If you want to comprehensive, down load, or print legitimate papers layouts, use US Legal Forms, the greatest assortment of legitimate forms, which can be found on the Internet. Take advantage of the site`s easy and handy look for to get the paperwork you will need. A variety of layouts for enterprise and individual purposes are categorized by groups and says, or key phrases. Use US Legal Forms to get the Utah Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act in a handful of clicks.

If you are currently a US Legal Forms buyer, log in to your accounts and click on the Download option to find the Utah Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act. You can also access forms you in the past delivered electronically from the My Forms tab of your accounts.

If you work with US Legal Forms initially, follow the instructions below:

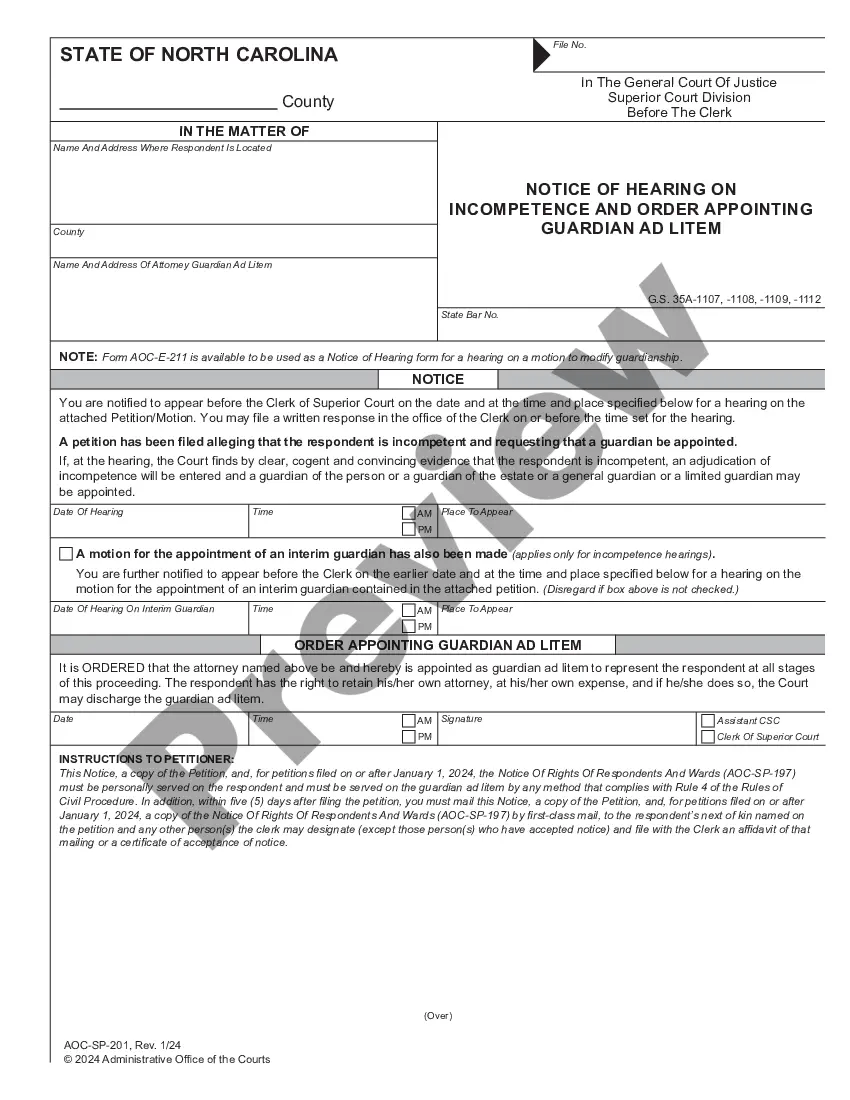

- Step 1. Be sure you have selected the form for the correct area/region.

- Step 2. Utilize the Preview choice to check out the form`s content. Don`t overlook to see the description.

- Step 3. If you are unhappy together with the develop, take advantage of the Lookup industry towards the top of the monitor to find other models in the legitimate develop format.

- Step 4. Once you have identified the form you will need, go through the Purchase now option. Opt for the pricing program you choose and put your credentials to sign up on an accounts.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Find the formatting in the legitimate develop and down load it on your own product.

- Step 7. Complete, modify and print or indicator the Utah Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act.

Every legitimate papers format you buy is the one you have for a long time. You have acces to every single develop you delivered electronically inside your acccount. Click the My Forms section and select a develop to print or down load again.

Be competitive and down load, and print the Utah Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act with US Legal Forms. There are millions of skilled and express-distinct forms you can utilize for your personal enterprise or individual demands.