Utah Software Support Agreement

Description

Software is often divided into two categories: Systems Software includes the operating system and all the utilities that enable the computer to function; and Applications Software includes programs that do real work for users (e.g., word processors, spreadsheets, and database management systems).

How to fill out Software Support Agreement?

You can spend several hours online attempting to locate the valid document format that satisfies the federal and state criteria you will require.

US Legal Forms offers thousands of legitimate templates that are reviewed by experts.

You can download or print the Utah Software Support Agreement from our service.

If available, use the Review button to also check the document format. To find another version of your form, use the Search field to locate the format that meets your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, print, or sign the Utah Software Support Agreement.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another copy of a purchased document, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your chosen state/city.

- Review the document details to confirm you have selected the right form.

Form popularity

FAQ

To fill an agreement form, like a Utah Software Support Agreement, start by gathering all necessary information. Make sure to understand each section of the form, and carefully input the required data. If you need guidance, consider leveraging resources like US Legal Forms, which offers comprehensive tools to help navigate the process smoothly.

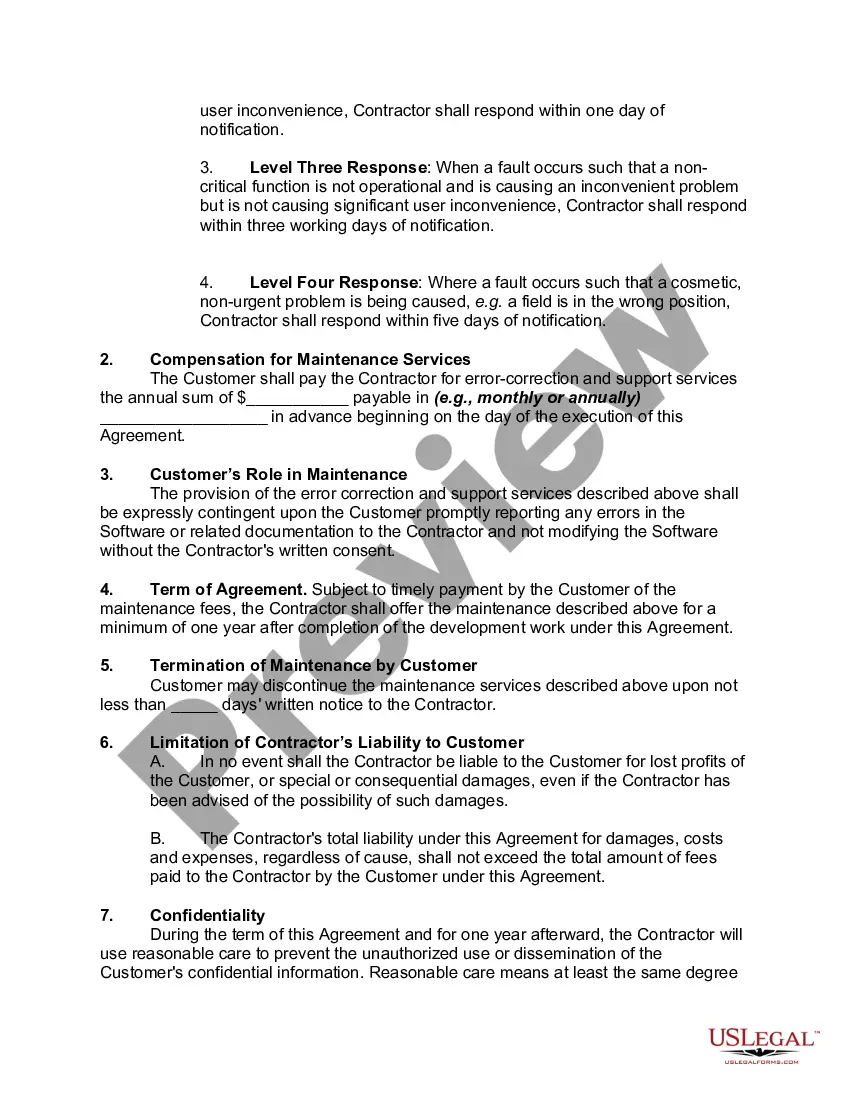

Filling out a Utah Software Support Agreement requires careful attention to detail. Begin by entering the names and contact information of both parties, followed by the description of the services provided. It is important to read through the entire document to ensure accuracy and completeness before obtaining signatures.

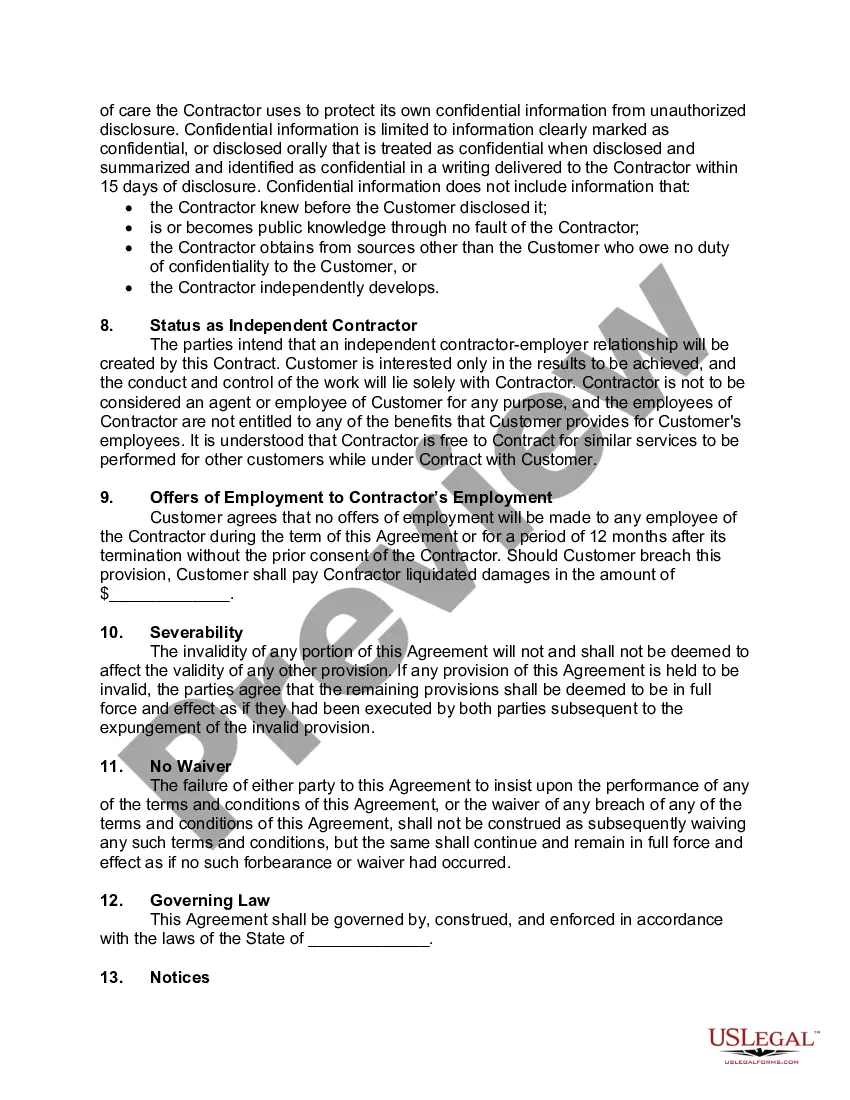

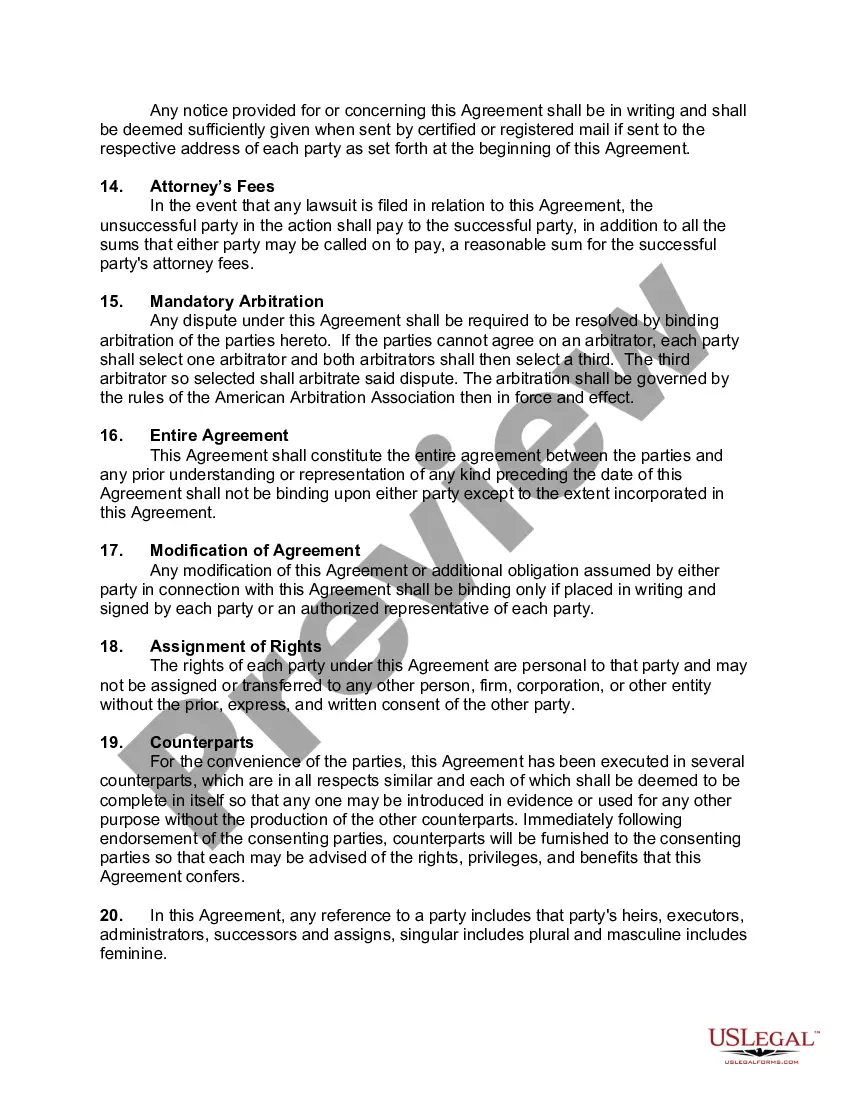

Writing a Utah Software Support Agreement involves defining key components such as the purpose, scope of support, and duration. You should also include clauses on payment, confidentiality, and termination conditions. Utilize templates from trusted sources like US Legal Forms to streamline the writing process while ensuring all necessary legal aspects are covered.

To complete a Utah Software Support Agreement, you need to gather relevant details such as parties' names, contact information, and the specific services offered. Next, review each section to ensure it accurately reflects the terms you have discussed. Finally, both parties should sign and date the document, making it an enforceable contract.

A Utah Software Support Agreement is a legal document that outlines the relationship between a software provider and its users. This agreement typically specifies the terms of support services, including maintenance, updates, and troubleshooting. It ensures users receive assistance when needed and defines the obligations of both parties in clear, concise terms.

Software as a Service (SaaS) is usually not considered taxable in Utah, as it is delivered as a service rather than a tangible product. However, understanding these distinctions is critical for your business. By implementing a comprehensive Utah Software Support Agreement, you can ensure compliance while maximizing your software usage.

In Utah, electronics generally incur sales tax based on the current rate, which is 4.85%, plus any local tax. This means you need to calculate the total rate applicable in your area. A Utah Software Support Agreement can assist in your software procurement process, helping you budget for tax implications.

Utah's base sales tax rate currently stands at 4.85%, but local taxes can increase this rate depending on your location. Overall, it’s wise for businesses to ensure compliance with these rates. Utilizing a Utah Software Support Agreement will help businesses anticipate costs associated with software purchases.

The tax rate for electronics in Utah generally aligns with the state sales tax rate, which is 4.85%. However, local municipalities may impose additional taxes, raising the total. By implementing a Utah Software Support Agreement, businesses can keep track of their software-related tax obligations effectively.

Yes, software is typically classified as personal property, as it represents ownership of a digital product. When discussing the Utah Software Support Agreement, it's crucial to recognize that software licensing also impacts how you manage and support your software assets.