The following form is a Petition that adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another.

Utah Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate

Description

How to fill out Petition Of Creditor Of An Estate Of A Decedent For Distribution Of The Remaining Assets Of The Estate?

If you need to complete, obtain, or print lawful file themes, use US Legal Forms, the greatest variety of lawful forms, which can be found on-line. Take advantage of the site`s basic and convenient look for to get the files you want. Various themes for organization and specific purposes are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the Utah Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate in just a number of clicks.

If you are previously a US Legal Forms consumer, log in to the bank account and click the Down load option to have the Utah Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate. You can also gain access to forms you earlier downloaded from the My Forms tab of your bank account.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the form for your proper town/land.

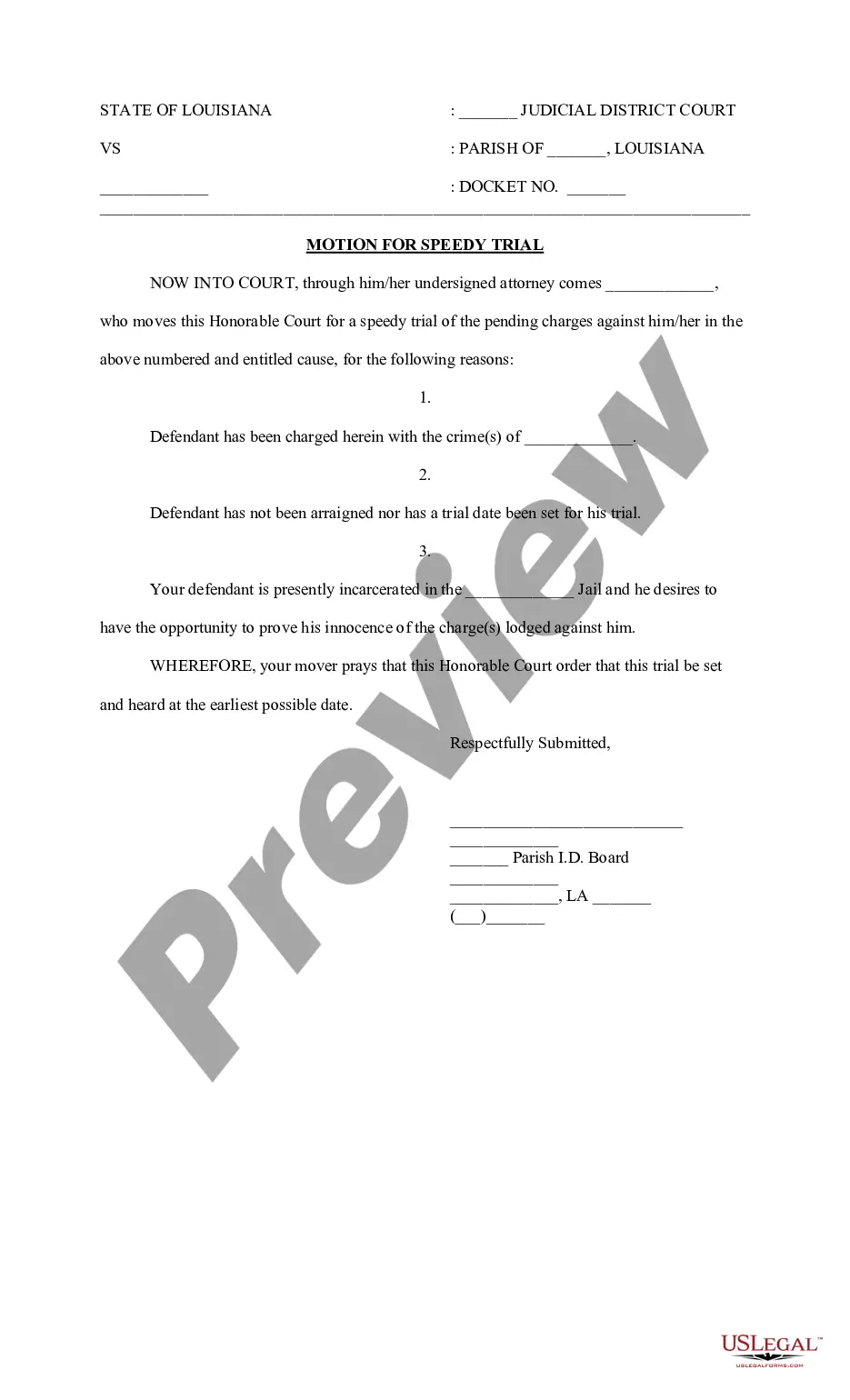

- Step 2. Utilize the Preview choice to look over the form`s information. Don`t forget about to see the description.

- Step 3. If you are not happy using the type, utilize the Search field on top of the display screen to find other models of the lawful type template.

- Step 4. Upon having found the form you want, go through the Purchase now option. Opt for the pricing plan you favor and put your credentials to sign up for the bank account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the structure of the lawful type and obtain it on your device.

- Step 7. Comprehensive, revise and print or indication the Utah Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate.

Every lawful file template you buy is the one you have forever. You possess acces to every type you downloaded in your acccount. Select the My Forms segment and choose a type to print or obtain once again.

Contend and obtain, and print the Utah Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate with US Legal Forms. There are many professional and state-distinct forms you can use to your organization or specific requirements.

Form popularity

FAQ

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The basic role of the probate court judge is to assure that the deceased person's creditors are paid, and that any remaining assets are distributed to the proper beneficiaries.

Common sources of information about asset existence include: The will. A list the decedent prepared in advance. The decedent's lawyer or tax accountant.

Probate is the court supervised process of identifying and gathering a person's assets after their death, paying all of their debts, and distributing the balance to the rightful heirs or beneficiaries.

A distribution is the delivery of cash or an asset to a given heir. After resolving debts and paying any taxes due, the executor should distribute the remaining estate to the heirs in ance with the instructions in the will (or as dictated by the court).

Probate is the legal process that you must follow to transfer or inherit property after the person who owned the property has passed away. Depending on the amount and type of property the deceased person owned, you may or may not need to go to court to transfer or inherit the property.