Are you within a position in which you require files for sometimes organization or personal functions nearly every day time? There are tons of legal papers templates available on the Internet, but finding types you can rely isn`t easy. US Legal Forms delivers thousands of develop templates, such as the Utah Renunciation and Disclaimer of Interest in Life Insurance Proceeds, that happen to be written to fulfill state and federal specifications.

Should you be already acquainted with US Legal Forms website and get a merchant account, simply log in. Afterward, you are able to obtain the Utah Renunciation and Disclaimer of Interest in Life Insurance Proceeds template.

If you do not offer an profile and wish to start using US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is to the correct metropolis/state.

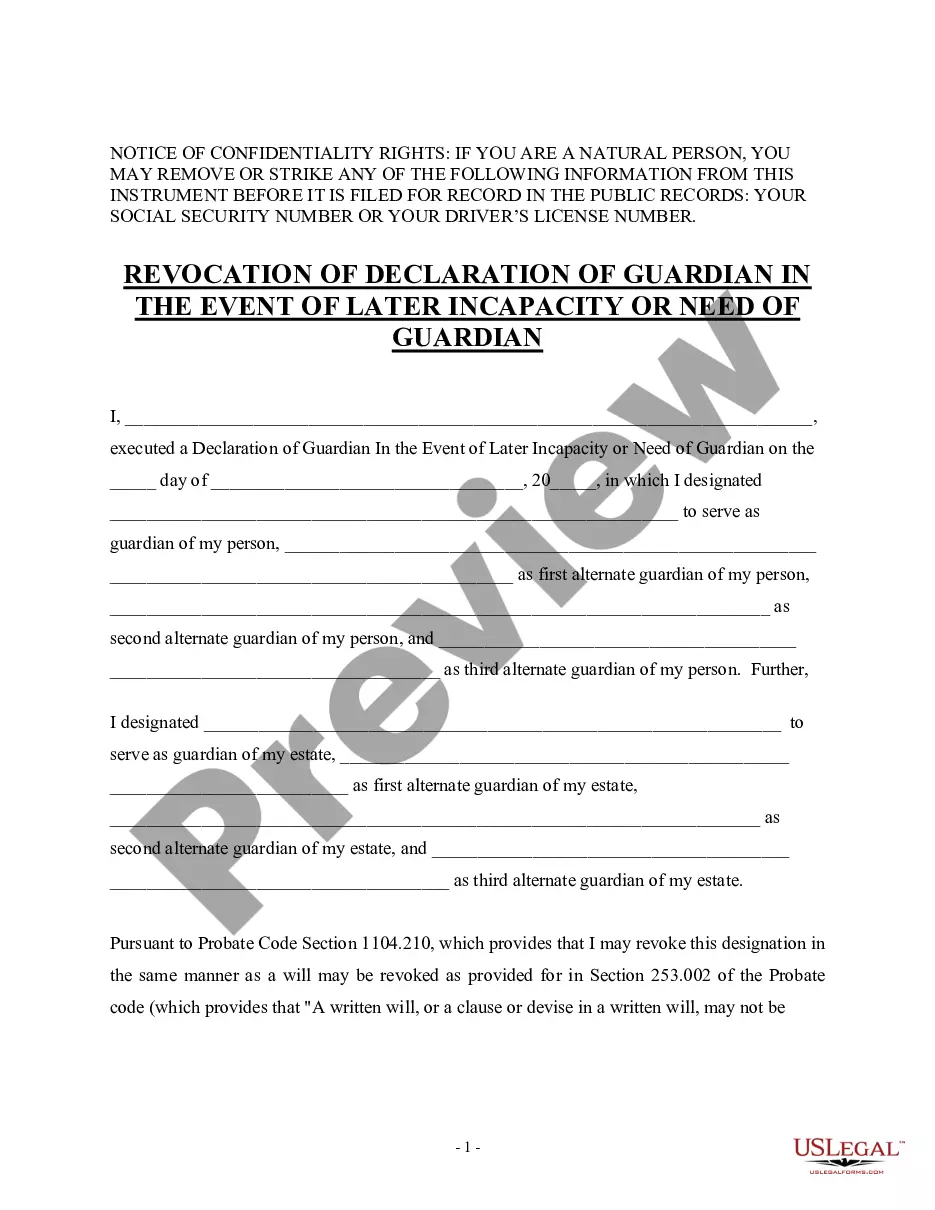

- Use the Preview option to review the shape.

- See the outline to actually have selected the proper develop.

- If the develop isn`t what you are seeking, make use of the Research area to get the develop that meets your needs and specifications.

- If you get the correct develop, click on Buy now.

- Choose the costs prepare you would like, complete the desired information and facts to generate your bank account, and pay for the order with your PayPal or charge card.

- Select a hassle-free paper structure and obtain your version.

Discover all the papers templates you may have bought in the My Forms food selection. You can get a further version of Utah Renunciation and Disclaimer of Interest in Life Insurance Proceeds whenever, if necessary. Just select the required develop to obtain or printing the papers template.

Use US Legal Forms, probably the most substantial collection of legal varieties, in order to save efforts and steer clear of errors. The support delivers appropriately produced legal papers templates that can be used for a selection of functions. Create a merchant account on US Legal Forms and commence producing your daily life a little easier.