Utah Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

Are you currently in a situation where you need documents for both business or personal purposes almost every day.

There are many legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Utah Revocable Trust for Lottery Winnings, designed to comply with federal and state requirements.

When you find the right form, click Get now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Utah Revocable Trust for Lottery Winnings template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

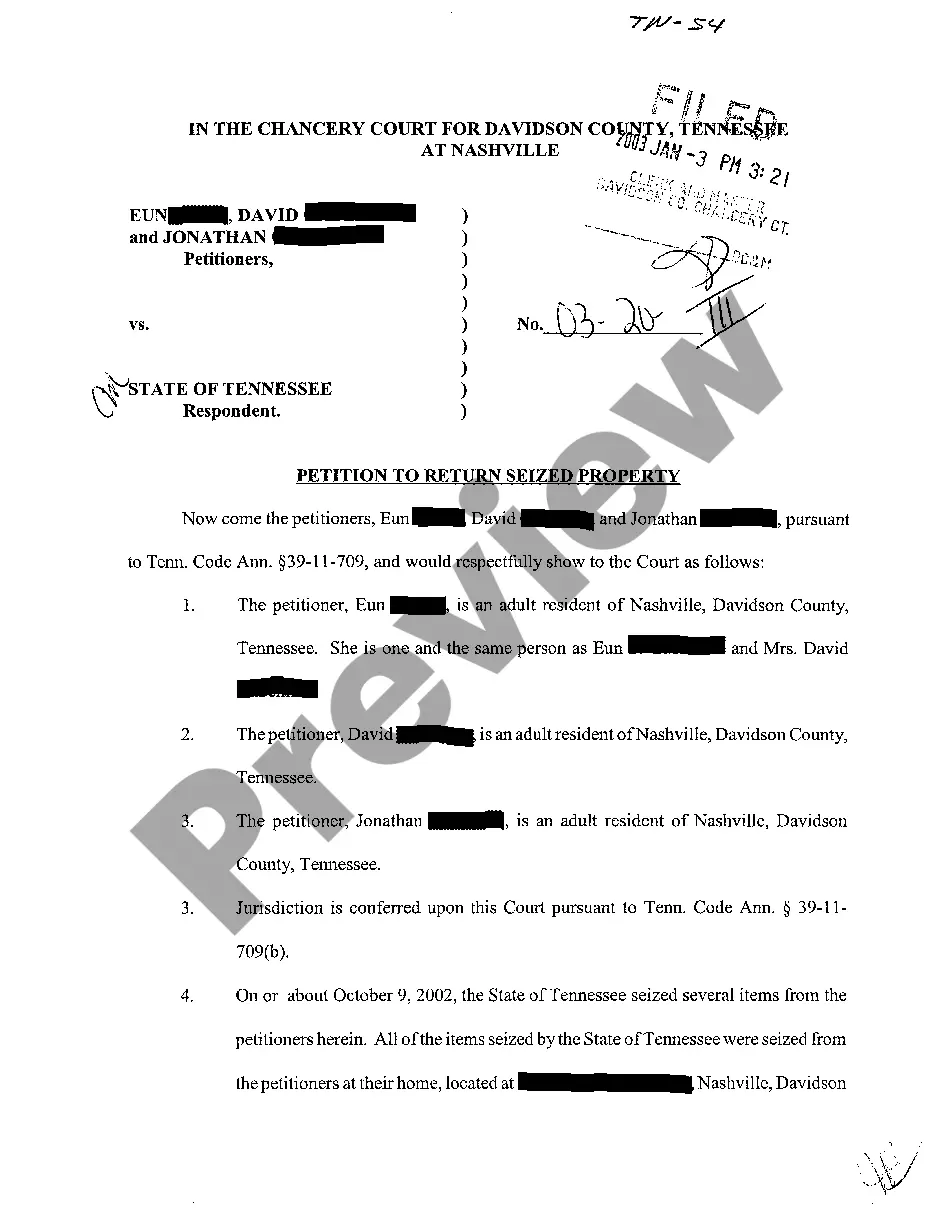

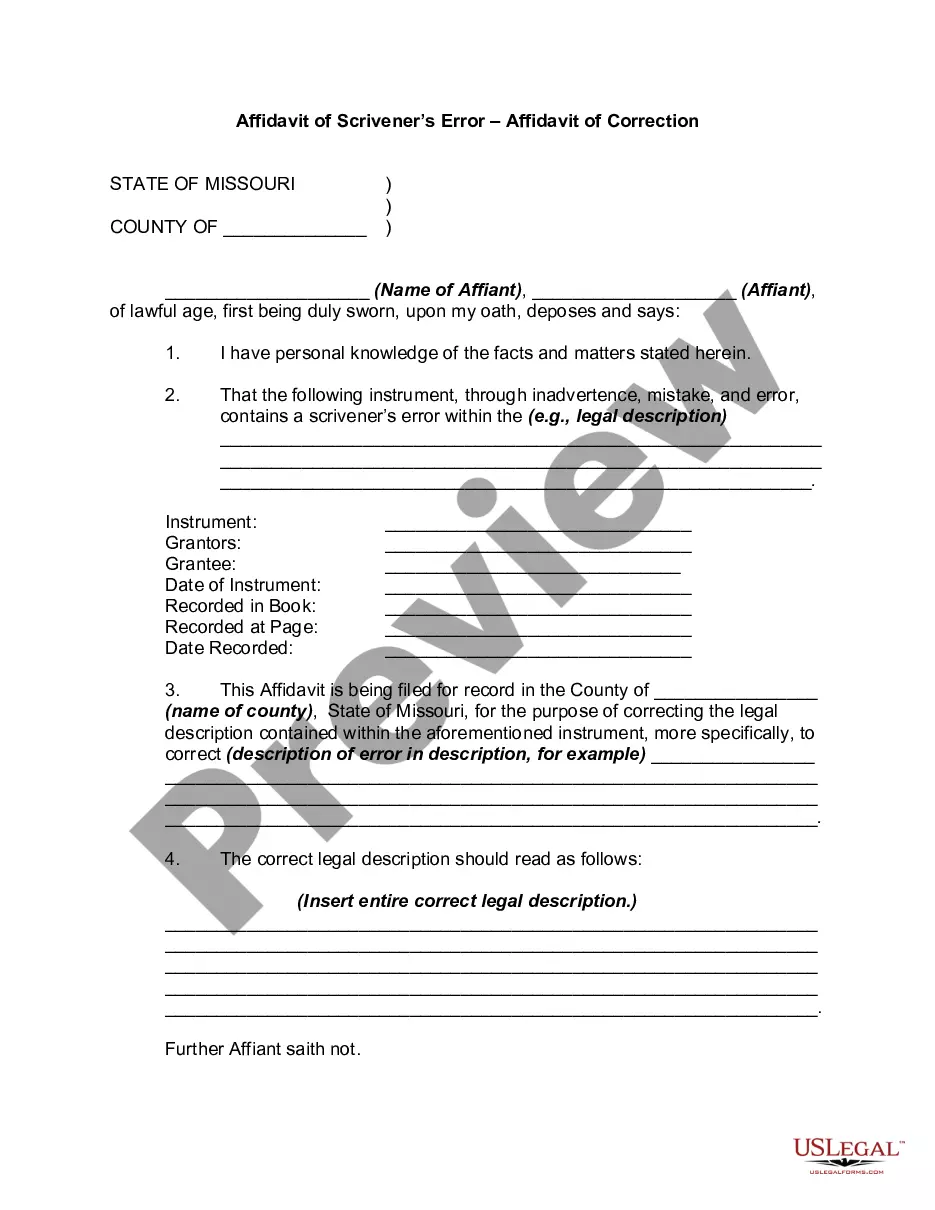

- Utilize the Review option to examine the form.

- Check the summary to confirm that you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The best option after winning the lottery includes working with financial advisors to create a Utah Revocable Trust for Lottery Winnings. This trust can help you protect your assets, maintain privacy, and ensure that your resources are allocated as you intend. Engaging with professionals will maximize the advantages of your newfound wealth.

The best trust to establish after winning the lottery is a Utah Revocable Trust for Lottery Winnings. This type of trust allows you to retain control over your assets while providing benefits like privacy and efficient estate management. It also minimizes the risk of losing your winnings to fraud or claims from others.

Upon winning the lottery, the first crucial step is to remain calm and secure your ticket. Next, consult with financial and legal advisors to discuss setting up a Utah Revocable Trust for Lottery Winnings. This will help protect your assets and plan for your future while minimizing taxes on your new wealth.

To claim lottery winnings with a trust, start by establishing a Utah Revocable Trust for Lottery Winnings prior to claiming your prize. After you win, the lottery agency may allow you to claim the prize in the name of your trust. This strategy not only provides you with privacy but also helps in effective estate planning.

Avoiding taxes on lottery winnings can be complex, but using a Utah Revocable Trust for Lottery Winnings may provide some benefits. By placing your winnings in a trust, you can create a distribution plan that makes tax implications more manageable. It’s crucial, however, to consult with tax professionals who can offer specific strategies tailored to your situation.

To avoid gift tax on lottery winnings, consider structuring your winnings under a trust, like a Utah Revocable Trust for Lottery Winnings. This approach can help limit tax liabilities if you plan to distribute funds to family or friends. Consulting with a financial advisor or attorney can help ensure that you stay compliant with tax regulations while utilizing the trust effectively.

When a trust wins the lottery, it means the lottery winnings are directed to a legal entity rather than an individual. This can provide a level of privacy and allow strategic management of the funds. For instance, a Utah Revocable Trust for Lottery Winnings can help you outline how to distribute those funds over time, offering both financial planning and peace of mind.

To avoid gift tax, consider gifting amounts within the annual exclusion limit of $17,000 per recipient. A Utah Revocable Trust for Lottery Winnings provides a structured way to distribute your winnings over time, potentially keeping gifts under this threshold. Consulting with an attorney can ensure you remain compliant while making generous gifts.

Lottery winners should seek an attorney who specializes in estate planning, with a focus on trusts and tax law. An attorney experienced in Utah Revocable Trust for Lottery Winnings can provide valuable guidance on protecting assets and maximizing tax benefits. They will help you navigate the complexities associated with significant winnings.

Gift tax regulations allow individuals to give a certain amount without incurring taxes. In 2023, the annual exclusion for gifts is $17,000 per recipient. Utilizing a Utah Revocable Trust for Lottery Winnings can help structure gifts in a way that adheres to these limits, thereby avoiding unnecessary taxes on large distributions.