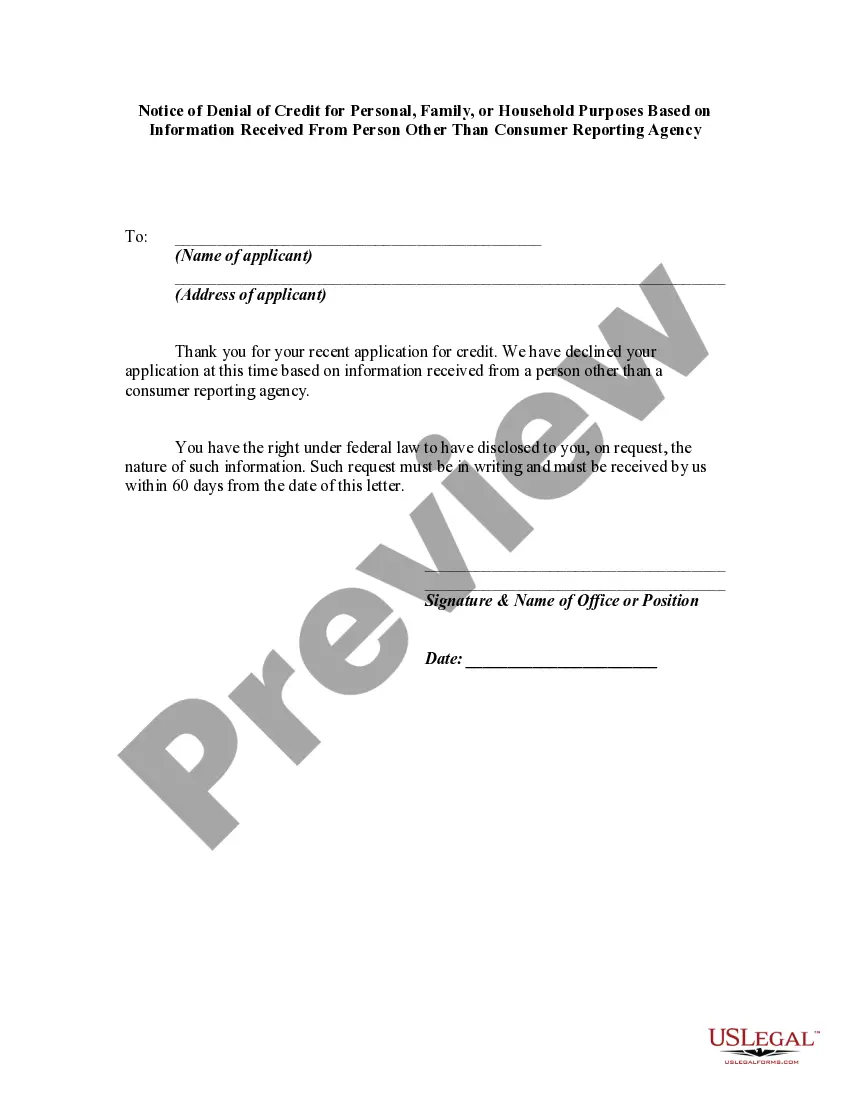

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

Utah Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency A Utah Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a legal document that notifies an individual of the denial of credit based on information provided by someone other than a consumer reporting agency. This notice is required by the Utah Credit Notification Act, which aims to protect consumers from unfair denials of credit. In Utah, there are different types of notices depending on the specific circumstances: 1. Standard Denial — This notice is used when an individual's application for credit, whether it's for a personal, family, or household purpose, is denied solely based on information received from a person other than a consumer reporting agency. The notice will provide details of the denial, including the reason(s) for the decision and contact information for the employer or other person who provided the adverse information. 2. Adverse Action Based on Multiple Sources — If the denial of credit is based on a combination of information from a consumer reporting agency and another person, this notice will be issued. It will outline both the adverse information received from the consumer reporting agency and the other person, along with the reasons for the denial. 3. Notice of Incomplete Application — Sometimes, a credit application may be denied because it is incomplete or lacks essential information. This notice specifies the missing information and provides an opportunity for the individual to rectify the deficiencies and resubmit the application. 4. Notification Requirements for Creditors — Utah law also dictates certain obligations for creditors who deny credit based on information received from a person other than a consumer reporting agency. Creditors must keep records of the information used in the credit decision for at least three years and must notify the applicant of the denial in writing, within a specific timeframe according to the Utah Credit Notification Act. It is important to note that this notice is different from a denial based solely on a credit score or information received from a consumer reporting agency. Separate notices are required for such circumstances under federal laws like the Fair Credit Reporting Act (FCRA). In conclusion, a Utah Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a crucial document that ensures transparency and fairness in credit decisions. Understanding the different types of notices and their specific requirements is essential for both consumers and creditors to comply with Utah state laws and protect their rights.Utah Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency A Utah Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a legal document that notifies an individual of the denial of credit based on information provided by someone other than a consumer reporting agency. This notice is required by the Utah Credit Notification Act, which aims to protect consumers from unfair denials of credit. In Utah, there are different types of notices depending on the specific circumstances: 1. Standard Denial — This notice is used when an individual's application for credit, whether it's for a personal, family, or household purpose, is denied solely based on information received from a person other than a consumer reporting agency. The notice will provide details of the denial, including the reason(s) for the decision and contact information for the employer or other person who provided the adverse information. 2. Adverse Action Based on Multiple Sources — If the denial of credit is based on a combination of information from a consumer reporting agency and another person, this notice will be issued. It will outline both the adverse information received from the consumer reporting agency and the other person, along with the reasons for the denial. 3. Notice of Incomplete Application — Sometimes, a credit application may be denied because it is incomplete or lacks essential information. This notice specifies the missing information and provides an opportunity for the individual to rectify the deficiencies and resubmit the application. 4. Notification Requirements for Creditors — Utah law also dictates certain obligations for creditors who deny credit based on information received from a person other than a consumer reporting agency. Creditors must keep records of the information used in the credit decision for at least three years and must notify the applicant of the denial in writing, within a specific timeframe according to the Utah Credit Notification Act. It is important to note that this notice is different from a denial based solely on a credit score or information received from a consumer reporting agency. Separate notices are required for such circumstances under federal laws like the Fair Credit Reporting Act (FCRA). In conclusion, a Utah Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a crucial document that ensures transparency and fairness in credit decisions. Understanding the different types of notices and their specific requirements is essential for both consumers and creditors to comply with Utah state laws and protect their rights.