Utah Independent Contractor Agreement with Massage Therapist: A Comprehensive Guide Introduction: The Utah Independent Contractor Agreement with Massage Therapist is a legally binding document that outlines the rights, responsibilities, and obligations between a massage therapist and their employer or client when hired as an independent contractor. This agreement is specific to the state of Utah and ensures proper compliance with state laws and regulations. Keywords: Utah Independent Contractor Agreement, Massage Therapist, Independent Contractor, legally binding document, rights, responsibilities, obligations, compliance, state laws, regulations. 1. Purpose and Scope of the Agreement: The Utah Independent Contractor Agreement with Massage Therapist aims to establish the professional relationship between the massage therapist and the hiring party. It outlines the terms and conditions of their engagement, describing the specific services provided, payment terms, and additional responsibilities of both parties. Keywords: Professional relationship, terms and conditions, engagement, services provided, payment terms, responsibilities. 2. Responsibilities of the Massage Therapist: This section of the agreement delineates the specific responsibilities and duties of the massage therapist, ensuring they perform their services in a professional and compliant manner. It may include requirements like maintaining licensure, carrying liability insurance, abiding by ethical standards, and ensuring client confidentiality. Keywords: Responsibilities, duties, professional manner, licensure, liability insurance, ethical standards, client confidentiality. 3. Compensation and Payment Terms: This segment outlines the payment structure, rates, and methods agreed upon between the massage therapist and the hiring party. It may mention whether compensation is based on a percentage of revenue, fixed fees, or other agreed-upon terms. Additionally, this section may detail when and how payment will be made (e.g., weekly, bi-weekly, direct deposit). Keywords: Compensation, payment structure, rates, methods, percentage of revenue, fixed fees, payment terms, bi-weekly, direct deposit. 4. Independent Contractor Status: This clause clarifies the relationship between the parties, confirming that the massage therapist is operating as an independent contractor rather than an employee. It includes language emphasizing that the massage therapist will not be eligible for employee benefits or entitled to employee-related protections. Keywords: Independent contractor status, employee benefits, employee-related protections. Types of Utah Independent Contractor Agreements with Massage Therapist: 1. Standard Utah Independent Contractor Agreement with Massage Therapist: This is a general agreement that covers the essential elements mentioned above, along with any additional state-specific requirements or clauses necessary to meet the legal obligations in Utah. 2. Commission-based Utah Independent Contractor Agreement with Massage Therapist: This variation focuses on compensating the massage therapist based on a percentage of the revenue generated from their services. It may include details on how the revenue is calculated and distributed to the massage therapist. 3. Multi-location Utah Independent Contractor Agreement with Massage Therapist: For massage therapists who work at multiple locations, this agreement addresses the specific terms related to offering services at different establishments. It may cover issues such as scheduling, travel expenses, and client confidentiality. Keywords: Standard agreement, commission-based agreement, multi-location agreement, revenue, scheduling, travel expenses, client confidentiality. Conclusion: The Utah Independent Contractor Agreement with Massage Therapist is a vital document for establishing a clear and mutually beneficial relationship between the massage therapist and their employer or client. It ensures compliance with state laws, outlines responsibilities and compensation terms, and clarifies the independent contractor status. By customizing the agreement to suit individual needs, both parties can foster a professional partnership in the massage therapy industry. Keywords: Mutually beneficial relationship, compliance, responsibilities, compensation terms, independent contractor status, professional partnership, massage therapy industry.

Utah Independent Contractor Agreement with Massage Therapist

Description

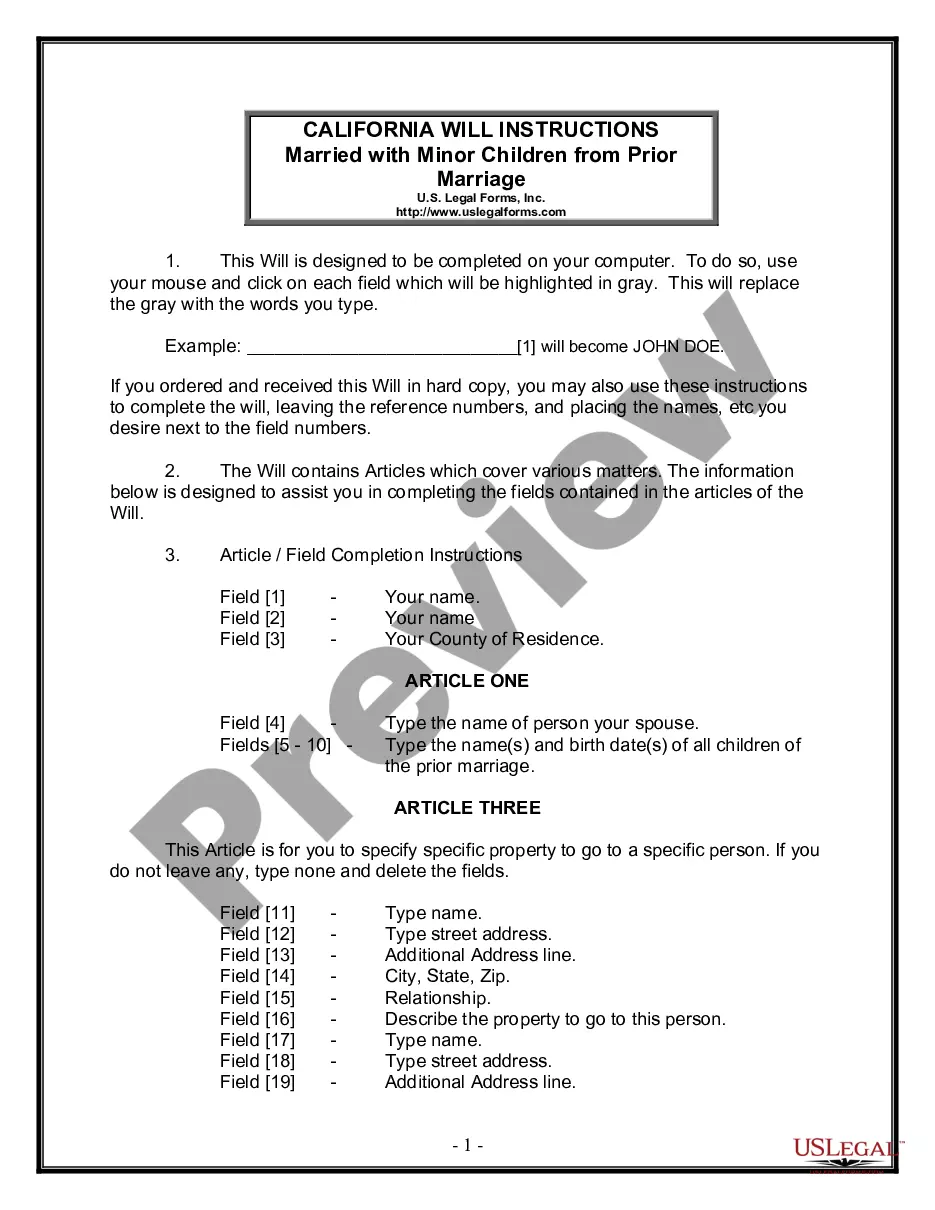

How to fill out Utah Independent Contractor Agreement With Massage Therapist?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document formats that you can download or create.

By using the platform, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent editions of forms such as the Utah Independent Contractor Agreement with Massage Therapist within seconds.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

When you are satisfied with the form, confirm your choice by clicking on the Download Now button. Then, choose your preferred pricing plan and provide your credentials to register for an account.

- If you already have a subscription, sign in and download the Utah Independent Contractor Agreement with Massage Therapist from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form's contents.

Form popularity

FAQ

Yes, you can freelance as a massage therapist, offering your services independently to clients. Freelancing allows you to set your own hours and decide on the types of services you provide. Just remember to have the proper permits and insurance in place. A Utah Independent Contractor Agreement with Massage Therapist can help outline the terms of your freelance work clearly.

Yes, if you hire a massage therapist as an independent contractor, you can issue them a 1099 form at the end of the tax year. This form reports their income to the IRS and is vital for their tax filings. Make sure to gather the necessary information from them, such as their Tax Identification Number. A Utah Independent Contractor Agreement with Massage Therapist can help ensure all necessary details are included for tax purposes.

To set up an independent contractor agreement, start by outlining the services to be performed, payment terms, and duration of the agreement. Clearly define each party's responsibilities to avoid misunderstandings. There are templates available, such as those offered by uSlegalforms, which can simplify the process. Using a Utah Independent Contractor Agreement with a Massage Therapist ensures clarity in your business relationship.

In Utah, massage services are generally taxable unless provided for certain medical purposes. When charging clients, be sure to add sales tax to the service fees to remain compliant with state regulations. It's essential to stay updated on any changes in tax laws pertaining to your practice. Using a Utah Independent Contractor Agreement with Massage Therapist can clarify your tax responsibilities.

As a self-employed massage therapist, you will file taxes using Schedule C of your Form 1040 to report income and expenses. Ensure you keep meticulous records of your earnings and deductible expenses throughout the year. You may also need to make estimated tax payments quarterly. A Utah Independent Contractor Agreement with Massage Therapist could help track your business-related income and expenses more easily.

Yes, a massage therapist can apply for a National Provider Identifier (NPI) if they meet specific requirements. The NPI is necessary for billing purposes, especially when dealing with health insurance providers. Obtaining one can enhance your credibility and streamline your billing processes. A Utah Independent Contractor Agreement with Massage Therapist can support your status as a recognized professional.

The IRS uses several codes for massage therapists, with the most common being 621340, which represents 'Offices of Physical, Occupational, and Speech Therapists.' Understanding your code helps with taxation and compliance. It’s crucial to classify your services correctly, as this can affect tax liabilities. Using a Utah Independent Contractor Agreement with Massage Therapist clarifies your status and services provided.

Yes, as a self-employed massage therapist, you can deduct certain business-related expenses on your taxes. This can include costs for equipment, supplies, and even professional development courses. Make sure to keep detailed records of your expenses, as this documentation will support your deductions. Utilizing a Utah Independent Contractor Agreement with Massage Therapist may help outline your business expenses.

Yes, as an independent contractor in Utah, you typically need a business license. The specific requirements may vary by city or county, so it is essential to check local regulations. Having a license legitimizes your services and keeps you in good standing with state authorities. Using a Utah Independent Contractor Agreement with Massage Therapist can also help clarify business arrangements.

Typically, the party that hires the contractor drafts the independent contractor agreement. However, both parties should review and agree on its terms before signing. In the case of a Utah Independent Contractor Agreement with a Massage Therapist, utilizing a reliable platform like uslegalforms can provide you with templates that ensure all necessary details are included. Always make sure the agreement reflects the needs of both parties.