Utah Bank Account Monthly Withdrawal Authorization is a financial service offered by banks in Utah, allowing account holders to authorize automatic monthly withdrawals from their bank accounts for various purposes. This service simplifies the process of paying recurring bills, making regular investments, or contributing to savings accounts. With Utah Bank Account Monthly Withdrawal Authorization, customers can enjoy the convenience of having their payments or savings contributions automatically deducted from their bank accounts on a predetermined date each month. This eliminates the need for manual transaction processing, reducing the risk of late fees or missed payments. There are different types of Utah Bank Account Monthly Withdrawal Authorization, each catering to various financial needs: 1. Bill Payment Authorization: This type of withdrawal authorization allows customers to designate certain monthly bills or utilities to be automatically paid from their bank account. Examples include mortgage or rent payments, electricity or water bills, internet or cable TV subscriptions, and insurance premiums. 2. Investment Contribution Authorization: Investors can use this withdrawal authorization to set up monthly contributions to their investment accounts, such as retirement savings, mutual funds, or stocks. It ensures a disciplined approach to investing and helps to grow wealth steadily over time. 3. Savings Account Contribution Authorization: Account holders can instruct their bank to transfer a fixed amount from their checking account to a savings account each month. This type of withdrawal authorization encourages regular savings and is ideal for setting aside funds for emergencies, holidays, or future projects. 4. Loan Repayment Authorization: For individuals with loans, such as personal loans, student loans, or car loans, this withdrawal authorization enables automated monthly deductions towards loan repayment. It guarantees timely repayments, avoiding late payment penalties and negative impacts on credit scores. In conclusion, Utah Bank Account Monthly Withdrawal Authorization is a convenient and efficient service that allows individuals to automate monthly withdrawals from their bank accounts for bill payments, investment contributions, savings, or loan repayments. By utilizing this service, customers can manage their finances with ease and avoid the hassle of manual transactions.

Utah Bank Account Monthly Withdrawal Authorization

Description

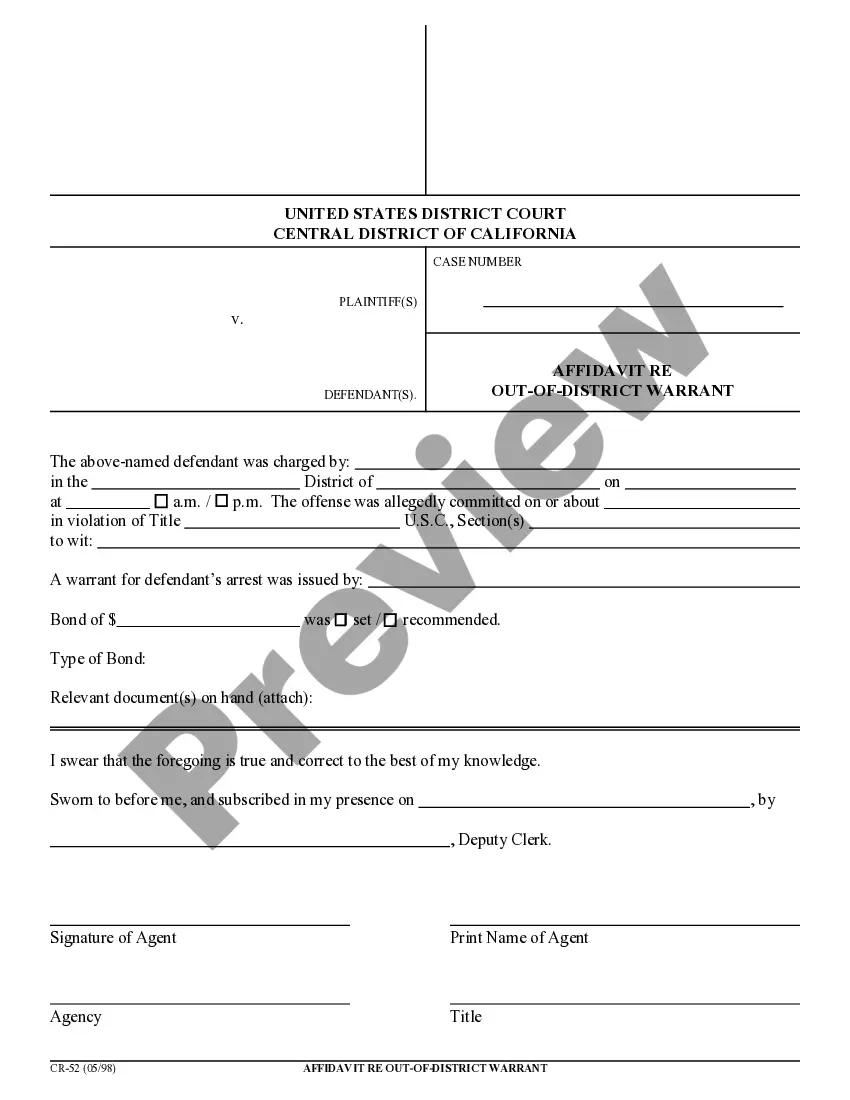

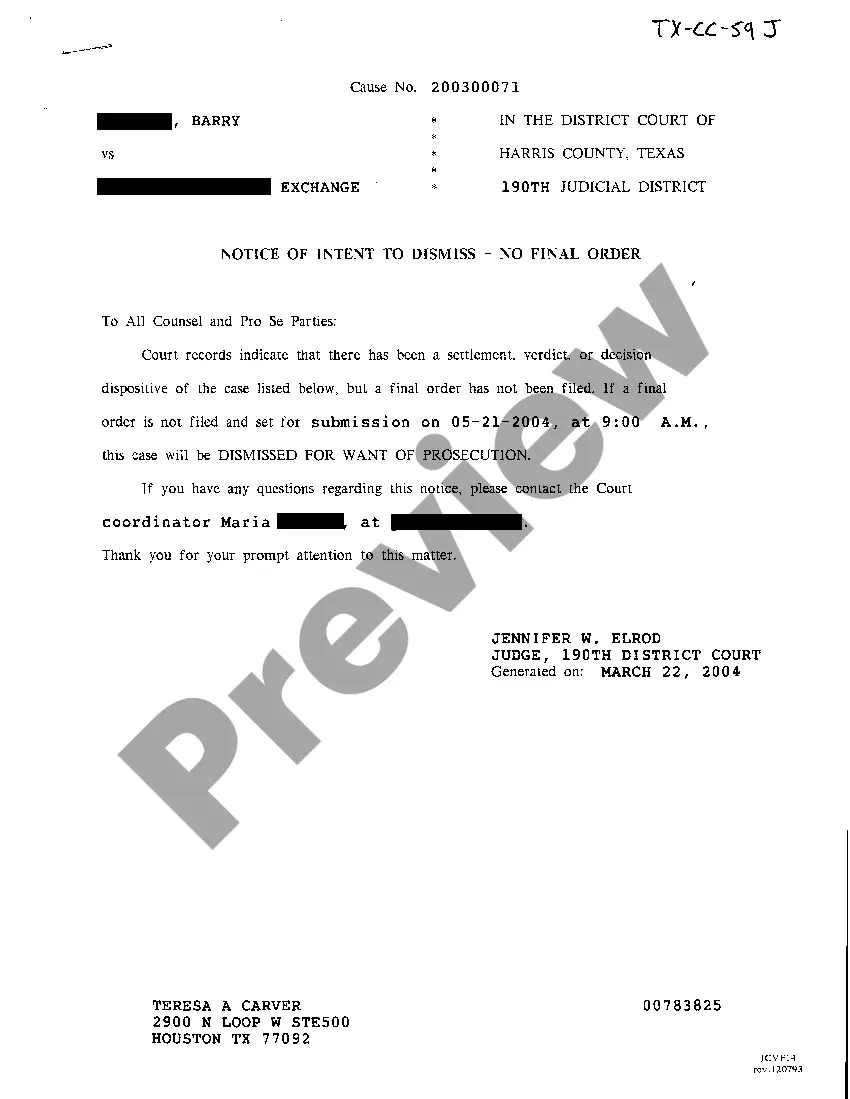

How to fill out Utah Bank Account Monthly Withdrawal Authorization?

US Legal Forms - one of the largest libraries of authorized forms in the USA - gives an array of authorized record templates you are able to down load or produce. Making use of the internet site, you may get a huge number of forms for business and individual uses, categorized by categories, claims, or key phrases.You can get the latest types of forms like the Utah Bank Account Monthly Withdrawal Authorization in seconds.

If you already have a monthly subscription, log in and down load Utah Bank Account Monthly Withdrawal Authorization in the US Legal Forms catalogue. The Obtain key can look on every type you see. You have access to all earlier delivered electronically forms from the My Forms tab of the bank account.

If you want to use US Legal Forms initially, allow me to share basic instructions to help you began:

- Make sure you have picked the correct type for your personal town/region. Select the Preview key to review the form`s content. Read the type description to actually have chosen the correct type.

- In the event the type doesn`t fit your requirements, use the Research discipline at the top of the monitor to find the one that does.

- If you are content with the shape, confirm your option by simply clicking the Get now key. Then, select the pricing prepare you like and provide your accreditations to sign up to have an bank account.

- Procedure the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Pick the format and down load the shape on the gadget.

- Make alterations. Fill up, edit and produce and indicator the delivered electronically Utah Bank Account Monthly Withdrawal Authorization.

Every format you added to your bank account lacks an expiration time and it is your own property permanently. So, if you want to down load or produce one more backup, just proceed to the My Forms segment and click on around the type you want.

Obtain access to the Utah Bank Account Monthly Withdrawal Authorization with US Legal Forms, the most considerable catalogue of authorized record templates. Use a huge number of specialist and state-distinct templates that satisfy your business or individual needs and requirements.