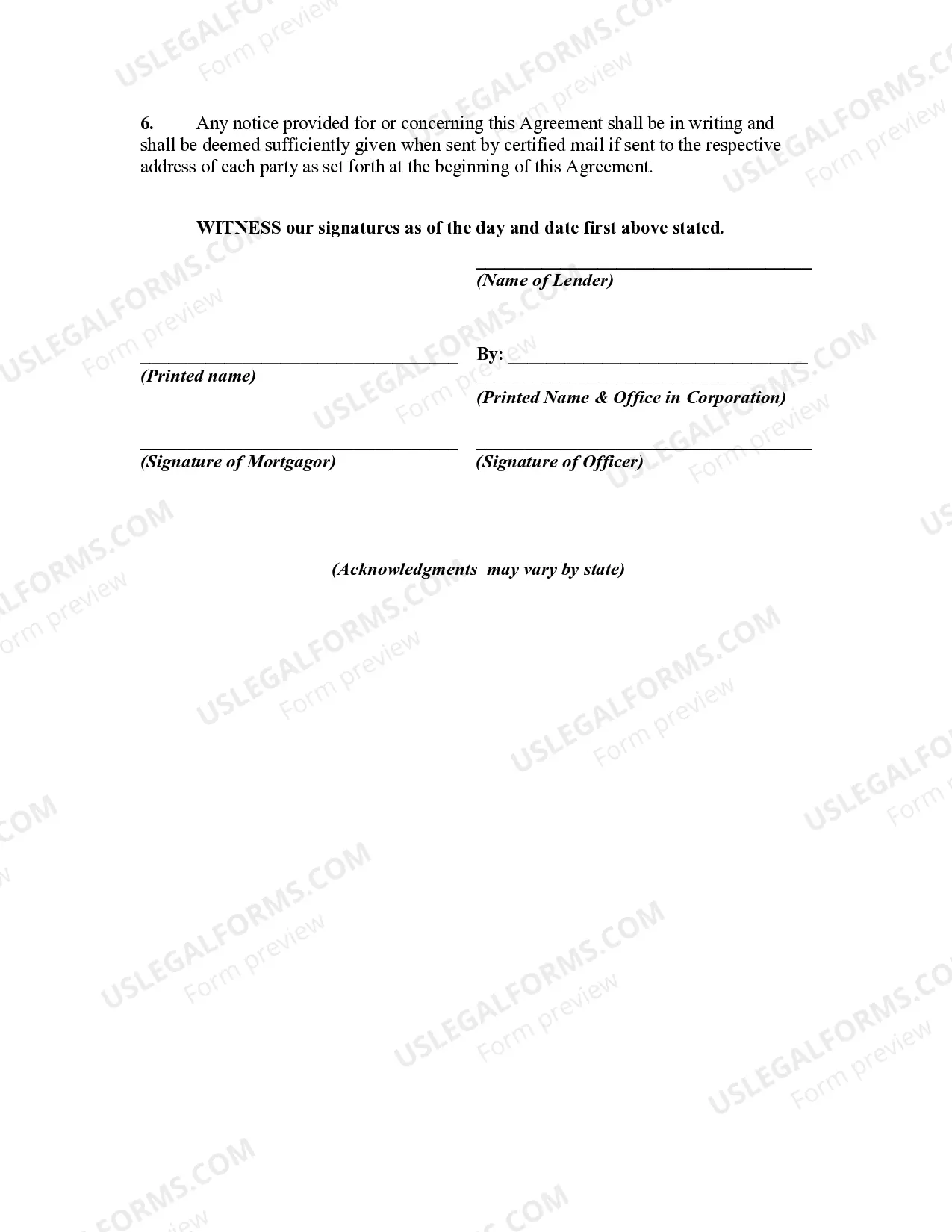

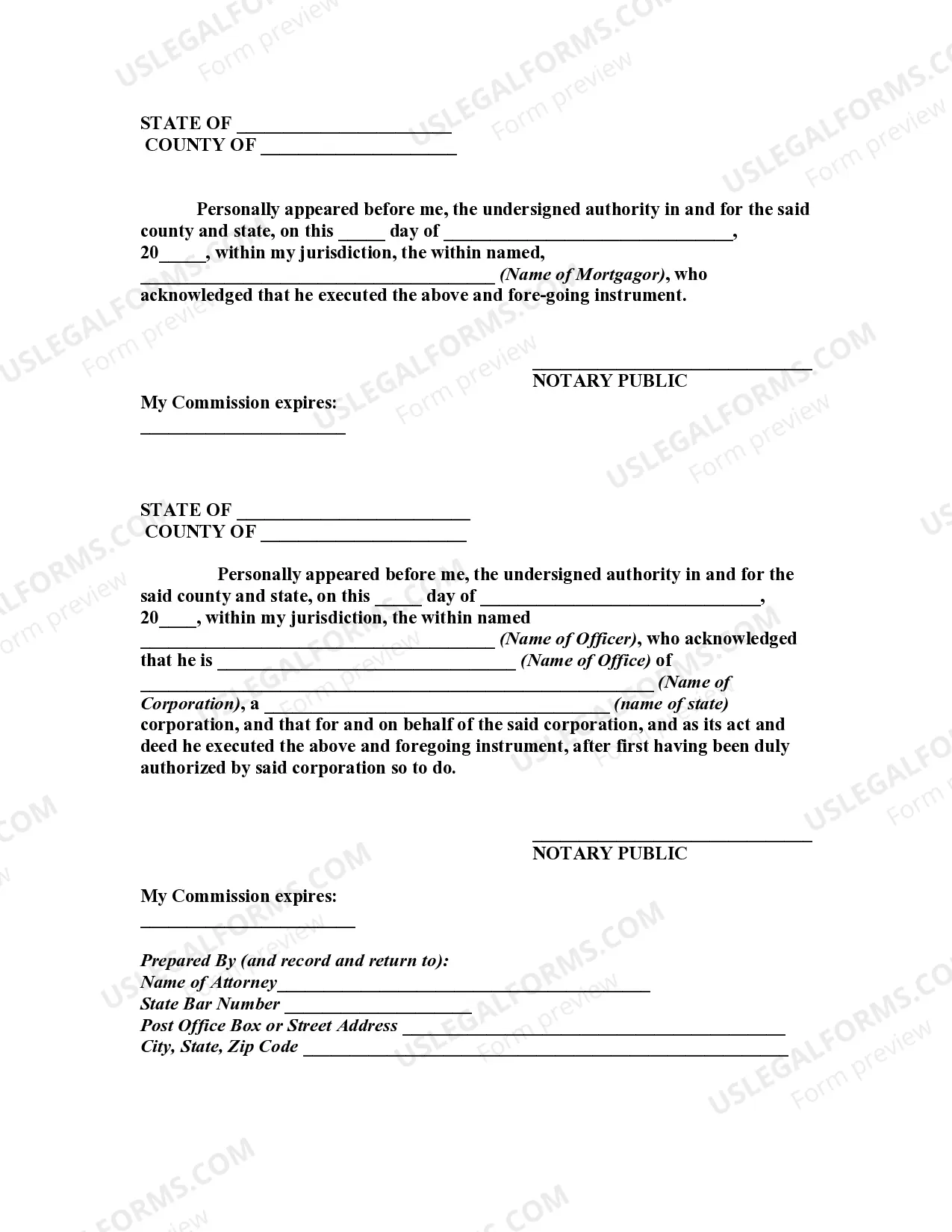

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

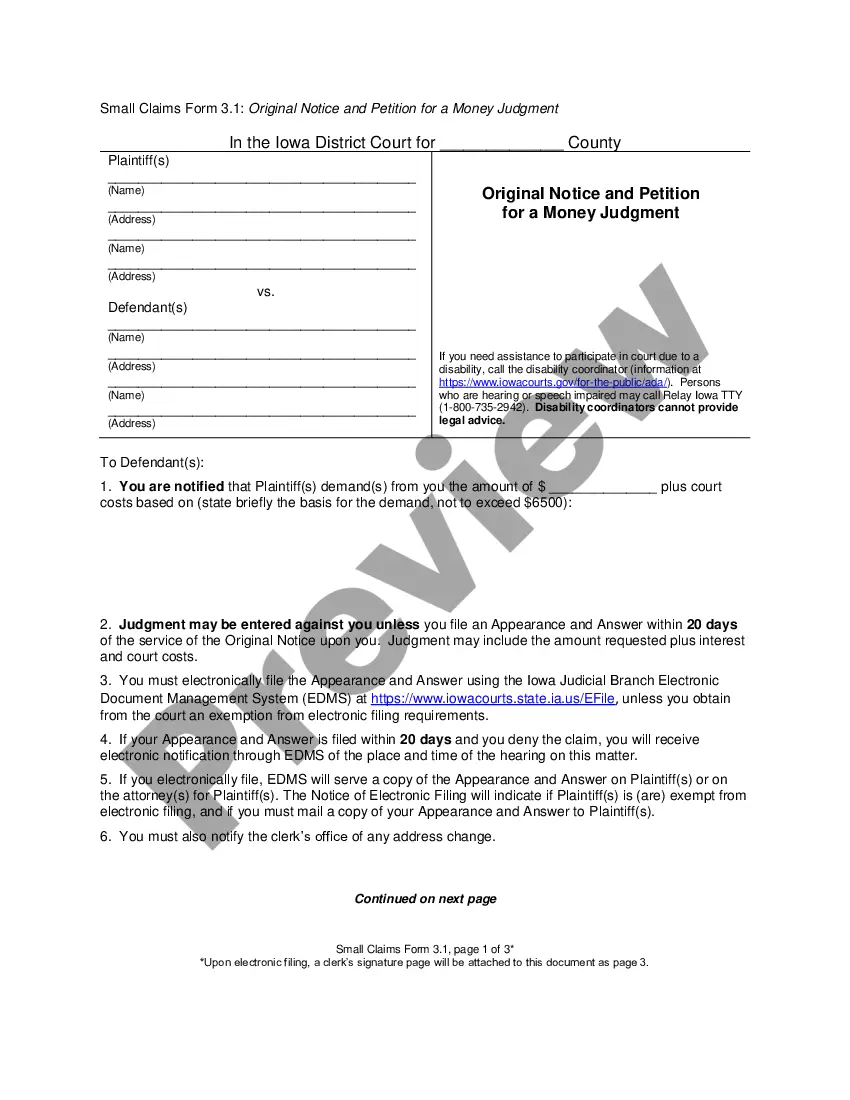

Utah Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate: A Comprehensive Guide Introduction: A Utah Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate refers to a legal document tailored to borrowers seeking an extension on their existing mortgage loan term. This agreement is primarily designed to modify two significant elements of a mortgage loan — the maturity date and the interest rate. By entering into this agreement with the lender, borrowers can secure extra time to repay their loan, along with revised terms related to the interest rate. Types of Utah Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate: 1. Fixed-Rate Extension Agreement: One type of Utah Mortgage Loan Extension Agreement is the Fixed-Rate Extension Agreement. This agreement allows borrowers to extend the maturity date of their loan while maintaining the existing fixed interest rate. It grants borrowers an opportunity to continue making regular fixed payments over the extended term, providing them with greater flexibility and easing any financial burden they may face. 2. Adjustable-Rate Extension Agreement: The Adjustable-Rate Extension Agreement is another prominent type of Utah Mortgage Loan Extension Agreement. It caters to borrowers whose mortgage loan carries an adjustable interest rate. With this agreement, the maturity date can be extended, and the borrower's interest rate can be adjusted based on prevailing market conditions. This type of extension grants borrowers the advantage of ensuring their mortgage aligns with future interest rate fluctuations. 3. Modification Agreement with Increased Interest Rate: While the primary focus of a Utah Mortgage Loan Extension Agreement is providing borrowers with an extended maturity date, it is also possible to include an increase in the interest rate. This agreement is suitable for borrowers who require an extension but are willing to accept a higher interest rate in return. By agreeing to this modification, the borrower acknowledges the lender's increased risk and agrees to pay a higher rate over the extended term. 4. Modification Agreement with Lowered Interest Rate: Though less commonly utilized, a Modification Agreement with Lowered Interest Rate is available for borrowers with exceptional circumstances. In certain cases, borrowers may negotiate a reduction in their mortgage interest rate while extending the maturity date. This type of agreement benefits borrowers by reducing their overall interest expenses, allowing for potentially more affordable monthly payments. Key Elements of a Utah Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate: 1. Loan Details: The agreement includes vital information about the loan, including the original loan amount, current loan balance, interest rate, maturity date, and desired extension period. 2. Revised Maturity Date: This section outlines the new maturity date, specifying the extended period granted to the borrower. It may also highlight any conditions associated with the extension. 3. Revised Interest Rate: If the agreement includes an increase or decrease in the interest rate, this clause outlines the revised terms, including the new rate and the effective date of the change. 4. Monthly Payment Adjustments: If necessary, the agreement will state whether the monthly payment amount will be adjusted based on the modified terms. 5. Fees and Costs: It is important to include any fees or costs associated with the modification process, such as administrative fees or appraisal expenses. Conclusion: Utah Mortgage Loan Extension Agreements as to Maturity Date and Increase in Interest Rate provide borrowers with the flexibility to modify and extend their mortgage loan terms. Whether borrowers choose a fixed-rate or adjustable-rate extension, or opt for a modification with increased or lowered interest rates, these agreements offer customized solutions to meet their financial needs. Before entering such agreements, it is advisable for borrowers to consult with legal and financial professionals to ensure the terms are favorable and align with their long-term objectives.