Utah Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

US Legal Forms - among the greatest libraries of legitimate types in the United States - gives a wide range of legitimate papers web templates it is possible to acquire or print. While using internet site, you can find 1000s of types for enterprise and individual functions, sorted by types, says, or key phrases.You can find the latest versions of types such as the Utah Acknowledgment by Debtor of Correctness of Account Stated within minutes.

If you already possess a monthly subscription, log in and acquire Utah Acknowledgment by Debtor of Correctness of Account Stated through the US Legal Forms local library. The Obtain button will show up on each kind you perspective. You have accessibility to all earlier saved types within the My Forms tab of your account.

If you wish to use US Legal Forms initially, allow me to share simple recommendations to obtain started off:

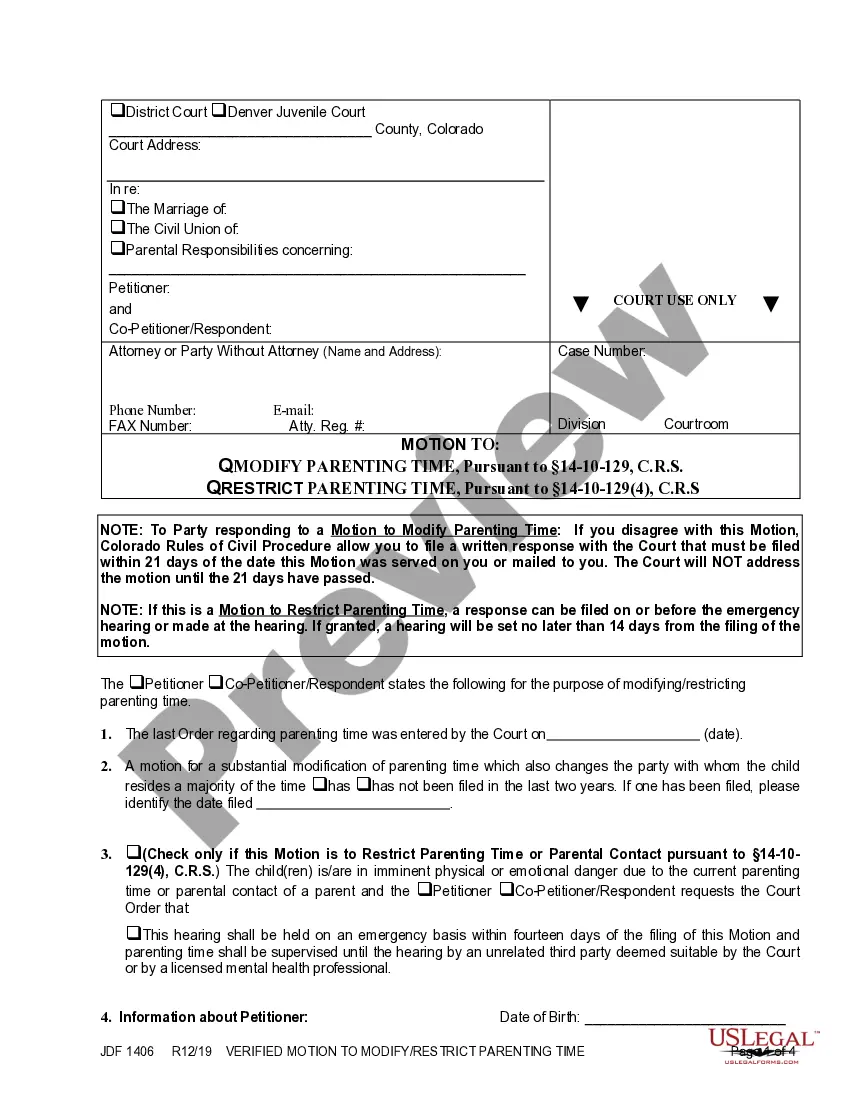

- Be sure you have selected the right kind to your area/county. Click the Review button to analyze the form`s articles. Read the kind explanation to actually have selected the right kind.

- In case the kind doesn`t fit your specifications, utilize the Search area on top of the display screen to find the one which does.

- If you are pleased with the shape, verify your choice by clicking on the Purchase now button. Then, choose the costs program you like and give your references to sign up on an account.

- Method the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the structure and acquire the shape on your own device.

- Make modifications. Complete, edit and print and signal the saved Utah Acknowledgment by Debtor of Correctness of Account Stated.

Every single web template you added to your account does not have an expiry particular date and is also the one you have eternally. So, if you would like acquire or print yet another version, just check out the My Forms portion and click on the kind you want.

Get access to the Utah Acknowledgment by Debtor of Correctness of Account Stated with US Legal Forms, by far the most considerable local library of legitimate papers web templates. Use 1000s of expert and express-particular web templates that meet up with your company or individual requirements and specifications.

Form popularity

FAQ

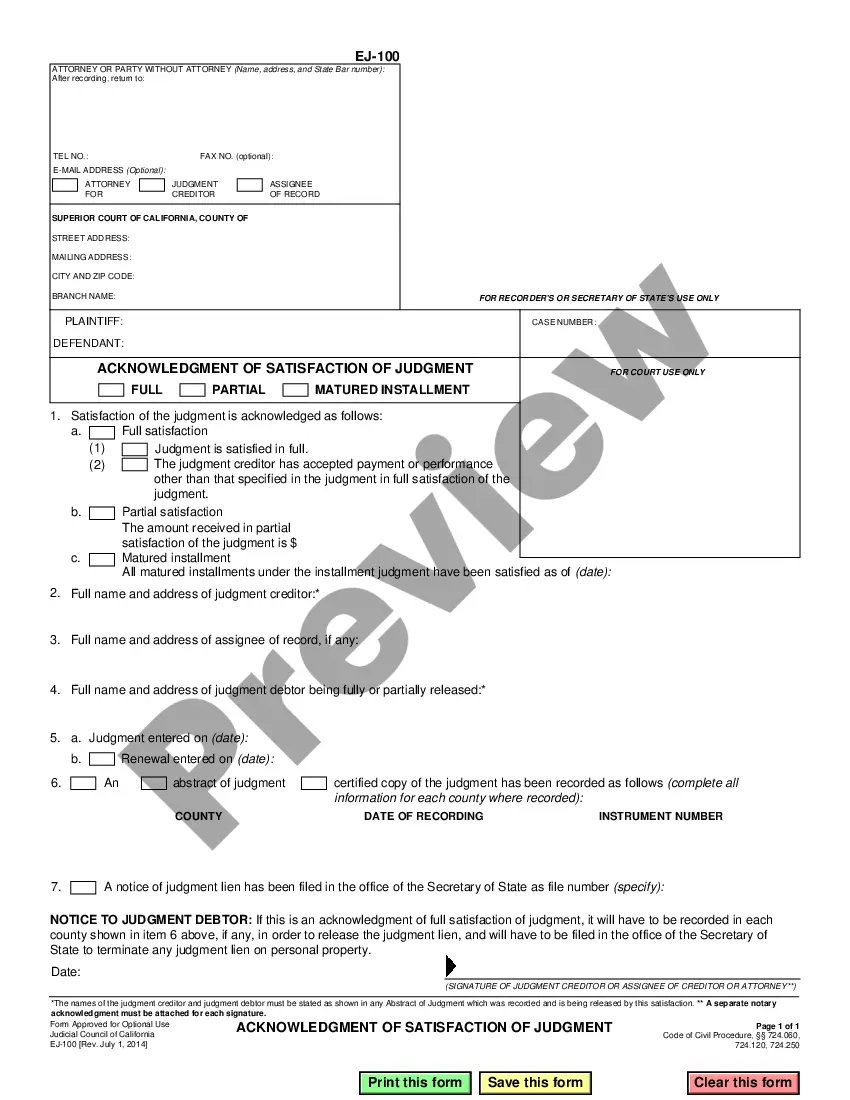

Summary This Acknowledgement of Debt can be used where a debt is owed by two or more persons or legal entities, who are jointly liable for the same debt to the creditor. An Acknowledgement of Debt is a form of payment undertaking, used to acknowledge and confirm that a debt is due, and to specify the payment date.

I,_____ hereby confirms and acknowledges to ________(creditor ) that the undersigned is indebted to the creditor in the amount of ____ as of date hereof which amount is due owing includes all accrued interest and other permitted charges to date.

An Acknowledgement of Debt is a legal document that states that you owe a debt to someone. It can be used as proof of the debt in court if necessary. The requirements for an Acknowledgement of Debt vary from country to country, but in general, it must be in writing and signed by both parties.

What are the requirements of an AOD? In addition to a clear and undeniable admission of liability (?IOU?), the agreement should contain the payment terms, a breach clause, and the signatures of both the creditor and the debtor.

An Acknowledgement of Debt, also known as an "IOU", is a formal document in which one party acknowledges that they owe money to another party. The document typically contains the amount owed, the date by which it is due, and the signature of the person acknowledging the debt.

What are the requirements of an AOD? In addition to a clear and undeniable admission of liability (?IOU?), the agreement should contain the payment terms, a breach clause, and the signatures of both the creditor and the debtor.

A 'share' represents ownership of the company whereas a debenture is only acknowledgement of debt.

I,_____ hereby confirms and acknowledges to ________(creditor ) that the undersigned is indebted to the creditor in the amount of ____ as of date hereof which amount is due owing includes all accrued interest and other permitted charges to date.