Utah Partnership Agreement Involving Silent Partner

Description

How to fill out Partnership Agreement Involving Silent Partner?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a wide range of legal document templates that you can download or print.

By utilizing the website, you'll find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms, like the Utah Partnership Agreement Between Silent Partner, in just seconds.

If you already have an account, Log In and download the Utah Partnership Agreement Between Silent Partner from your US Legal Forms collection. The Download button will be present on every form you view. You have access to all previously saved forms from the My documents section of your account.

Proceed with the purchase. Utilize your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Then make amendments. Complete, modify, print, and sign the saved Utah Partnership Agreement Between Silent Partner. Each template you added to your account has no expiration date and is yours to keep indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and select the form you need. Access the Utah Partnership Agreement Between Silent Partner with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

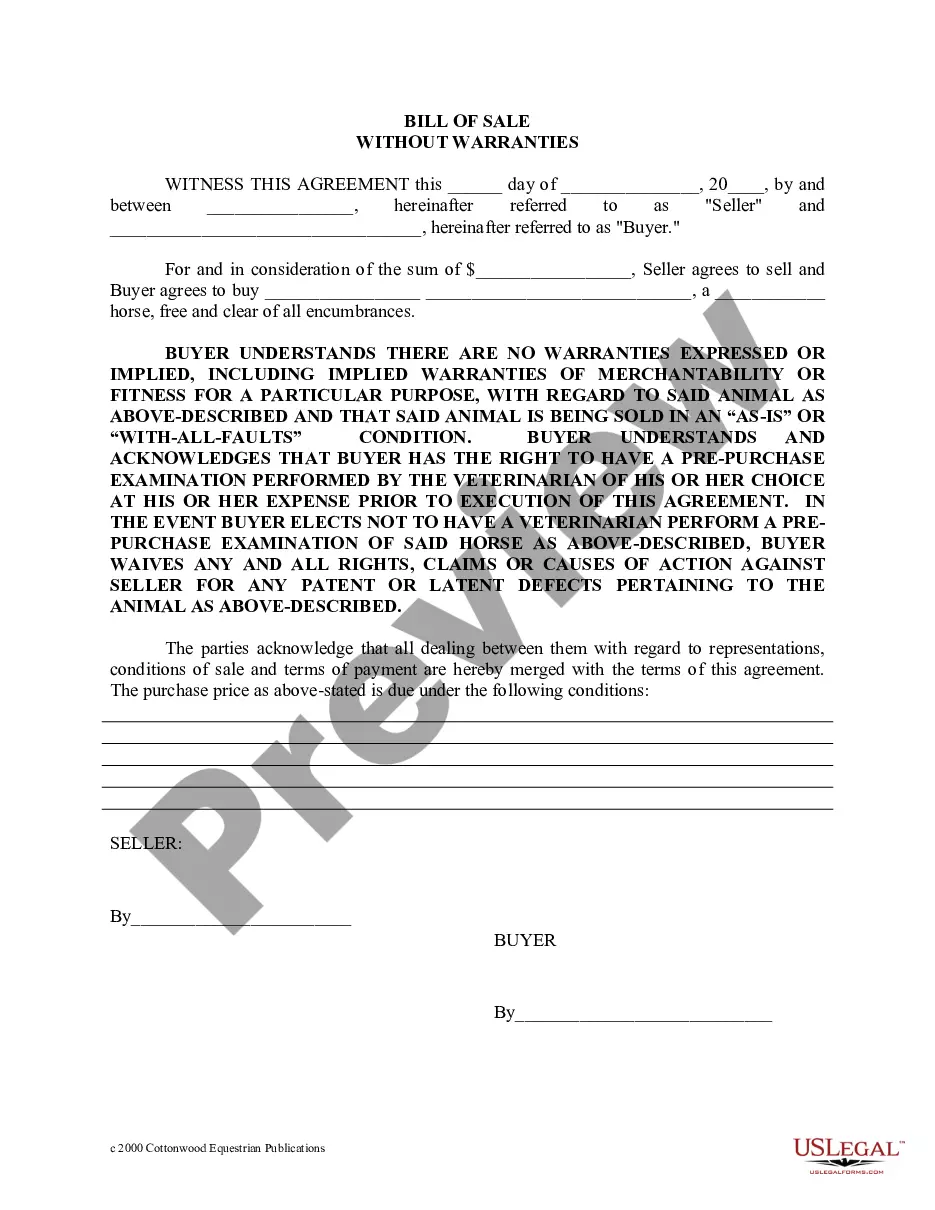

- Click the Preview button to review the form’s content.

- Check the form summary to ensure you have chosen the right form.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find the appropriate one.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your payment method and provide your details to create an account.

Form popularity

FAQ

To structure a silent partnership agreement, start by clearly defining each partner's contributions, roles, and profit-sharing arrangements. Include provisions for decision-making processes and how disputes will be resolved. A well-crafted Utah Partnership Agreement Involving Silent Partner can provide clarity and safeguard the interests of both active and silent partners.

Yes, a partnership can have a silent partner, who contributes capital but does not take an active role in managing the business. This arrangement allows the business to benefit from additional funding while giving the silent partner the security of limited involvement. Using a Utah Partnership Agreement Involving Silent Partner helps formalize this relationship and protect all parties.

The silent partner clause outlines the roles and responsibilities of a silent partner within the partnership. This clause specifies their contributions, profit-sharing ratio, and any limitations on their involvement in management. Having a clear clause in a Utah Partnership Agreement Involving Silent Partner ensures that both active and silent partners understand their rights and obligations.

A silent partner participates in a partnership without being involved in daily operations or management. They typically contribute capital in exchange for a share of profits, but their liability may be limited based on the terms outlined in a Utah Partnership Agreement Involving Silent Partner. It is essential that all terms are clearly defined in the partnership agreement to avoid misunderstandings.

While a silent partner can provide necessary funds, there are some disadvantages to consider. First, their lack of participation can lead to misalignment in business goals and strategies. Furthermore, disputes may arise regarding financial contributions, profit distribution, or operational control if not clearly addressed in the Utah Partnership Agreement Involving Silent Partner. Open communication and a well-drafted agreement can mitigate these concerns.

To structure a silent partnership, first define the roles of each partner clearly in a Utah Partnership Agreement Involving Silent Partner. The silent partner provides capital but does not participate in day-to-day operations. It’s essential to outline profit-sharing, decision-making authority, and exit strategies. By clarifying these elements, both partners can work harmoniously and avoid future misunderstandings.

A silent partnership agreement outlines the relationship between active partners and silent partners in a business. This agreement details the extent of the silent partner's investment and their share of profits, while explicitly stating their lack of involvement in management. Establishing a Utah Partnership Agreement Involving Silent Partner is vital for defining these roles clearly. This clarity helps ensure all parties are aligned and understand their responsibilities.

When a partnership agreement is silent, it means that certain important topics are not addressed within the document. This silence can lead to confusion or disputes among partners on issues like profit-sharing or responsibilities. To avoid these complications, it is advisable to have a thorough Utah Partnership Agreement Involving Silent Partner. A well-defined agreement promotes harmony among partners.

If the partnership deed is silent, partners should review applicable state laws to determine entitlements and obligations. Engaging in open dialogue among partners can help reach a mutual agreement on issues not covered. To prevent future ambiguity, consider creating a Utah Partnership Agreement Involving Silent Partner to cover unaddressed aspects. This step provides a clear framework moving forward.

If the partnership deed is silent on the matter of drawings, interest may not automatically be applied. However, it can depend on the laws governing the partnership and prior agreements among partners. To ensure clarity and avoid potential disputes, it's wise to specify this in a Utah Partnership Agreement Involving Silent Partner. This approach helps maintain fairness and transparency.