The Utah Affidavit of Domicile is a legal document used to establish a person's permanent residence in the state of Utah. This affidavit is typically required when someone passes away, and their estate needs to be administered and taxes need to be paid. It helps confirm where the deceased person resided at the time of their death, which can be crucial for determining their domicile for estate tax purposes. The Utah Affidavit of Domicile contains important information about the deceased person, including their full name, date of birth, date of death, and social security number. It also requires the affine (the person providing the affidavit) to provide their full name, address, and relationship to the deceased person. Keywords: Utah, Affidavit of Domicile, legal document, permanent residence, estate, taxes, deceased person, domicile, estate tax. In Utah, there are different types of Affidavits of Domicile that may be required depending on the specific circumstances: 1. Utah Affidavit of Domicile for Probate: This type of affidavit is used when someone passes away and their estate needs to go through the probate process. It is submitted to the court as part of the probate proceedings to establish the deceased person's domicile in Utah. 2. Utah Affidavit of Domicile for Estate Tax Purposes: In cases where the deceased person's estate is subject to federal or state estate taxes, this particular affidavit must be filed. It provides evidence of their domicile in Utah, which is essential for determining the appropriate tax liabilities. 3. Utah Affidavit of Domicile for Real Estate Transactions: This affidavit may be required in certain real estate transactions, such as property sales or transfers. It helps verify the seller's domicile in Utah and assures the buyer that the transaction is legally valid. Keywords: Utah Affidavit of Domicile, probate, estate tax, real estate transactions, seller, buyer, probate process, tax liabilities.

Utah Affidavit of Domicile

Description

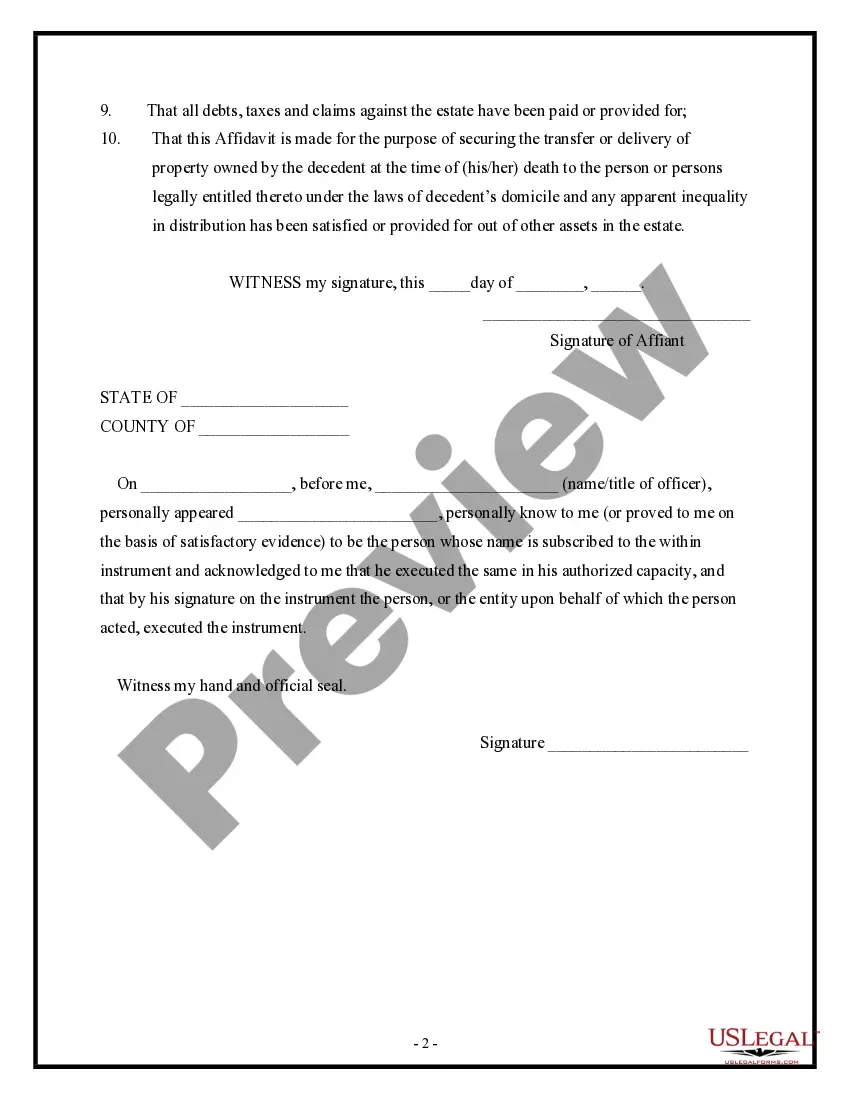

How to fill out Utah Affidavit Of Domicile?

If you want to full, download, or print out legal file themes, use US Legal Forms, the largest collection of legal kinds, that can be found on the Internet. Utilize the site`s simple and practical research to get the documents you want. A variety of themes for enterprise and individual functions are categorized by groups and says, or keywords. Use US Legal Forms to get the Utah Affidavit of Domicile with a few click throughs.

When you are previously a US Legal Forms buyer, log in to the accounts and then click the Obtain option to obtain the Utah Affidavit of Domicile. You may also access kinds you formerly downloaded inside the My Forms tab of the accounts.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape to the proper area/nation.

- Step 2. Utilize the Review solution to look through the form`s articles. Don`t forget about to read the information.

- Step 3. When you are not happy with all the develop, make use of the Research field near the top of the display to locate other models in the legal develop web template.

- Step 4. When you have located the shape you want, select the Get now option. Choose the prices strategy you like and put your references to register for the accounts.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Select the formatting in the legal develop and download it in your device.

- Step 7. Total, modify and print out or indication the Utah Affidavit of Domicile.

Every single legal file web template you purchase is your own permanently. You might have acces to each and every develop you downloaded within your acccount. Go through the My Forms segment and choose a develop to print out or download yet again.

Remain competitive and download, and print out the Utah Affidavit of Domicile with US Legal Forms. There are many skilled and condition-specific kinds you can utilize for your enterprise or individual requires.

Form popularity

FAQ

Before you can turn in your Utah residency form, you first have to live in the state for 12 or more continuous months. If you are a student, the months don't count if you are attending school unless you meet one of the state's exceptions.

Bring proof of identity (name and date of birth.) Bring social security card. Bring two (2) documents of Utah residence address. Visit our Required Documentation page for what is acceptable proof of each type of document required.

Your physical presence in a state plays an important role in determining your residency status. Usually, spending over half a year, or more than 183 days, in a particular state will render you a statutory resident and could make you liable for taxes in that state.

Adult Original You will need to visit one of our Driver License offices. You will take a photo upon arrival. You will be required to pass the eye test. Submit a nonrefundable fee of $52.00. Bring proof of identity (name and date of birth.) Bring social security card. Bring two (2) documents of Utah residence address.

Under subsection (ii), you are also considered a Utah resident if you remain in Utah 183 days or more during any tax year. In that case, you will be required to file a Utah resident tax return. If you remain in Utah less than 183 days and you do not establish Utah residency, you are considered a non- resident.

You maintain a place of abode in Utah and spent 183 or more days of the taxable year in Utah. You or your spouse did not vote in Utah during the taxable year but voted in Utah in any of the three prior years and was not registered to vote in another state during those three years.

Spend more than 30 days in a calendar year in Utah, receive earned income for services performed in Utah, vote in Utah, or. have a Utah driver's license.

Evidence of intent to establish Utah as permanent residence, which may include any one of the following: Utah voter registration card. Utah driver's license or identification card. Utah vehicle registration. Evidence of employment in Utah (pay stubs or employment letter)