Utah Seller's Real Estate Disclosure Statement

Description

How to fill out Seller's Real Estate Disclosure Statement?

If you aim to complete, acquire, or print sanctioned document templates, utilize US Legal Forms, the primary collection of legal forms, accessible online.

Employ the site's user-friendly and convenient search feature to obtain the documents you need.

A variety of templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you find the form you want, click the Purchase now button. Select the payment plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Utah Seller's Real Estate Disclosure Statement with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to access the Utah Seller's Real Estate Disclosure Statement.

- You can also find forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct state/country.

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the document, use the Search area at the top of the screen to find other variations of the legal document format.

Form popularity

FAQ

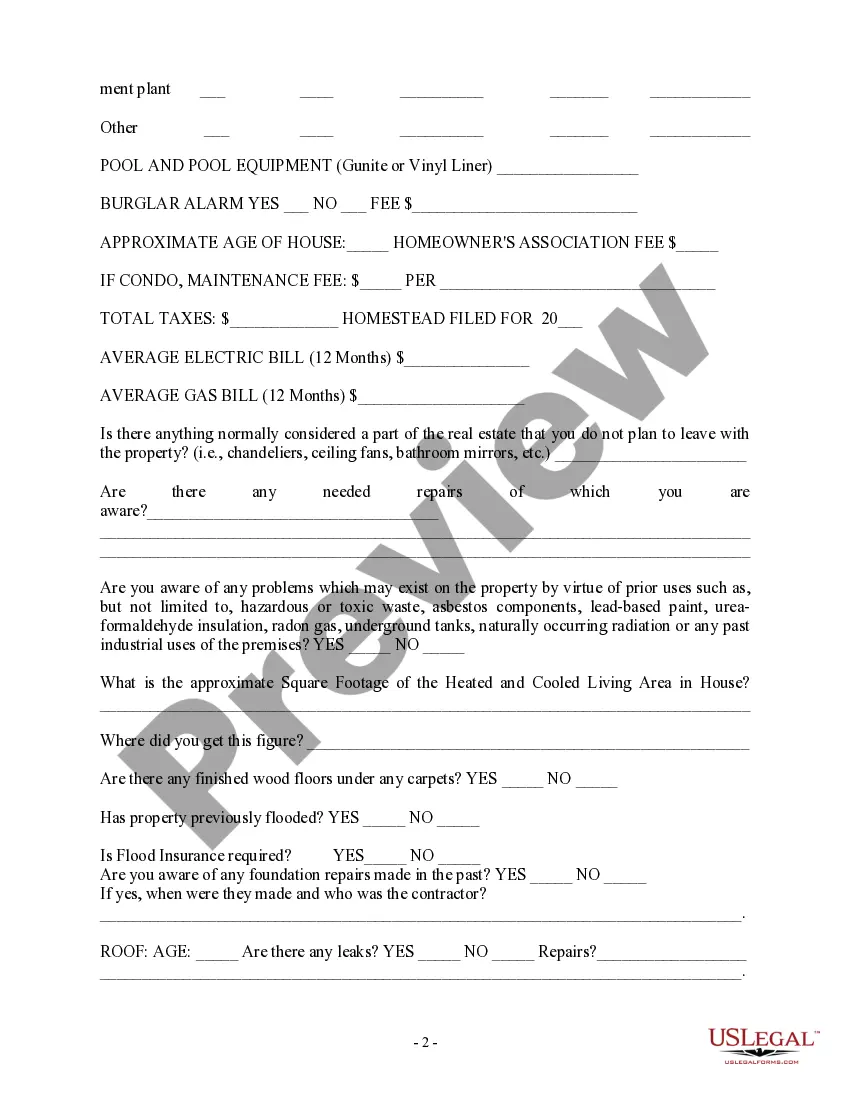

Here are eight common real estate seller disclosures to be aware of, whether you're on the buyer's side or the seller's side.Death in the Home.Neighborhood Nuisances.Hazards.Homeowners' Association Information.Repairs.Water Damage.Missing Items.Other Possible Disclosures.

A disclosure statement is a financial document given to a participant in a transaction explaining key information in plain language. Disclosure statements for retirement plans must clearly spell out who contributes to the plan, contribution limits, penalties, and tax status.

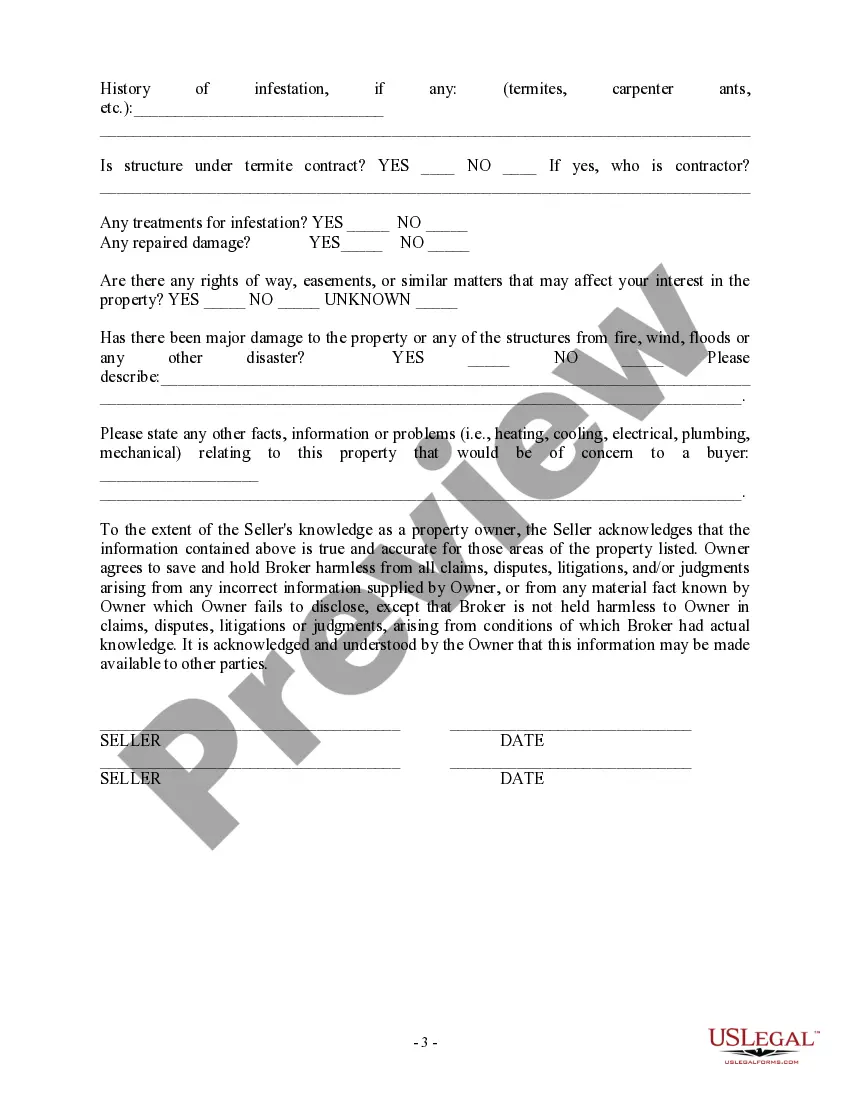

Often, an attempted waiver of the TDS by the buyer or the seller, such as the use of an as is clause in the purchase agreement, makes an agent's standard due diligence and disclosures seem unnecessary. However, the buyer cannot waive the seller's delivery of the statutorily-mandated TDS.

However, sellers are under a duty to disclose any defects in the title deeds and any latent (hidden) encumbrances (adverse matters) to potential buyers. The latter have been held to include a right of way that, although apparent on inspection, was held to be a latent defect that should have been disclosed to the buyer.

But, there are 12 states that are still considered non-disclosure: Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming. In a non-disclosure state, transaction sale prices are not available to the public.

If a real estate property owner doesn't use an agent to sell or buy a property, parties involved in a transaction can choose to keep the sales price anonymous in Utah which is a non-disclosure state. The sales price of the transaction is not held as a public record in Utah.

A Seller's Disclosure is a legal document that requires sellers to provide previously undisclosed details about the property's condition that prospective buyers may find unfavorable. This document is also known as a property disclosure, and it's important for both those buying a house and for those selling a house.

The document provided by the seller that described the condition of the property is known as the Transfer Disclosure Statement. As a buyer, you should receive this document during the contract contingency period.

In Utah, sellers do not have to disclose up front if a felony crime or death, violent or natural, took place at the home.

The only disclosure explicitly required by Utah's statutory law is that sellers tell prospective buyers whether there has been contamination due to "use, storage, or manufacture of methamphetamines" in the home. (See Utah Code. Annot. § 57-27-201.)