The Utah Indemnification of Buyer and Seller of Business refers to the legal provisions and agreements put in place to protect both the buyer and seller of a business in the state of Utah. These provisions aim to allocate the risks associated with any potential liabilities or losses that may arise after the transaction is completed. By establishing indemnification clauses, the parties involved can ensure that they are protected from unforeseen consequences that may arise from the business sale. There are different types of Utah Indemnification of Buyer and Seller of Business, including: 1. General Indemnification: This type of indemnification provides broad protection to the buyer against any losses, damages, liabilities, or claims arising from the business's operations prior to the sale. It typically covers undisclosed debts, pending litigation, tax liabilities, or any other undisclosed material information that may impact the value of the business. 2. Environmental Indemnification: Due to growing concerns about environmental liabilities, this type of indemnification specifically tackles environmental issues. It protects the buyer from any potential environmental contamination, violations, or remediation costs that may arise from the business's past activities or operations. 3. Employee Indemnification: With employee-related concerns, this type of indemnification safeguards the buyer against any undisclosed employment-related claims, lawsuits, or liabilities. It ensures that the seller remains responsible for any outstanding employee claims, including wrongful termination, discrimination, or wage and hour disputes. 4. Tax Indemnification: Tax-related indemnification protects the buyer from any undisclosed or pending tax liabilities, including unpaid taxes or unresolved audits. The seller would remain liable for any tax assessments, penalties, or interest arising from pre-sale activities. In Utah, the Indemnification provisions are typically incorporated within the purchase and sale agreement, outlining the responsibilities and liabilities of each party. These contractual terms provide clarity and prevent potential disputes regarding indemnification obligations in the future. It is important for both the buyer and seller to thoroughly review and negotiate the indemnification terms as they significantly impact the risk allocation between the parties involved. Seeking the advice of a qualified attorney is crucial to ensure a fair and comprehensive indemnification agreement is established, tailored to the specific needs of the business transaction.

Utah Indemnification of Buyer and Seller of Business

Description

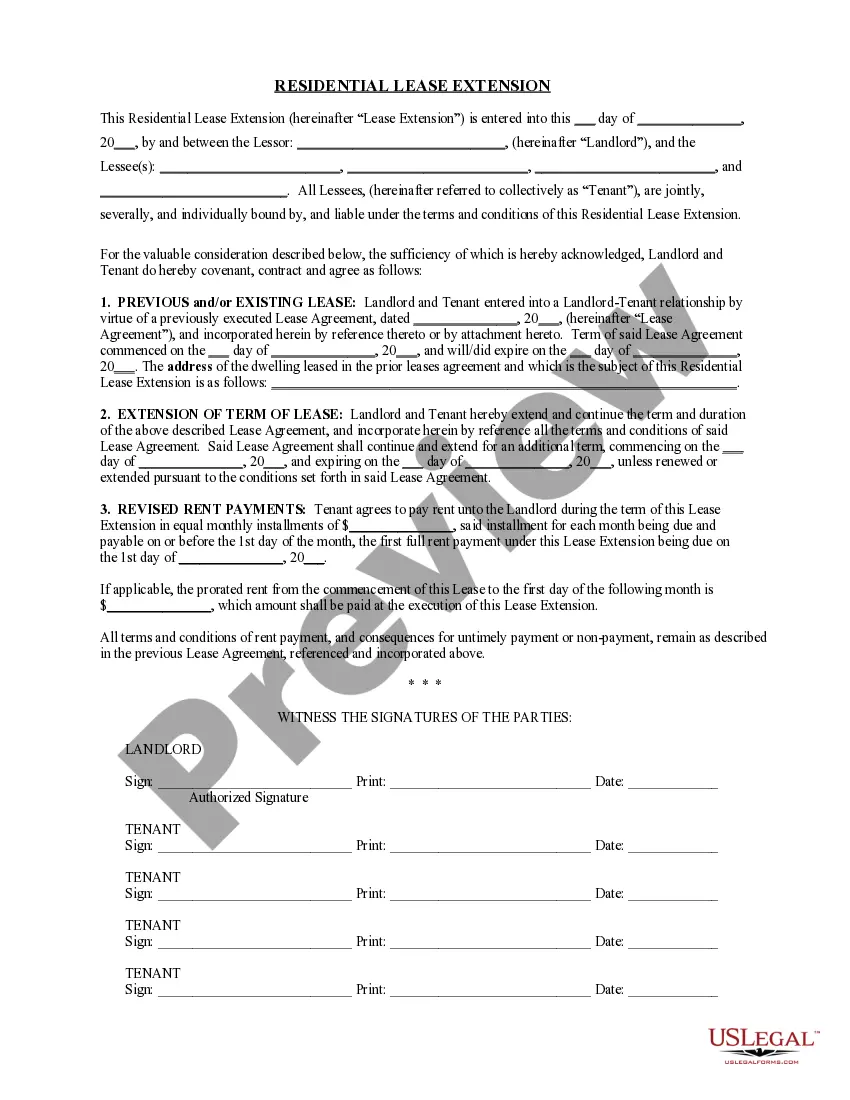

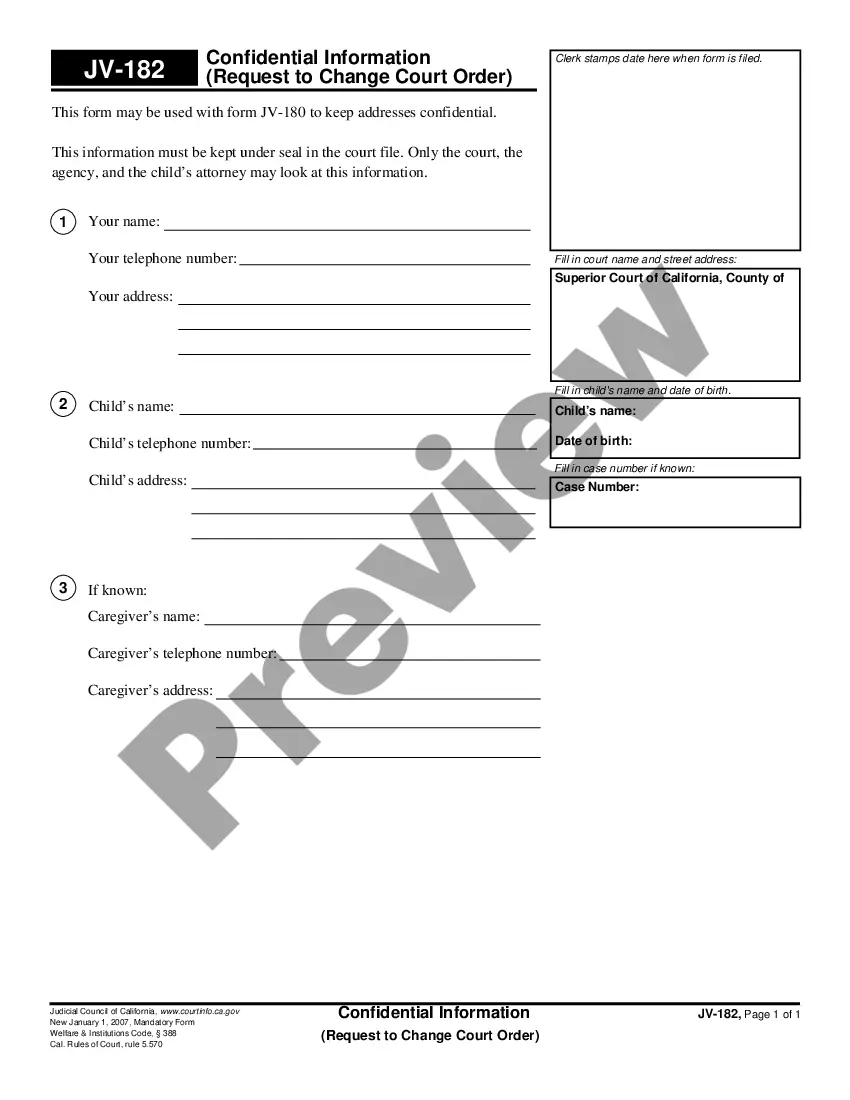

How to fill out Utah Indemnification Of Buyer And Seller Of Business?

Selecting the finest legal document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Utah Indemnification of Buyer and Seller of Business, which you can use for both business and personal purposes. All the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to locate the Utah Indemnification of Buyer and Seller of Business. Use your account to search for the legal forms you may have purchased previously. Visit the My documents tab in your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are some straightforward guidelines to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview button and review the form outline to confirm it is suitable for you. If the form does not fulfill your requirements, use the Search feature to find the appropriate form. Once you are confident that the form is correct, click the Purchase now button to obtain the form. Select the pricing plan you wish to use and provide the required information. Create your account and finalize your order using your PayPal account or credit card.

- Choose the file format and download the legal document template onto your device.

- Complete, edit, print, and sign the obtained Utah Indemnification of Buyer and Seller of Business.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Take advantage of the service to download professionally created documents that adhere to state requirements.

Form popularity

FAQ

The indemnification clause in a contract is a provision that specifies one party's obligation to compensate the other for certain losses or damages. This remains especially relevant in the Utah indemnification of buyer and seller of business, where it helps define the liability landscape. By including such clauses, both parties can have peace of mind, knowing they are protected against particular risks.

Owner indemnification refers to the protection offered by the owner of a business to cover losses incurred by others, such as buyers or partners, due to the owner's actions. This concept is significant in the context of the Utah indemnification of buyer and seller of business, as it helps create a secure environment for investments. It fosters trust, making transactions smoother and more efficient.

A vendor indemnification agreement is a contract where the vendor agrees to protect the buyer from losses or damages associated with the vendor's products or services. This type of agreement is particularly important in transactions involving goods or services that may carry risks. In the Utah indemnification of buyer and seller of business, such agreements help ensure that both parties can proceed with confidence.

The indemnity clause in a sales contract outlines the seller's responsibility to compensate the buyer for losses incurred due to the seller's actions or business history. It serves as an essential element in the Utah indemnification of buyer and seller of business, as it provides clarity on how risks are shared. This clause assures the buyer that they are protected from certain unforeseen circumstances.

An example of an indemnity clause can be found in sales contracts where the seller may say, 'The seller will indemnify the buyer against any legal claims arising from the business's past operations.' This clause protects the buyer from unforeseen liabilities. In the context of the Utah indemnification of buyer and seller of business, such clauses are key in creating trust between parties.

In simple terms, an indemnity clause is an agreement where one party agrees to compensate the other for potential losses or damages. This agreement offers reassurance and protection, especially during transactions, like the Utah indemnification of buyer and seller of business. It ensures that if something goes wrong, one party will take responsibility and cover the costs involved.

The indemnity clause for the seller provides protection against certain liabilities that may arise after the sale of a business. Essentially, it states that the seller agrees to cover any potential losses or claims that the buyer may face related to the business's prior operations. This clause is crucial in the Utah indemnification of buyer and seller of business, as it creates a safety net for both parties.

Yes, indemnification clauses can hold up in court if they are clearly written and legally compliant. Courts typically enforce these clauses when they are specific, reasonable, and agreed upon by both parties. However, it's wise to ensure that your indemnification clause aligns with the Utah indemnification of buyer and seller of business framework to enhance its enforceability.

To write an indemnification clause, clearly define the circumstances that trigger indemnification, outline the responsibilities of both parties, and specify the coverage limits. Use straightforward language to ensure both parties can easily understand their obligations. If you need assistance, uslegalforms provides templates and guidance for drafting an effective indemnification clause tailored to the Utah indemnification of buyer and seller of business.

The indemnification clause for the seller outlines the seller's responsibility to cover specific claims or liabilities that may arise post-sale. This clause protects the buyer from losses that occur due to seller negligence or undisclosed liabilities. Therefore, having a well-defined indemnification clause is essential in the Utah indemnification of buyer and seller of business to maintain fairness and transparency.

More info

S. State Toggle navigation State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming. Find Lawyers in Your Area of Practice Find Lawyers in Your Area of Practice How Lawyers Find Professional Offices Who is Using Lawyers? By Type of Lawyer Toggle navigation Type of Lawyer Legal Attorney Other Personal Attorneys Employers Business Attorneys Family Attorneys Firm Formation Attorneys Law Firm Management Attorneys Law Firm Structure Lawyers Attorney Law Firm Attorney Business Law Firm Attorneys Attorney Law Firm. Get Started Today. Find a Law Firm Near You.