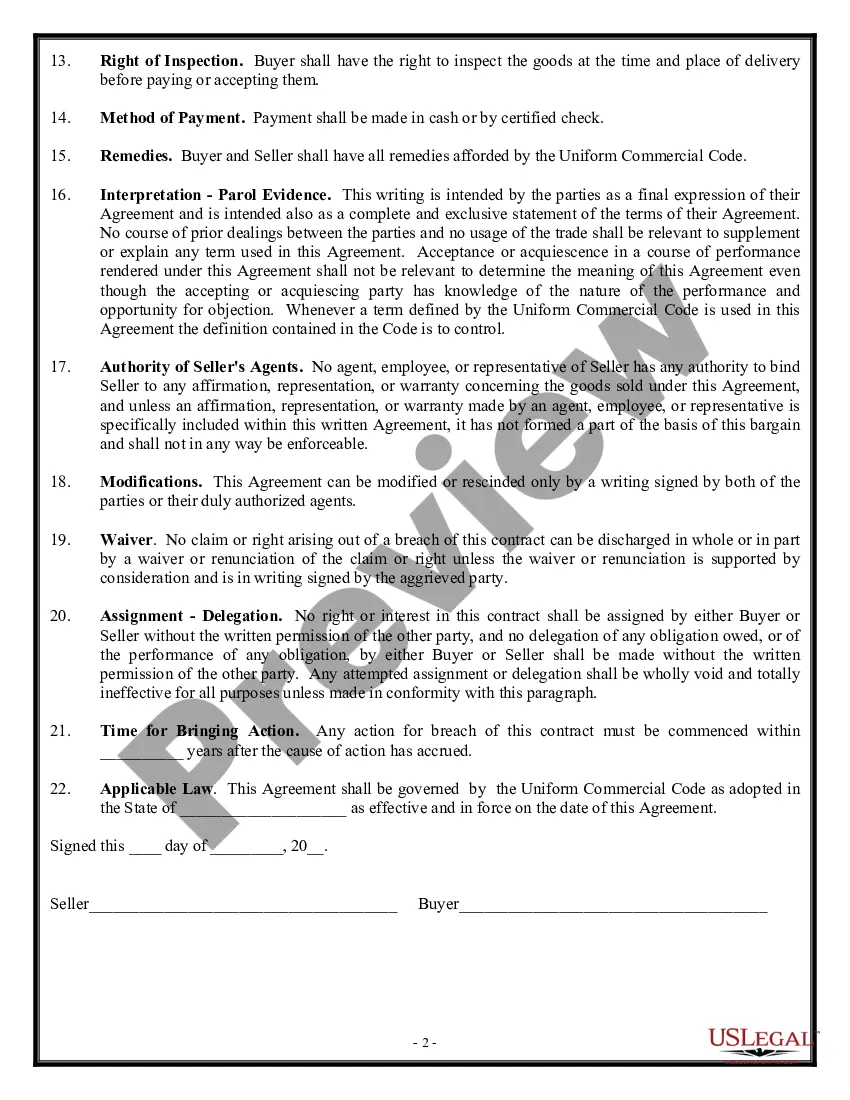

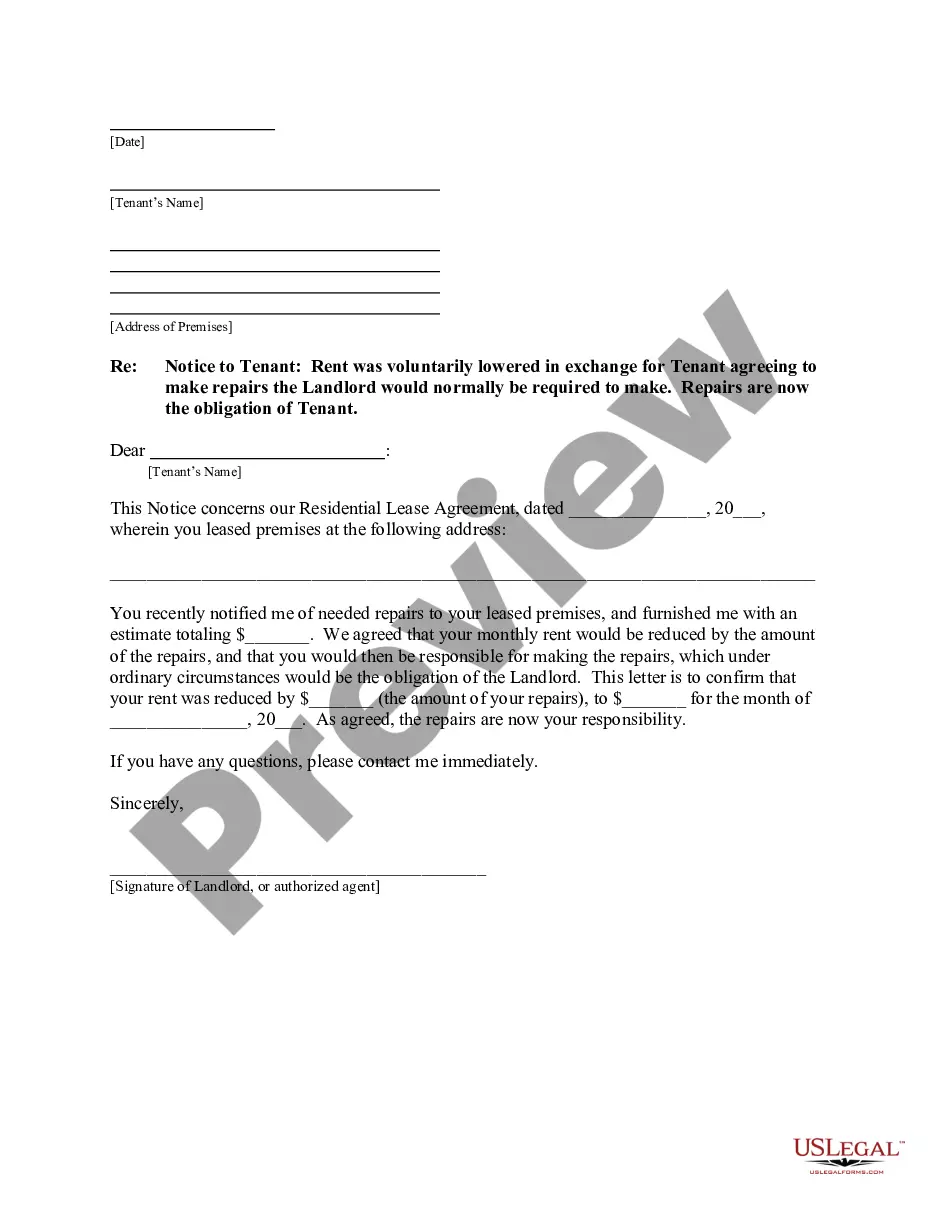

Utah Contract — Sale of Good— - A Detailed Description Keywords: Utah, contract, sale of goods, purchase, legal obligations, parties, terms and conditions, types. The Utah Contract — Sale of Goods pertains to the legal framework governing the purchase and sale of goods within the state of Utah. A contract is a legally binding agreement between two or more parties, which outlines the rights and responsibilities of each party in the transaction. In the context of goods, this contract ensures that goods are sold in a fair and efficient manner, with clear terms and conditions for both the buyer and the seller. In Utah, the contract for the sale of goods falls under the Uniform Commercial Code (UCC), specifically Article 2. This article is applicable to transactions involving the sale, lease, or exchange of goods, excluding real estate and certain types of services. The UCC establishes general rules and regulations that are followed in commercial transactions to promote uniformity and clarity. The Utah Contract — Sale of Goods consists of several essential elements. Firstly, it includes the identification of the parties involved in the transaction, namely the buyer and the seller. Each party must be identified accurately, including their names and addresses. This ensures that both parties are legally bound by the terms and conditions of the contract. Secondly, the agreement outlines the terms and conditions of the sale, which encompass various aspects of the transaction. These terms typically include the description of the goods being sold, their quantity or volume, the price agreed upon, and the method of payment. The delivery terms, such as the place and time of delivery, are also specified in the contract. Additionally, any warranties or guarantees provided by the seller regarding the quality or condition of the goods are covered in this agreement. Further, the Utah Contract — Sale of Goods includes provisions addressing the remedies available to the parties in case of a breach, such as the right to cancel the contract, seek damages, or specific performance. These provisions ensure that both parties have legal recourse if the other fails to fulfill their obligations. It is important to note that there can be different types of Utah Contract — Sale of Goods, depending on the specific nature of the transaction. For instance, contracts may vary based on the goods being sold, such as contracts for the sale of tangible goods like electronics, vehicles, or furniture, or contracts for the sale of intangible goods like software or intellectual property. Different contracts may also exist for specific industries or sectors, such as contracts for the sale of agricultural products or medical devices. In summary, the Utah Contract — Sale of Goods is a legally binding agreement that governs the purchase and sale of goods within the state. It ensures that both the buyer and the seller fulfill their obligations and protects the rights of each party involved in the transaction. The contract establishes clear terms and conditions, outlines remedies in case of a breach, and fosters fair and efficient commerce in Utah.

Utah Contract - Sale of Goods

Description

How to fill out Contract - Sale Of Goods?

US Legal Forms - one of the most extensive repositories of legal documents in the United States - offers a variety of legal templates that can be downloaded or generated.

On the website, you can access thousands of forms for both business and personal purposes, sorted by categories, states, or keywords. You can find the latest versions of forms such as the Utah Contract - Sale of Goods in just a few minutes.

If you already possess a membership, Log In to download the Utah Contract - Sale of Goods from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Make modifications. Complete, edit, print, and sign the downloaded Utah Contract - Sale of Goods.

Each template you add to your account has no expiration date and belongs to you permanently. So, to download or generate another version, simply go to the My documents section and click on the form you need. Access the Utah Contract - Sale of Goods with US Legal Forms, one of the most significant libraries of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements and needs.

- If you wish to use US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the correct form for your area/state. Click on the Review button to examine the content of the form. Check the form details to confirm you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

- If you are content with the form, verify your selection by clicking the Purchase now button. Then, choose the pricing option you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Select the format and download the form onto your device.

Form popularity

FAQ

Utah is considered an origin-based sales tax state, which means that the sales tax rate is determined by where the seller is located. This is particularly relevant for businesses that deal with the Utah Contract - Sale of Goods, as the tax rate will depend on the seller’s physical presence. Understanding this aspect can help you accurately calculate taxes and maintain compliance in your sales operations.

The de minimis rule in Utah allows businesses to avoid collecting sales and use tax if their total sales are below a specified threshold. This rule is beneficial for smaller operators engaged in transactions covered under the Utah Contract - Sale of Goods, as it reduces administrative burdens. However, it's essential to monitor your sales closely to ensure you remain compliant with tax laws.

To file your sales and use tax in Utah, first, gather all necessary documentation related to your sales. You can file online through the Utah State Tax Commission’s website or by submitting paper forms. The process is straightforward, especially when you utilize services like uslegalforms, which help you streamline your filing tasks related to the Utah Contract - Sale of Goods. Don't forget to adhere to due dates to avoid penalties.

Yes, if you are selling taxable goods or services in Utah, you must obtain a sales and use tax license. This license allows you to collect sales tax on behalf of the state on transactions covered under the Utah Contract - Sale of Goods. You can easily apply for this license through the Utah State Tax Commission’s website. It's essential to stay compliant to avoid any potential fines.

To file sales tax in Utah, you need accurate records of your sales transactions, the sales tax rates applied, and any applicable exemptions. Ensure you keep details about the goods sold under the Utah Contract - Sale of Goods as they may influence your tax calculations. Additionally, you will need your business identification number and your sales tax license information. Using platforms like uslegalforms can simplify record-keeping and filing processes.

Conditions in a contract for sale of goods define the obligations both the buyer and seller must satisfy for the deal to proceed. These can cover quality, performance, and delivery expectations, providing a clear framework for the transaction. When drafting or reviewing a Utah Contract - Sale of Goods, understanding these conditions helps prevent disputes and ensures a smoother negotiation process.

Conditions in a contract for sale of goods refer to the specific requirements that must be met for the contract to be enforceable. These conditions might include the description of goods, delivery timelines, and payment terms. Familiarizing yourself with these aspects is essential when engaging in a Utah Contract - Sale of Goods to ensure both parties fulfill their obligations.

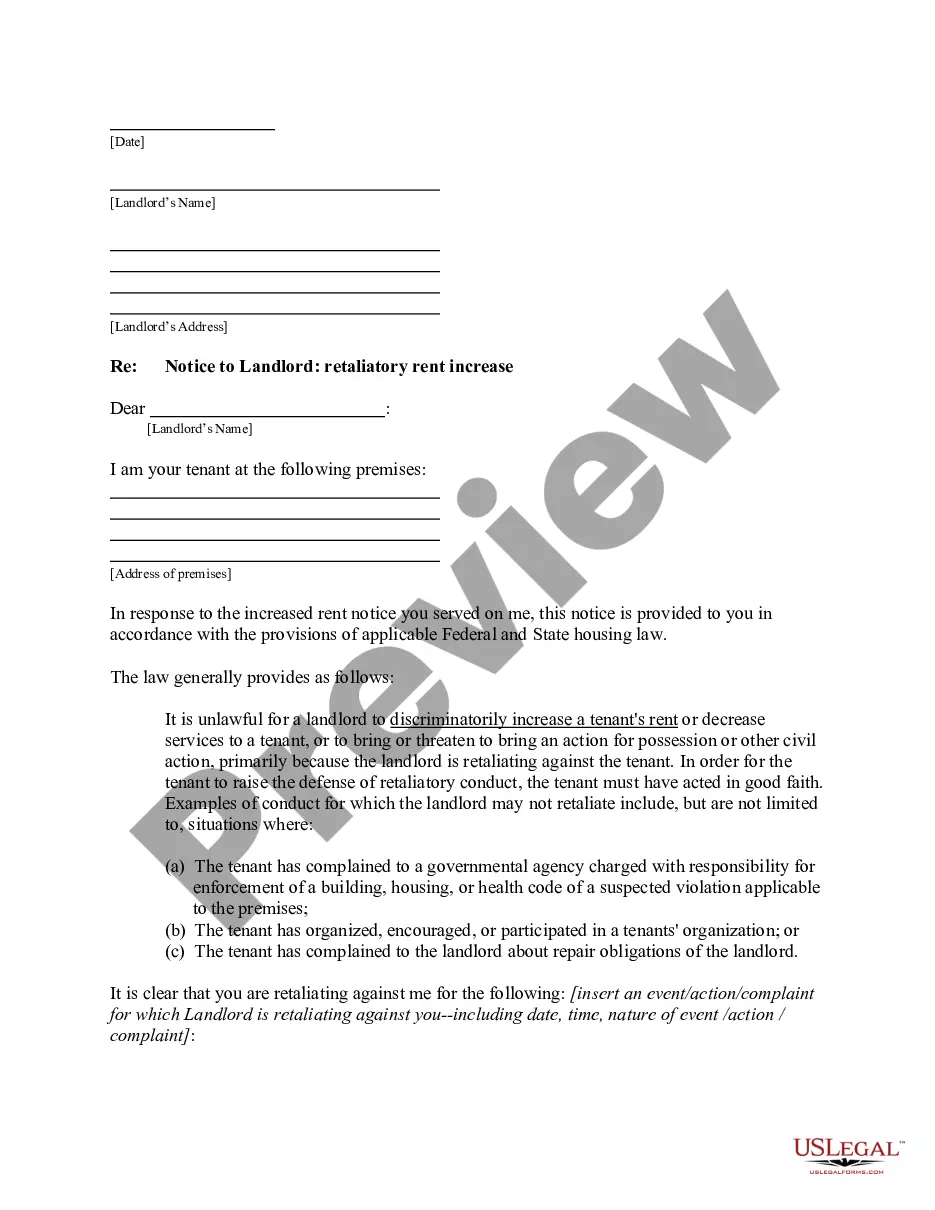

Yes, Utah has a 3 day right of rescission, particularly in specific transactions like home loans or sales involving door-to-door sales agreements. This right ensures consumers can review their commitments and cancel, if necessary. For contracts related to the Utah Contract - Sale of Goods, it's essential to verify if this right applies based on the type of goods purchased.

The 3 day right of rescission in Utah allows buyers to cancel certain types of contracts within three days after signing. This right provides protection for consumers, enabling them to reconsider their decisions without penalties. It's important to note that this right may not apply to every contract; understanding its applicability under the Utah Contract - Sale of Goods is crucial.

A contract becomes legally binding in Utah when it meets certain criteria, such as mutual consent, a lawful object, and consideration. Both parties must agree to the contract terms, and it should serve a lawful purpose. Additionally, the contract should be written and signed to be enforceable. Utilizing the US Legal platform can guide you through the requirements for creating a valid Utah Contract - Sale of Goods.