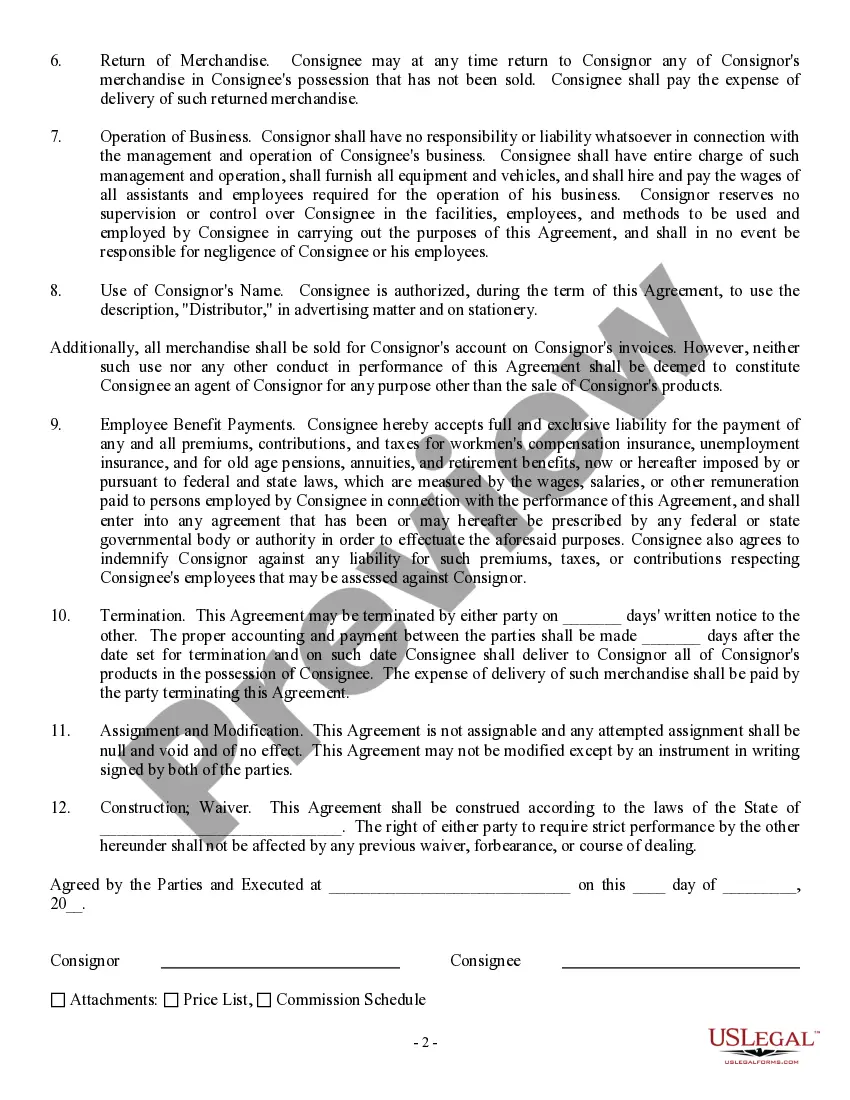

Utah Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the most up-to-date versions of documents such as the Utah Contract for Sale of Goods on Consignment in just moments.

If you already have a membership, sign in to download the Utah Contract for Sale of Goods on Consignment from the US Legal Forms library. The Download button will appear on every form you view. You can find all previously obtained forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the payment.

Choose the format and download the document to your device. Edit. Fill out, revise, and print and sign the downloaded Utah Contract for Sale of Goods on Consignment. Every template you added to your account does not expire and is yours permanently. So, if you want to download or print another copy, just visit the My documents section and click on the form you need. Access the Utah Contract for Sale of Goods on Consignment with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to help you begin.

- Make sure you have selected the correct form for your region/state. Click the Review button to examine the content of the form.

- Read the form description to confirm that you have chosen the appropriate document.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form you've chosen, confirm your selection by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

When you consign something, you place your goods with a consignee, authorizing them to sell the items on your behalf. The consignee takes ownership only of the sale proceeds, while you retain ownership of the goods until they are sold. Utilizing a Utah Contract for Sale of Goods on Consignment is crucial, as it helps to define the arrangements, responsibilities, and payment terms between you and the consignee, ensuring clarity throughout the process.

Yes, a consignment is a type of contract that establishes a legal agreement between the consignor and the consignee. This contract details the terms under which the consignee sells the goods for the consignor. A well-drafted Utah Contract for Sale of Goods on Consignment ensures that both parties understand their rights and obligations, contributing to a smoother transaction process.

There are two main types of consignments: retail consignment and wholesale consignment. Retail consignment involves placing goods in a store, where the retailer sells the products while only paying the consignor for what is sold. On the other hand, wholesale consignment typically involves larger quantities and deals more directly with stores or distributors. When navigating these options, a Utah Contract for Sale of Goods on Consignment can clearly outline the terms for both parties.

Yes, consignment sales are reported to the IRS, as they constitute taxable income. Both buyers and sellers must adhere to IRS regulations and report their earnings accurately. Including this information in your Utah Contract for Sale of Goods on Consignment is vital for both parties to comply with tax obligations and maintain transparent financial records.

To account for goods on consignment, maintain detailed records of inventory, sales, and agreements. This practice helps track what items are still in the consignment shop and which have sold. Using a structured Utah Contract for Sale of Goods on Consignment can aid in organizing these details and maintaining clear communication with the consignment partner.

The typical consignment split varies but usually falls between 40% for the seller and 60% for the consignment shop. This division allows both parties to benefit, as sellers retain a significant portion of the sale. When drafting a Utah Contract for Sale of Goods on Consignment, be sure to clearly outline this split to prevent misunderstandings.

To terminate a consignment agreement, you must review the terms outlined in your contract. Generally, written notice is required, specifying a termination date that adheres to the contract’s conditions. This ensures that the cancellation process aligns with the stipulations in your Utah Contract for Sale of Goods on Consignment.

Yes, consignment sales must be reported to the IRS as these sales generate taxable income. It is important to keep accurate records of all transactions related to consignment sales. Consult with a tax professional to ensure compliance and consider how a Utah Contract for Sale of Goods on Consignment fits into your overall financial strategy.

Yes, goods sold on consignment can usually be returned, but the terms for returns should be clearly defined in the consignment agreement. This provision protects both the seller and the consignee by setting expectations regarding unsold items. Understanding these terms is important when drafting a Utah Contract for Sale of Goods on Consignment.

Goods sold on consignment refer to items displayed and sold by one party on behalf of another. The seller retains ownership until the items are sold, which decreases financial risk for the consignee. This model fosters collaboration and allows sellers to reach more customers, making it a suitable option to explore under a Utah Contract for Sale of Goods on Consignment.