Utah Credit Card Application with Bonus Features on Using Card Are you in search of a versatile credit card that offers exceptional benefits and rewards? Look no further than the Utah Credit Card Application with Bonus Features on Using Card. This credit card is designed to cater to the needs of individuals residing in Utah, providing them with exclusive privileges and perks. One of the remarkable features of this credit card is the bonus program that comes with it. Upon successful application and usage, cardholders can enjoy multiple bonus features that enhance their overall credit card experience. These bonus features are carefully curated to provide customers with added value and rewards as they use their credit card for various transactions. The Utah Credit Card Application with Bonus Features on Using Card encompasses different types, targeting various customer preferences and lifestyles. Some notable variations include: 1. Cashback Rewards Card: This type of credit card allows users to earn a percentage of cashback on their purchases. Every time the card is used for eligible transactions, a specific amount is credited back into the cardholder's account. This cashback can be accumulated and redeemed in various ways, including statement credits or direct deposits. 2. Travel Rewards Card: Ideal for frequent travelers, this type of credit card offers exclusive travel-related benefits. Cardholders earn travel points or miles for every qualifying purchase, which can later be redeemed for discounted or free flights, hotel stays, car rentals, or other travel-related expenses. Additional perks may include access to airport lounges, travel insurance, and concierge services. 3. Reward Points Card: With this credit card, users earn reward points for every dollar spent on eligible purchases. These points can be redeemed for a wide range of rewards, including merchandise, gift cards, experiences, or even cashback. Some credit card companies may also partner with specific retailers, allowing cardholders to earn extra points when shopping at their partner stores. 4. Balance Transfer Card: This type of credit card allows individuals to consolidate their existing debts by transferring balances from other credit cards or loans. The Utah Credit Card Application with Bonus Features on Using Card may offer promotional interest rates for a specified period on balance transfers, helping users save on interest payments and pay off their debts more effectively. Regardless of the card type, the Utah Credit Card Application with Bonus Features on Using Card provides added incentives such as introductory offers, travel and purchase protections, personalized customer service, and convenient online account management tools. In conclusion, the Utah Credit Card Application with Bonus Features on Using Card is an excellent choice for individuals seeking a credit card tailored to their needs. With its various types and enticing bonus features, this credit card is designed to enhance customer experiences and provide exceptional value in every transaction.

Utah Credit Card Application with Bonus Features on Using Card

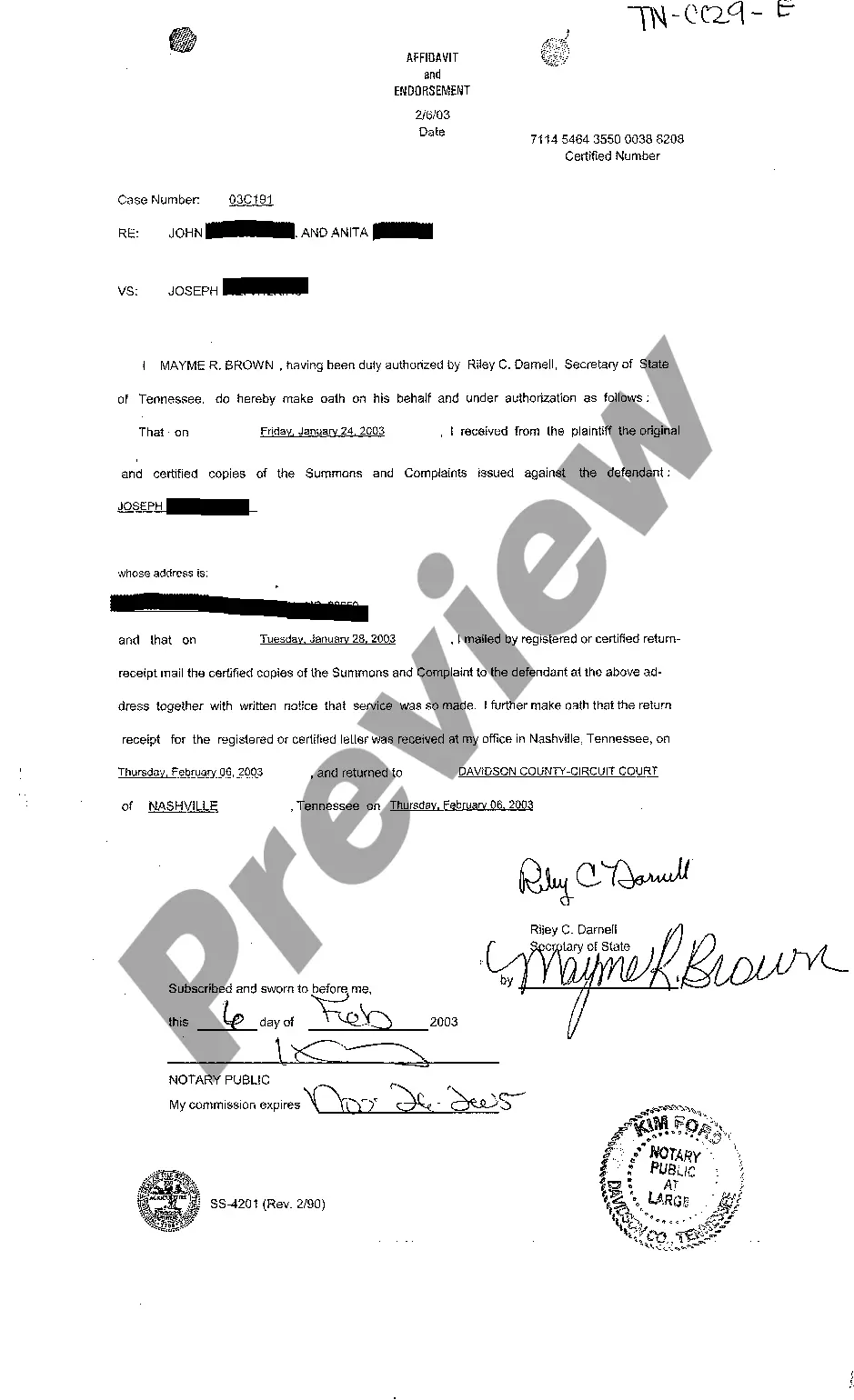

Description

How to fill out Utah Credit Card Application With Bonus Features On Using Card?

Discovering the right legal document web template can be quite a battle. Needless to say, there are tons of templates available on the Internet, but how would you get the legal kind you require? Utilize the US Legal Forms website. The assistance delivers a huge number of templates, for example the Utah Credit Card Application with Bonus Features on Using Card, which you can use for company and personal needs. Each of the forms are checked by specialists and meet federal and state specifications.

In case you are already registered, log in for your bank account and click the Download key to have the Utah Credit Card Application with Bonus Features on Using Card. Make use of your bank account to look from the legal forms you might have acquired in the past. Proceed to the My Forms tab of your own bank account and get an additional duplicate in the document you require.

In case you are a new customer of US Legal Forms, listed here are simple guidelines for you to adhere to:

- Very first, make certain you have selected the appropriate kind for your personal city/region. You may look through the form while using Review key and read the form description to guarantee it will be the right one for you.

- In the event the kind is not going to meet your requirements, take advantage of the Seach field to get the right kind.

- When you are sure that the form would work, click on the Get now key to have the kind.

- Opt for the pricing program you need and enter in the necessary info. Make your bank account and purchase the transaction using your PayPal bank account or charge card.

- Select the file format and download the legal document web template for your product.

- Full, change and print out and signal the acquired Utah Credit Card Application with Bonus Features on Using Card.

US Legal Forms will be the most significant collection of legal forms for which you will find different document templates. Utilize the service to download professionally-manufactured documents that adhere to state specifications.