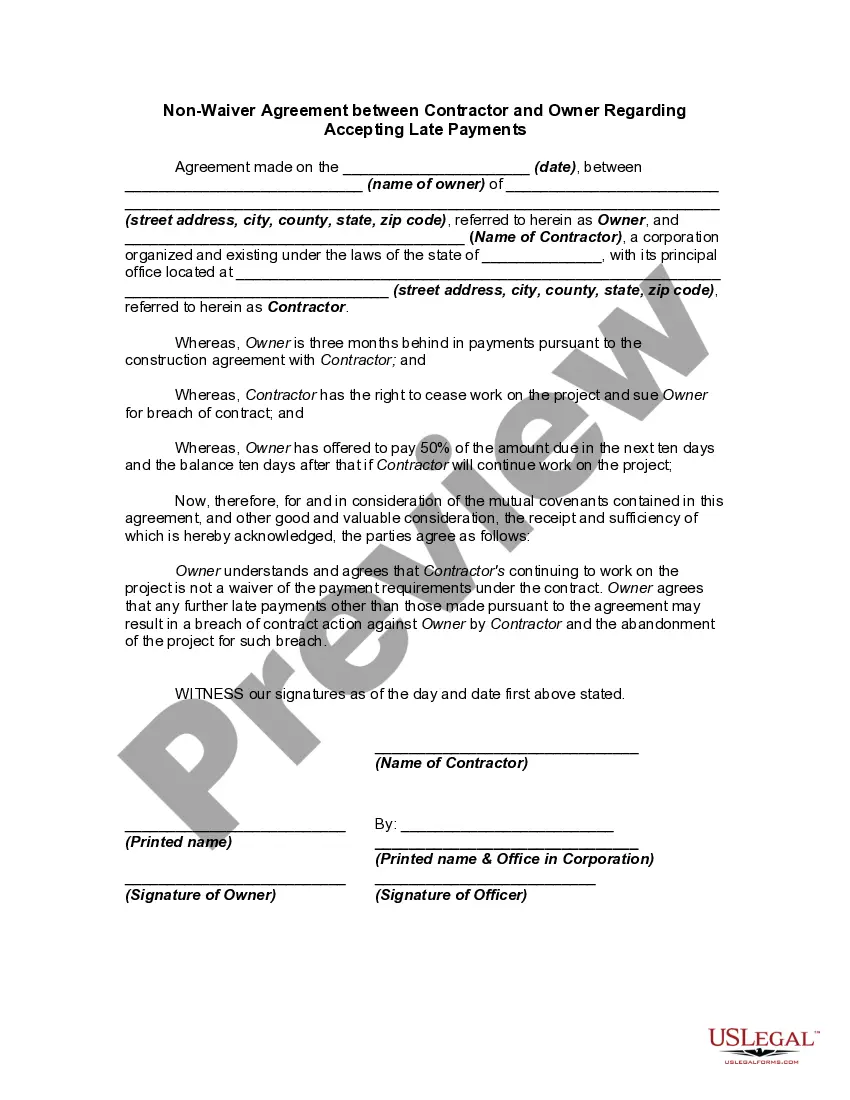

This form is a sample agreement between the owner of property and the contractor agreeing that acceptance by contractor of late payments as described in the agreement do not constitute a waiver of the right to receive timely payments pursuant to the agreement in the future.

Utah Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments is a legal document commonly used in the construction industry to define the terms and conditions surrounding late payments for services rendered. This agreement outlines the rights and responsibilities of both the contractor and the owner in the event of delayed or overdue payments. One specific type of Utah Non-Waiver Agreement commonly used is a "Partial Payment Agreement." This type of agreement specifically addresses situations where the contractor agrees to accept a partial payment in lieu of the full outstanding amount owed. It sets out the terms of the partial payment, including any agreed-upon interest or penalties, and ensures that the remaining unpaid balance is not waived or forgotten. Another type is the "Payment Plan Agreement." In cases where the owner is experiencing financial difficulties or unforeseen circumstances, this type of agreement establishes a structured payment plan to settle the outstanding balance over a set period. It provides a framework for both parties to adhere to and manage the late payment issue without resorting to legal action, while still safeguarding the contractor's rights. A key feature of any Utah Non-Waiver Agreement is the inclusion of a "Non-Waiver Clause." This provision states that accepting late payments or entering into alternative payment arrangements does not waive the contractor's right to seek full payment, including any accrued interest or penalties, in the future. It is crucial to include this clause to protect the contractor's ability to enforce payment obligations if further issues arise. The agreement generally includes important details such as the names and contact information of the contractor and owner, project description and location, payment obligations and due dates, consequences of late payments, any agreed-upon interest or penalties, dispute resolution mechanisms, and applicable state laws. Utah Non-Waiver Agreements between Contractor and Owner Regarding Accepting Late Payments play a vital role in managing payment-related concerns in construction projects, preventing conflicts, and ensuring transparency. It is advisable for both parties to consult legal counsel before entering into such agreements to ensure compliance with Utah state laws and to protect their respective interests.