Utah Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

If you wish to full, acquire, or produce authorized file layouts, use US Legal Forms, the largest variety of authorized varieties, that can be found online. Utilize the site`s simple and handy lookup to find the documents you want. A variety of layouts for business and personal reasons are sorted by groups and says, or search phrases. Use US Legal Forms to find the Utah Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust in just a couple of clicks.

Should you be previously a US Legal Forms client, log in to the bank account and click the Obtain button to find the Utah Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. Also you can gain access to varieties you previously acquired in the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape to the proper area/country.

- Step 2. Use the Review solution to look through the form`s articles. Never overlook to learn the information.

- Step 3. Should you be not satisfied using the form, take advantage of the Research discipline on top of the monitor to locate other versions in the authorized form template.

- Step 4. When you have found the shape you want, click on the Acquire now button. Pick the rates program you favor and put your references to sign up on an bank account.

- Step 5. Method the transaction. You should use your credit card or PayPal bank account to finish the transaction.

- Step 6. Find the structure in the authorized form and acquire it in your gadget.

- Step 7. Comprehensive, modify and produce or indicator the Utah Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Each and every authorized file template you acquire is your own property forever. You have acces to every form you acquired in your acccount. Select the My Forms portion and select a form to produce or acquire once again.

Remain competitive and acquire, and produce the Utah Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with US Legal Forms. There are thousands of skilled and state-specific varieties you can use for the business or personal requires.

Form popularity

FAQ

Selling a House with Multiple Inheritors in Utah: If the inherited property has multiple heirs, the majority can decide to sell the house by filing a lawsuit of partition action in the state probate court of Utah.

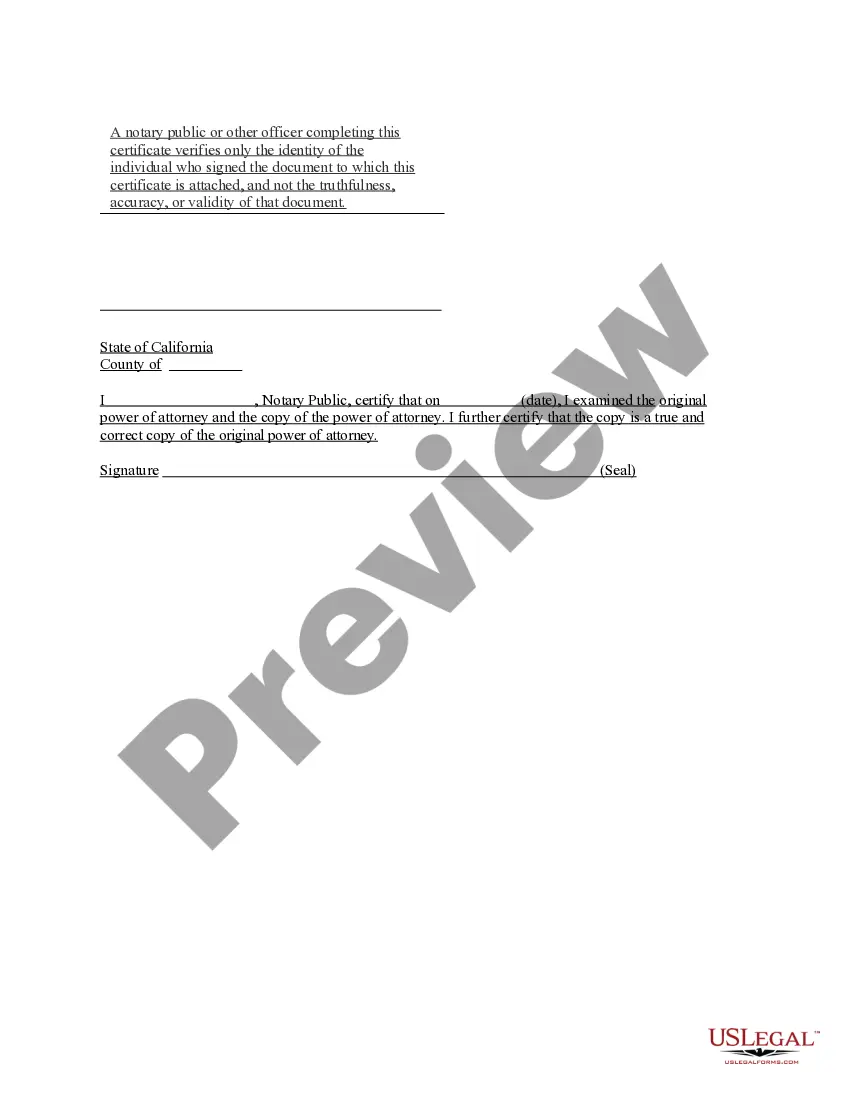

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

You disclaim the assets within nine months of the death of the person you inherited them from. (There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.) You receive no benefits from the proceeds of the assets you're disclaiming.

Once you accept an inheritance, it's yours. If you know you intend to disclaim the inheritance, have an estate planning attorney create the disclaimer to protect yourself. If the disclaimer is valid and properly prepared, you simply won't receive the inheritance.

Who Gets What in Utah? If you die with:here's what happens:spouse and descendants from you and someone other than that spousespouse inherits the first $75,000 of your intestate property, plus 1/2 of the balance descendants inherit everything elseparents but no spouse or descendantsparents inherit everything4 more rows

You can give money or property that you own as an inheritance any time you want. You can give it to your family now, and you don't have to wait until after you die to do so.

What Happens After a Beneficiary Refuses Inheritance. Once you refuse an inheritance you lose all control over who receives it in your place. A grantor's Will generally includes contingent beneficiaries ? people who should receive assets if any of the primary beneficiaries cannot receive the money.

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

If one sibling is living in an inherited property and refuses to sell, a partition action can potentially be brought by the other siblings or co-owners of the property in order to force the sale of the property. In general, no one can be forced to own property they don't want, but they can be forced to sell.