicle description, and the sale amount. Utilizing a Utah Owner Financing Contract for Car formalizes the agreement and provides additional security for both the buyer and seller. Always ensure that the document is signed and dated by both parties to make it enforceable.

Interesting Questions

More info

Your first step is always to have the buyer check out your car and get his/her own opinion and recommendation, then you offer your price. You have an agreed on contract price and in the end of the deal, the deal is done. Step 5: You get a contract, the deal is done! But first I want to show you how many of those other deals are not true deals. My personal experience. I sold my new car with my current dealer. A little further down the road that was the dealership's suggestion to sell the car to us for as little as possible. We were told by both the dealers that we had to take out a 2000 down payment to get the car. I did but now down payment was included, so I was charged 2000, and I had to take out another 2000 from savings. That put me at 5,000, and we made a deal. Then shortly after we were told by the dealer that we could still buy the car for 500, we had to take out an extra 2000. This time, we were charged 3000.