A license authorizes the holder to do something that he or she would not be entitled to do without the license. Licensing may be directed toward revenue raising purposes, or toward regulation of the licensed activity, or both. Statutes frequently require that a person obtain a license before practicing certain professions such as law or medicine, or before carrying on a particular business such as that of a real estate broker or stock broker. If the license is required to protect the public from unqualified persons, an assignment of that license to secure a loan would probably not be enforceable.

Utah Assignment of Business License as Security for a Loan

Description

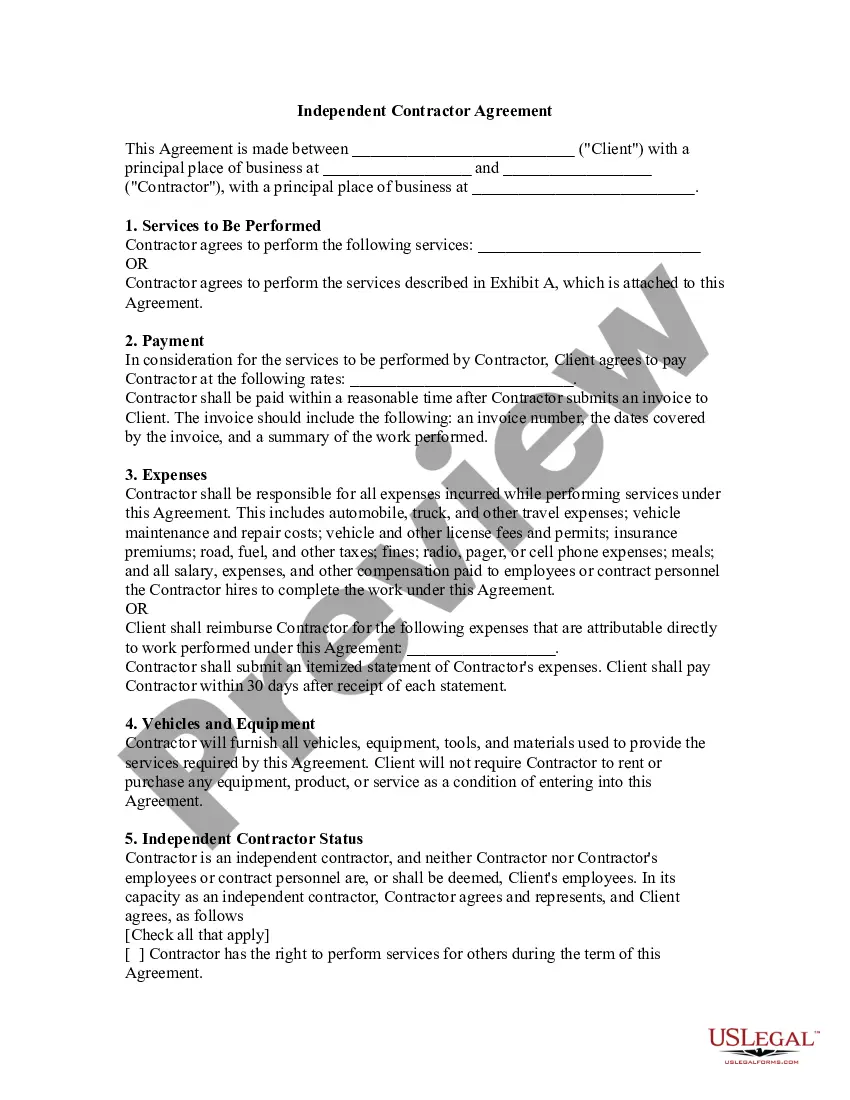

How to fill out Assignment Of Business License As Security For A Loan?

Are you currently in a situation where you need to have files for sometimes business or personal purposes virtually every day time? There are tons of legal record web templates available on the net, but getting versions you can rely on is not easy. US Legal Forms provides thousands of form web templates, like the Utah Assignment of Business License as Security for a Loan, which are composed to fulfill federal and state needs.

If you are previously acquainted with US Legal Forms site and get a free account, simply log in. After that, you are able to download the Utah Assignment of Business License as Security for a Loan web template.

Should you not offer an profile and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the form you require and ensure it is for your appropriate city/region.

- Use the Review key to examine the form.

- Read the description to actually have chosen the proper form.

- In the event the form is not what you are looking for, make use of the Look for industry to obtain the form that fits your needs and needs.

- If you obtain the appropriate form, click on Get now.

- Select the rates strategy you desire, fill in the specified information to produce your bank account, and buy the transaction using your PayPal or bank card.

- Choose a hassle-free file formatting and download your duplicate.

Find every one of the record web templates you have purchased in the My Forms menu. You may get a additional duplicate of Utah Assignment of Business License as Security for a Loan at any time, if needed. Just select the required form to download or print out the record web template.

Use US Legal Forms, one of the most substantial selection of legal varieties, to save time and stay away from faults. The assistance provides professionally made legal record web templates that can be used for a variety of purposes. Make a free account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

All Utah businesses must be licensed with the city or county where they are doing business. Each Utah city and county has its own licensing requirements, forms and procedures. If you're conducting business within a city's limits, check with your city government to determine licensing requirements.

In Utah, you pay a $54 LLC filing fee and file the LLC Certificate of Organization with the Division of Corporations. And a business license is a document, which gives a person, or a company, the right to transact business.

The filing fee for both in-state and out-of-state entities forming LLCs is $70. Remittance should be made payable to the state of Utah. It costs $75 to expedite the process. You may submit documents online, directly to the Division of Corporations and Commercial Code, or mail them to P.O. Box 146705.

Utah LLC Processing Times Normal LLC processing time:Expedited LLC;Utah LLC by mail:3-7 business days (plus mail time)2 business days ($75 extra)Utah LLC online:2 business daysNot available

All Utah businesses must be licensed with the city or county where they are doing business. Each Utah city and county has its own licensing requirements, forms and procedures. If you're conducting business within a city's limits, check with your city government to determine licensing requirements.

What do I need to obtain a business license? Completed the online application. Pay licensing fees and have required inspections completed. Registration with the Utah State Department of Commerce (Business Name, Corporation, LLC, Partnership) State Sales Tax Number (if applicable) Federal Tax ID Number (if applicable)