Utah Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

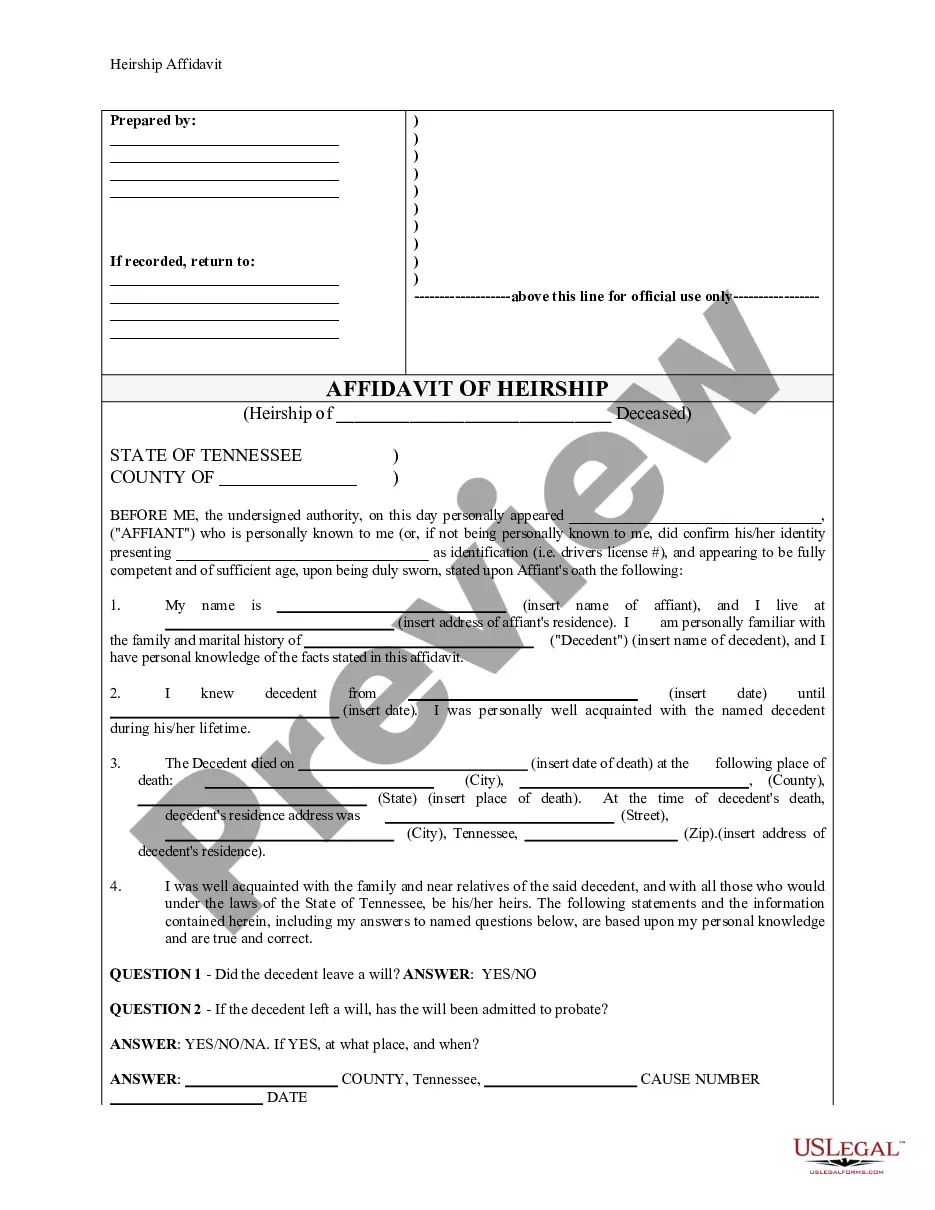

How to fill out Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

Have you ever been in a location where you require documentation for either business or personal reasons almost every day.

There are numerous legal document templates available online, yet discovering trustworthy forms isn't straightforward.

US Legal Forms provides thousands of template options, including the Utah Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement, designed to comply with state and federal requirements.

Select the pricing plan you desire, enter the necessary information to create your account, and pay for your order using PayPal or a credit card.

Choose a convenient document format and download your copy. Retrieve all the document templates you have purchased in the My documents section. You can acquire an additional copy of the Utah Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement at any time if needed. Simply click the relevant form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct region.

- Utilize the Review button to evaluate the form.

- Check the description to confirm you have picked the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that fits your needs and specifications.

- When you have found the right form, click Acquire now.

Form popularity

FAQ

A transfer agreement is a legally binding document that conveys ownership from one person or entity to another.

A corporate stock transfer agreement, also known as a share purchase agreement or a stock purchase agreement, is used to sell or transfer one's shares in a company to another individual.

A shares transfer agreement, also known as a stock purchase agreement, is an legal document used to transfer the ownership of shares of stock. The party transferring shares could be a person or a company.

The number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place. price per share.

A Share Purchase Agreement is a document that transfers company shares (also called stocks) from one party to another. It contains the shares for sale, price, date of the transaction, and other terms and conditions.

Transferring stocks is a straightforward process to complete.Request a Transfer of Stock Ownership form from your stockbroker or directly from the brokerage company.Write a letter with the instructions on the means of transfer to include with your Transfer of Stock Ownership form.More items...

Change in Ownership means any sale, disposition, transfer or issuance or series of sales, dispositions, transfers and/or issuances of shares of the capital stock by the Corporation or any holders thereof which results in any person or group of persons (as the term group is used under the Securities Exchange Act of

In real estate, a purchase agreement is a binding contract between a buyer and seller that outlines the details of a home sale transaction. The buyer will propose the conditions of the contract, including their offer price, which the seller will then either agree to, reject or negotiate.

What is a "secondary sale"? A secondary sale is a sale by an existing stockholder to a third-party purchaser, the proceeds of which benefit the selling stockholder. This is in contrast to a "primary" issuance, in which the company is selling its stock to an investor and using the proceeds for corporate purposes.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.