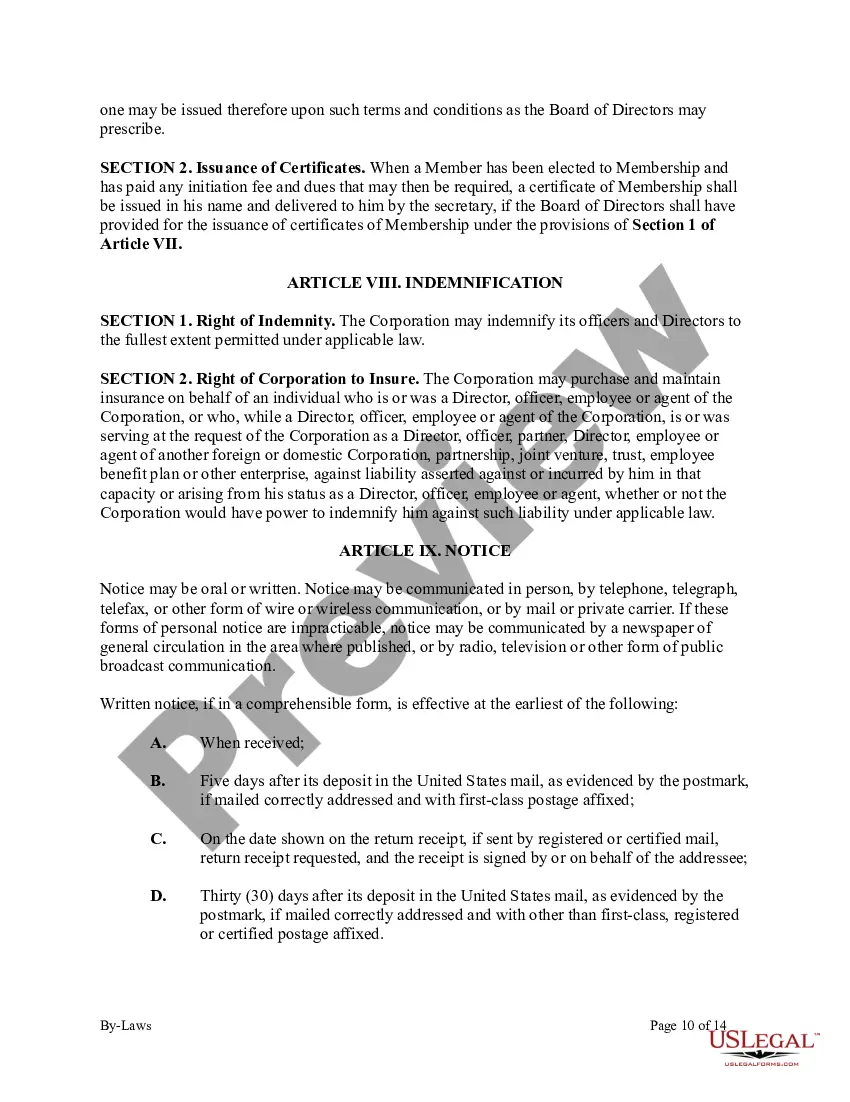

Utah Bylaws of Nonprofit Corporation are legal documents that outline the structure, operation, and internal rules of nonprofit organizations in the state of Utah. These bylaws are crucial for establishing and maintaining the organization's governance, roles and responsibilities of directors, officers, and members, as well as important operational procedures. The following are some relevant keywords that can help explain the intricacies of Utah Bylaws of Nonprofit Corporation: 1. Purpose: The bylaws typically begin by stating the nonprofit organization's purpose, mission, and goals. This section outlines the primary objective behind the nonprofit's existence. 2. Board of Directors: The bylaws clearly define the composition, qualifications, election, terms, and powers of the board of directors. It outlines the number of directors, their roles, responsibilities, and the procedures for meetings, including quorum requirements and voting processes. 3. Officers and Their Duties: The bylaws describe the roles and responsibilities of officers, such as the president, vice-president, treasurer, and secretary. It includes their appointment or election, terms, powers, and the procedures for their removal. 4. Committees: If applicable, the bylaws may detail the establishment, purpose, composition, and powers of committees within the nonprofit organization. These committees often focus on specific areas like finance, fundraising, or program development. 5. Membership: The bylaws specify the qualifications, rights, and obligations of members, if the nonprofit has a membership structure. This section may also cover matters like membership fees, termination, and voting rights. 6. Meetings: The bylaws provide guidelines for conducting board meetings, annual general meetings, and special meetings. They outline the notice requirements, locations, procedures, and quorum for these meetings. 7. Conflicts of Interest: To ensure transparency and integrity, the bylaws address conflicts of interest in establishing policies and procedures for disclosing, managing, and addressing such conflicts among directors, officers, and employees. 8. Amendments: This section describes the process for amending the bylaws. It typically outlines the requirements for proposing, approving, and documenting amendments, ensuring any changes are in compliance with state laws. Types of Utah Bylaws of Nonprofit Corporation: 1. Public Benefit Corporation: These bylaws apply to nonprofit organizations primarily established for charitable, educational, religious, scientific, or public safety purposes that benefit the public or a specific section of it. 2. Mutual Benefit Corporation: These bylaws are relevant for nonprofit organizations that focus on providing services or benefits to a specific group of members, such as professional associations, social clubs, or trade organizations. 3. Religious Corporation: These bylaws are specific to nonprofit organizations that are formed to fulfill religious, spiritual, or faith-based purposes, focusing on the practice and promotion of religious beliefs and activities. It is important to consult an attorney or refer to the Utah Nonprofit Corporation Act to ensure accuracy and compliance while drafting and interpreting the Utah Bylaws of Nonprofit Corporation. These bylaws serve as a vital governance framework, guiding nonprofits in Utah to operate efficiently, ethically, and in accordance with the law.

Utah Bylaws of Nonprofit Corporation

Description

How to fill out Utah Bylaws Of Nonprofit Corporation?

Are you currently in a position where you frequently require documentation for either business or personal reasons? There are numerous official document templates accessible online, yet finding reliable forms isn't easy.

US Legal Forms offers thousands of template designs, including the Utah Bylaws of Nonprofit Corporation, which can be tailored to comply with state and federal requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Utah Bylaws of Nonprofit Corporation template.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Utah Bylaws of Nonprofit Corporation anytime if needed. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of official documents, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Locate the form you need and verify that it is for the correct state/region.

- Use the Review feature to examine the form.

- Check the summary to ensure you have selected the right document.

- If the form isn’t what you’re after, use the Search section to find the form that meets your specifications.

- If you identify the correct form, click on Buy now.

- Select the pricing plan you desire, provide the required details to create your account, and complete the transaction with your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

The minimum number of board members for a nonprofit organization is typically three in most states, including Utah. This structure ensures that your nonprofit meets quorum requirements for decision-making and fosters a collaborative environment. Crafting your Utah Bylaws of Nonprofit Corporation with this guideline in mind will help you build a solid foundation for effective governance, fostering greater community involvement and support.

In Utah, a nonprofit is required to have a minimum of three board members. These members should represent diverse interests and expertise to guide the organization effectively. Establishing a well-rounded board is essential to fulfill the legal requirements stipulated in the Utah Bylaws of Nonprofit Corporation. This way, your organization can avoid challenges related to governance and compliance.

The 33% rule indicates that at least one-third of a nonprofit's board members should be independent, meaning they do not have a material relationship with the organization. This guideline helps promote transparency and impartial decision-making within the board. Adhering to this rule is important when creating your Utah Bylaws of Nonprofit Corporation, as it fosters trust among stakeholders and aligns with best practices.

Non-profit bylaws should outline key components like the organization’s purpose, membership requirements, board structure, and meeting procedures. Additionally, provisions for amendments and handling conflicts of interest should also be included. Having a comprehensive set of bylaws ensures that your organization operates based on clear, organized principles. For guidance, you can refer to the Utah Bylaws of Nonprofit Corporation available on platforms like uslegalforms.

You can find examples of non-profit bylaws through various resources, including state government websites and legal aid organizations. Online platforms, like uslegalforms, also offer templates tailored to meet specific state requirements, including Utah. By utilizing these resources, you can quickly access the necessary information to create your Utah Bylaws of Nonprofit Corporation.

The 49 rule refers to the requirement that no more than 49% of the board of directors for a nonprofit can be from outside the organization. This rule aims to maintain a balance between external perspectives and internal insights. Understanding the application of this rule is crucial for crafting effective Utah Bylaws of Nonprofit Corporation. By following these guidelines, you can enhance governance and community engagement.

Typically, bylaws do not need to be notarized to be effective. However, depending on the organization’s structure, some nonprofits may find it beneficial to have their bylaws notarized for added legitimacy. It’s essential to adhere to the specific requirements stated in the Utah Bylaws of Nonprofit Corporation. To navigate these details easily, consider the resources offered by uslegalforms for clarity and compliance.

Writing nonprofit bylaws requires careful planning and consideration of your organization's unique needs. Start by drafting a clear purpose statement, then define the structure, membership policies, and voting procedures. Also, examine the Utah Bylaws of Nonprofit Corporation for required components to include. For ease and accuracy, look into uslegalforms, which provides tailored templates to help you create comprehensive bylaws.

Filling out corporate bylaws involves providing detailed information about your nonprofit's structure and operational processes. Begin by entering your organization's name, purpose, and address, then outline the roles of officers and directors, member rights, and meeting guidelines. Ensure you incorporate specific elements aligned with Utah Bylaws of Nonprofit Corporation. Consider using uslegalforms to guide you through this process with customizable templates.

Yes, nonprofit bylaws should be signed by the founding members or board members to demonstrate their agreement and commitment. A signed copy acts as proof of the organization's governance framework and offers legitimacy. Following the guidelines of the Utah Bylaws of Nonprofit Corporation, it’s essential to keep these signed documents on record. Utilizing tools from uslegalforms can simplify this process with templates and easy management options.

More info

Menu Mobile Help, Help Menu Mobile Menu Toggle menu Main navigation mobile File Overview INFORMATION Individuals Business Self Employed Charities Nonprofits International Taxpayers Federal State Local Governments Indian Tribal Governments Exempt Bonds FILING INDIVIDUALS Should File When File Where File Update Information POPULAR Your Record Apply Employer Number Check Your Amended Return Status Identity Protection File Your Taxes Free Overview Bank Account.