Statutory provisions in the various jurisdictions specify the formal requisites of a valid will. Also, in the absence of pertinent will provisions, the statutes generally govern the construction of a will and determine the effect of various acts or events on the will, such as the testator's subsequent marriage or divorce, or the birth or adoption of children after the execution of the will.

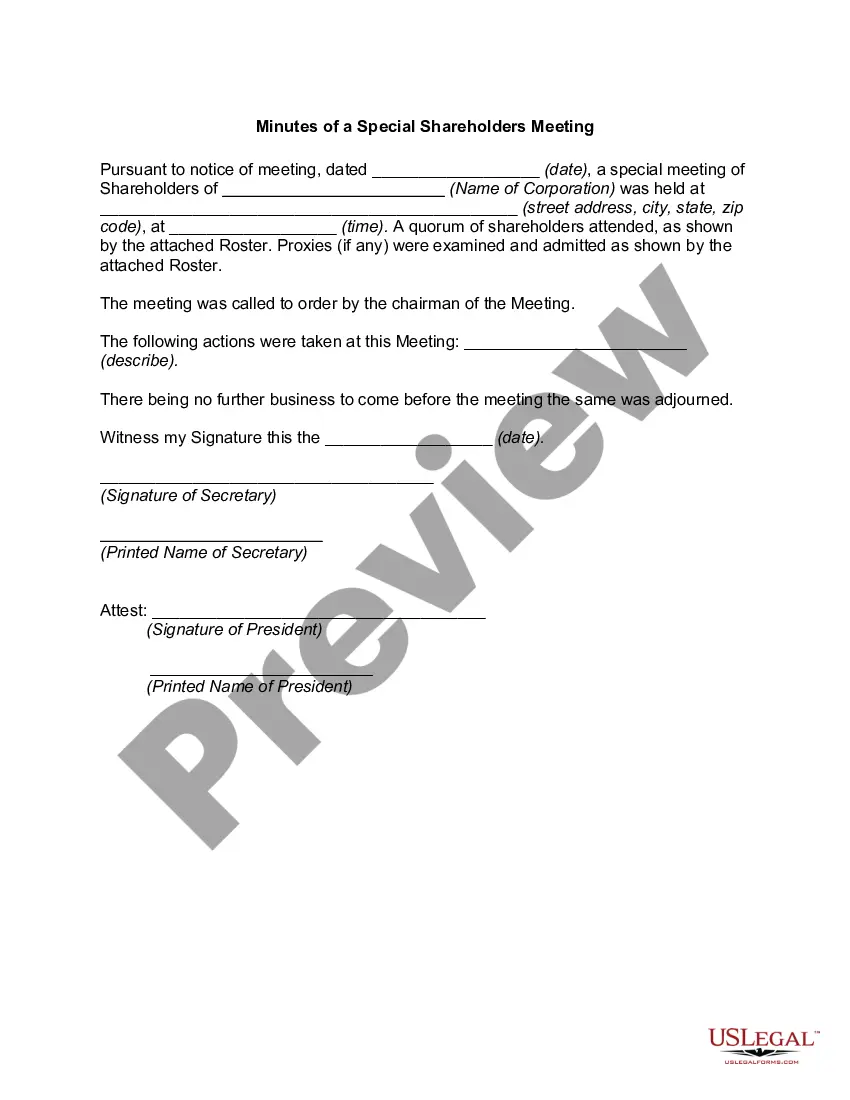

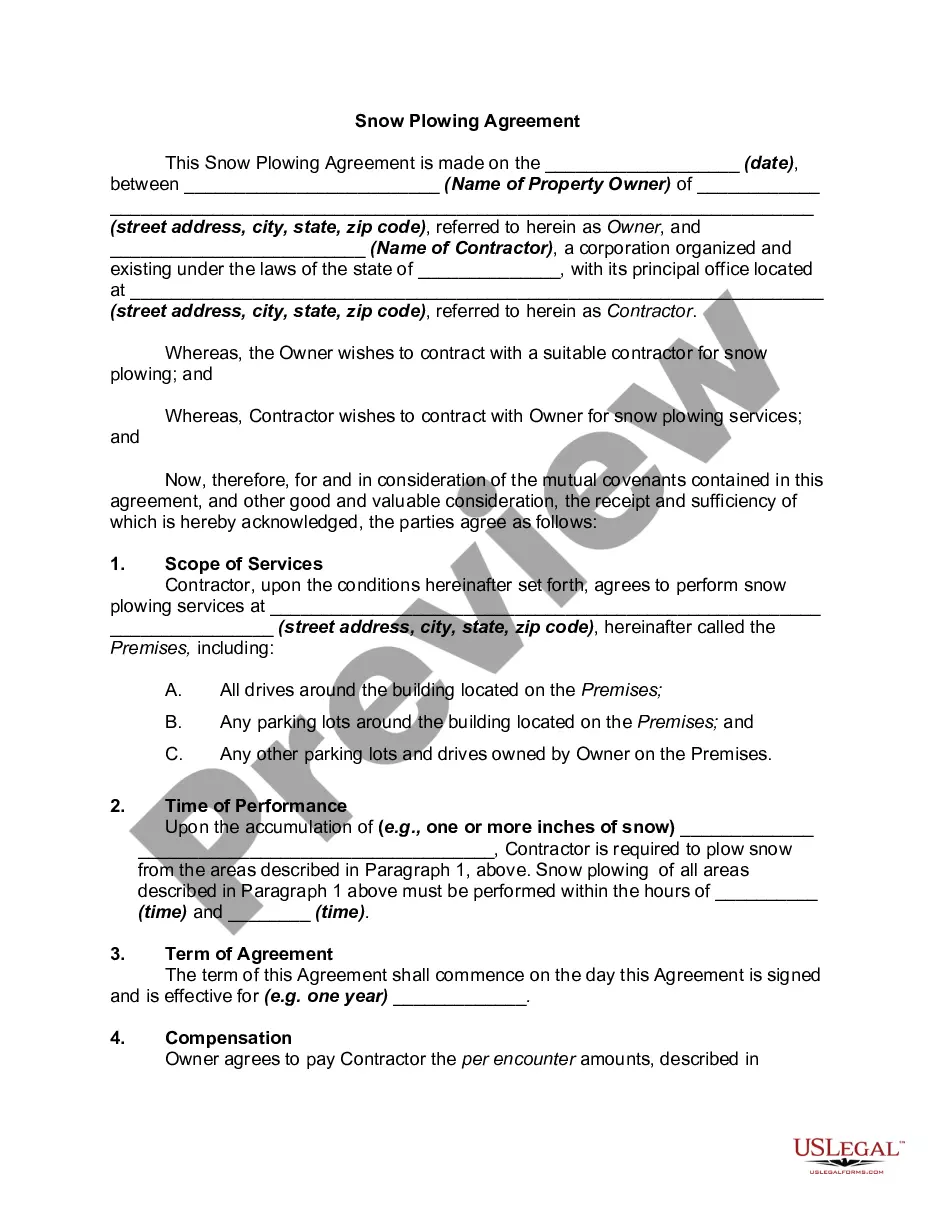

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

When drafting wills, practitioners should beware of the perfunctory use of standard boilerplate language directing that all taxes be paid out of the residue of the estate. Because a number of Internal Revenue Code provisions include non-probate assets in the taxable estate if they pass as a result of the decedent's death, the result of such boilerplate could be to cause the residuary beneficiary to pay taxes on assets that pass to others, often wiping out the residuary estate altogether -- a circumstance probably not intended by the testator. In addition to the problems that may result for beneficiaries, the estate may also suffer if the residuary beneficiary is a charity or spouse, since the marital or charitable deduction can be drastically reduced by the necessity of paying taxes out of the residue, resulting in considerably higher taxes. Attorneys should discuss with their clients the existence of non-probate assets and the distribution of the tax burden.