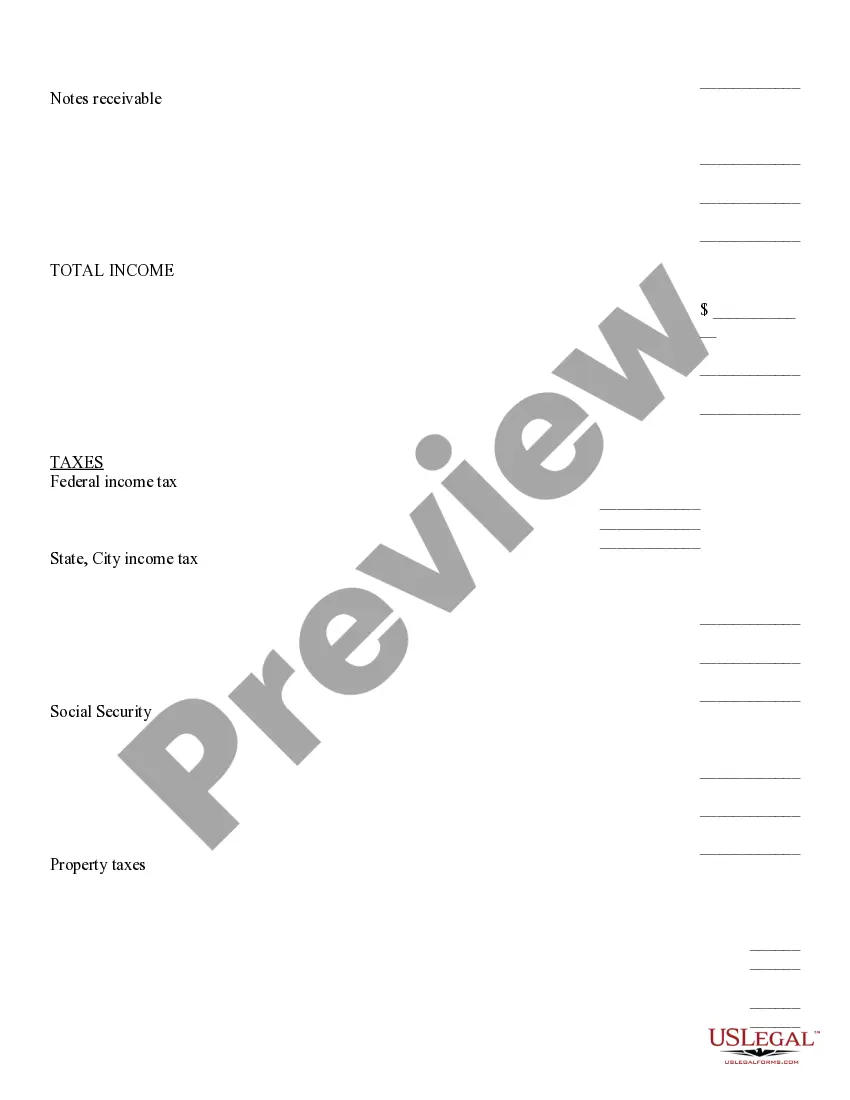

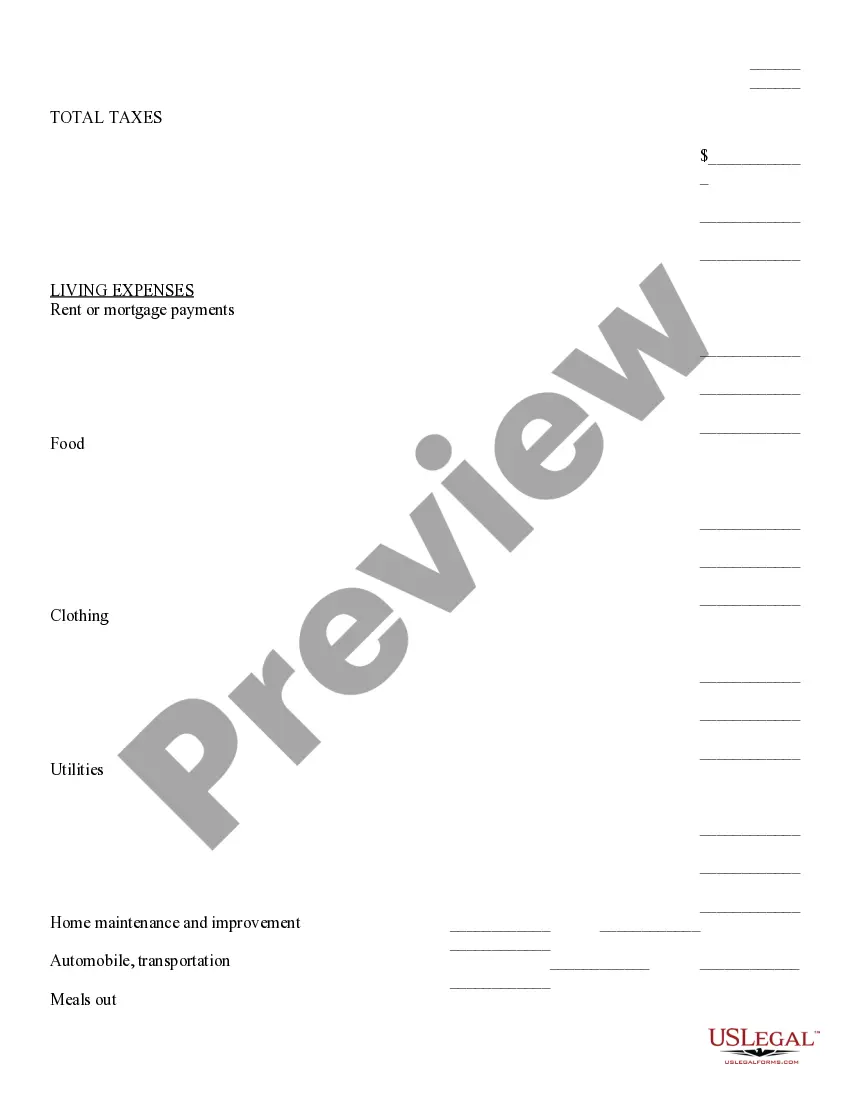

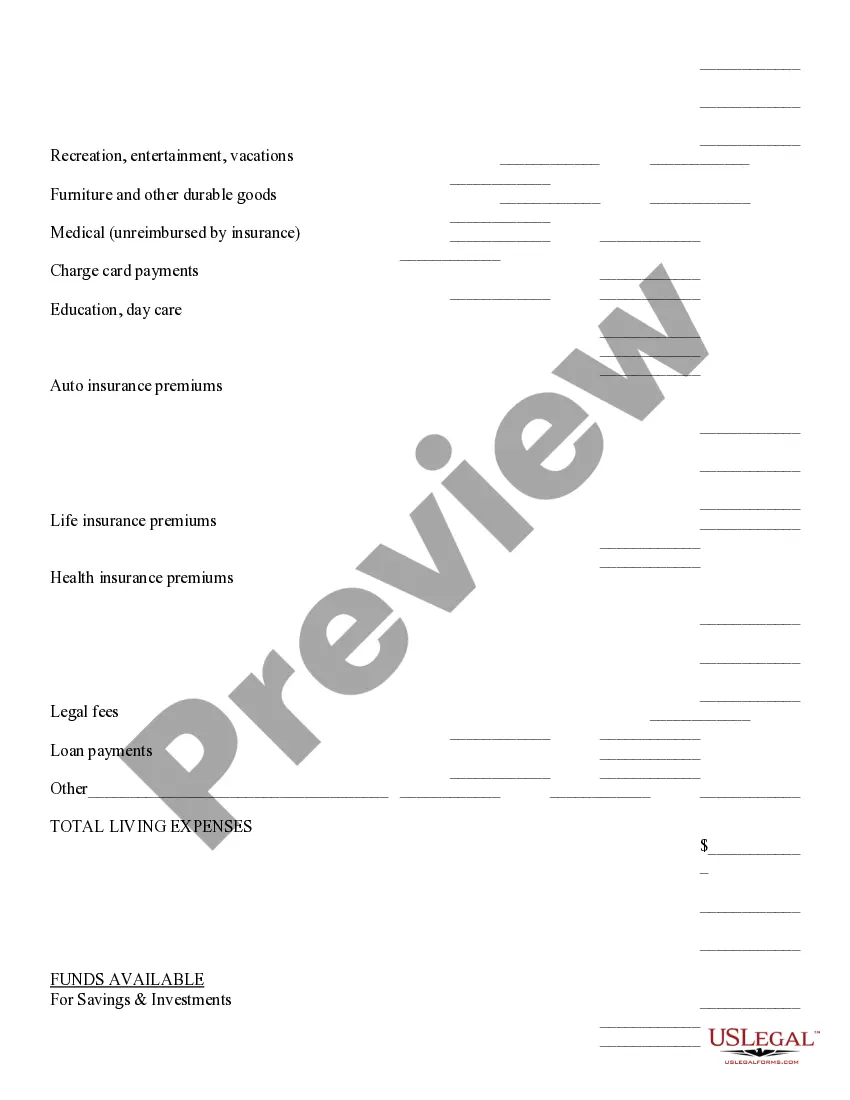

Utah Cash Flow Statement

Description

How to fill out Cash Flow Statement?

Selecting the finest legal document template can be quite challenging.

It's obvious that there are numerous templates available online, but how can you find the legal form you need.

Visit the US Legal Forms website.

First, ensure you have chosen the correct form for your city/county. You can review the form using the Review button and read the form description to confirm it is suitable for you.

- The service provides thousands of templates, including the Utah Cash Flow Statement, suitable for business and personal purposes.

- All the forms are verified by specialists and meet federal and state regulations.

- If you are already registered, sign in to your account and click on the Download button to access the Utah Cash Flow Statement.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

A cash flow statement of a company lays down an organisation's total fund inflow in the form of cash and cash equivalents through operational, investment, and financing activities. It also showcases the total cash outflow through the aforesaid activities.

The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flowthe precise amount of cash you have on hand for that time period. For example, depreciation is recorded as a monthly expense.

The cash flow statement differs from the balance sheet and income statement in that it excludes non-cash transactions required by accrual basis accounting, such as depreciation, deferred income taxes, write-offs on bad debts and sales on credit where receivables have not yet been collected.

A typical cash flow statement comprises three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The financial statement of a company consists of a cash flow statement. All companies other than one person company, dormant company and small company come under the applicability of cash flow statements under Companies Act, 2013.

You'll also notice that the statement of cash flows is broken down into three sectionsCash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

The main components of the cash flow statement are:Cash flow from operating activities.Cash flow from investing activities.Cash flow from financing activities.Disclosure of non-cash activities, which is sometimes included when prepared under generally accepted accounting principles (GAAP).

Here are four steps to help you create your own cash flow statement.Start with the Opening Balance.Calculate the Cash Coming in (Sources of Cash)Determine the Cash Going Out (Uses of Cash)Subtract Uses of Cash (Step 3) from your Cash Balance (sum of Steps 1 and 2)An Alternative Method.More items...