A Utah subcontractor agreement for insurance is a legally binding contract that outlines the terms and conditions between an insurance company and a subcontractor in the state of Utah. This agreement serves to protect the rights and responsibilities of both parties involved in insurance-related projects. A subcontractor agreement for insurance in Utah typically includes the following key elements: 1. Parties Involved: The agreement identifies the insurance company as the "Company" and the subcontractor as the "Subcontractor." 2. Scope of Work: The agreement specifies the type of insurance-related services to be provided by the subcontractor, such as claims adjustment, risk assessment, underwriting, policy administration, or any other insurance-related activities. 3. Duration: The agreement includes the start and end dates of the contractual relationship between the insurance company and the subcontractor. It may also outline options for renewal or termination. 4. Compensation: Details regarding payment terms, rates, and methods of payment are articulated in this section. It may include information about hourly rates, project-based fees, or commission-based models. 5. Responsibilities: The agreement clearly outlines the specific duties and responsibilities of the subcontractor, including compliance with applicable laws and regulations, confidentiality, data protection, and any relevant industry standards. 6. Insurance Requirements: This section may stipulate the insurance coverage required from the subcontractor, such as general liability insurance, professional liability insurance, worker's compensation insurance, or any other specific policies necessary for the project. 7. Indemnification: The agreement may address indemnification provisions, which specify the responsibilities of each party in case of claims, losses, or damages arising from the subcontractor's actions or omissions. Types of Utah subcontractor agreements for insurance may include: 1. General Subcontractor Agreement for Insurance: This is a broad agreement used for various insurance-related services provided by subcontractors. 2. Claims Adjuster Subcontractor Agreement for Insurance: This agreement specifically covers subcontractors providing claims adjusting services, such as investigating, evaluating, and settling insurance claims. 3. Underwriting Subcontractor Agreement for Insurance: This agreement pertains to subcontractors involved in the appraisal and acceptance/rejection of insurance proposals, and may also include risk assessment and policy pricing. 4. Policy Administration Subcontractor Agreement for Insurance: This type of agreement applies to subcontractors responsible for managing policies, premium collection, client communication, and other administrative tasks. In conclusion, a Utah subcontractor agreement for insurance is crucial for defining the relationship between an insurance company and a subcontractor, protecting both parties' rights and responsibilities. By obeying the relevant legal and industry requirements, these agreements ensure smooth operations and minimize risks for all stakeholders involved in insurance-related projects.

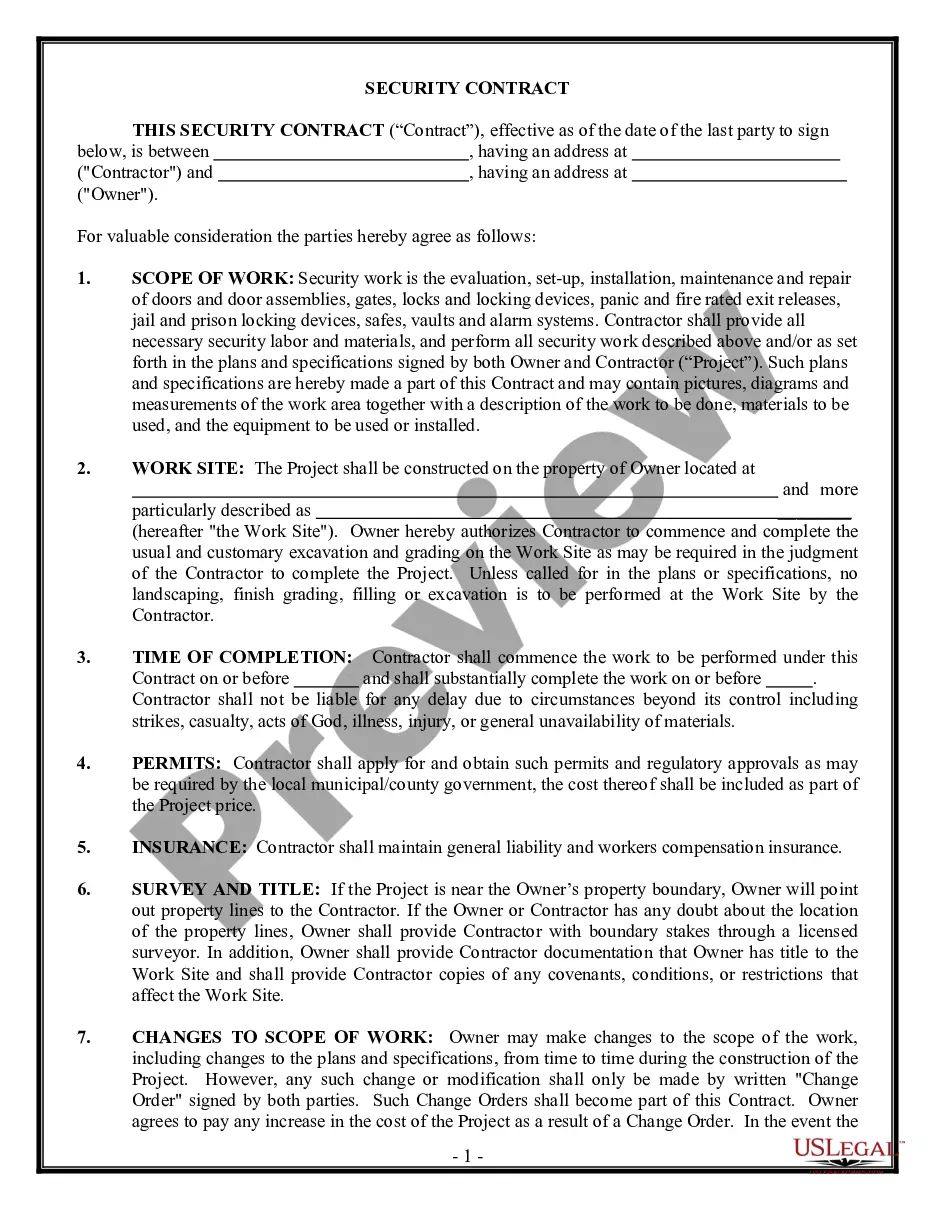

Utah Subcontractor Agreement for Insurance

Description

How to fill out Utah Subcontractor Agreement For Insurance?

Are you presently in the place where you need papers for sometimes enterprise or specific purposes nearly every working day? There are plenty of legitimate file themes available online, but discovering kinds you can trust isn`t simple. US Legal Forms gives a huge number of form themes, much like the Utah Subcontractor Agreement for Insurance, that are written to fulfill federal and state requirements.

Should you be previously informed about US Legal Forms website and also have a merchant account, basically log in. Afterward, you are able to down load the Utah Subcontractor Agreement for Insurance template.

Unless you come with an profile and want to begin using US Legal Forms, abide by these steps:

- Find the form you require and make sure it is for your proper town/state.

- Make use of the Preview button to review the form.

- See the description to ensure that you have chosen the correct form.

- If the form isn`t what you`re looking for, take advantage of the Look for field to obtain the form that fits your needs and requirements.

- Once you get the proper form, just click Buy now.

- Select the costs strategy you would like, submit the desired information to generate your account, and buy your order using your PayPal or bank card.

- Select a convenient document structure and down load your copy.

Get each of the file themes you might have purchased in the My Forms menu. You can obtain a additional copy of Utah Subcontractor Agreement for Insurance whenever, if required. Just go through the necessary form to down load or print the file template.

Use US Legal Forms, probably the most considerable variety of legitimate kinds, to save lots of time and stay away from mistakes. The assistance gives expertly produced legitimate file themes which can be used for an array of purposes. Create a merchant account on US Legal Forms and initiate producing your lifestyle a little easier.