Utah Credit Card Agreement and Disclosure Statement is a legally binding document outlining the terms and conditions of a credit card issued by financial institutions in Utah. This agreement ensures that both the credit card issuer and the cardholder are aware of their rights, responsibilities, and obligations regarding credit card usage. The Utah Credit Card Agreement and Disclosure Statement is designed to provide comprehensive information related to interest rates, fees, billing practices, and credit card policies in a clear and transparent manner. It includes crucial details such as the Annual Percentage Rate (APR), grace periods, late payment fees, balance transfer fees, cash advance fees, and penalty charges. Within Utah, several types of credit card agreements and disclosure statements may be available. These can include: 1. Fixed-Rate Credit Card Agreement: This type of agreement specifies a consistent interest rate throughout the payment period, ensuring that cardholders pay a fixed percentage on their outstanding balance. 2. Variable-Rate Credit Card Agreement: This agreement outlines an interest rate that fluctuates with market conditions. The rate may be tied to a financial index, such as the Prime Rate, and can change periodically within certain limits. 3. Rewards Credit Card Agreement: This type of agreement is associated with credit cards that offer reward programs, including cashback, travel points, or other benefits. The agreement explains how cardholders can earn and redeem rewards, any limitations or restrictions, and potential fees associated with reward usage. 4. Secured Credit Card Agreement: This agreement pertains to credit cards that require collateral, such as a cash deposit, as a means of establishing creditworthiness for individuals with limited or poor credit history. It outlines the terms related to the collateral, credit limits, and responsibility for repayment. 5. Student Credit Card Agreement: Specifically designed for students, this agreement provides information about credit cards tailored to their unique needs. It may offer special benefits or terms for those enrolled in educational institutions. It's important for consumers to carefully review and understand the Utah Credit Card Agreement and Disclosure Statement before signing up for a credit card. By familiarizing themselves with the terms and conditions, cardholders can make informed decisions, avoid possible misunderstandings, and effectively manage their credit card usage to maintain financial stability.

Utah Credit Card Agreement and Disclosure Statement

Description

How to fill out Utah Credit Card Agreement And Disclosure Statement?

Are you inside a place where you need papers for either organization or personal reasons almost every day? There are tons of legitimate papers web templates accessible on the Internet, but getting types you can depend on isn`t easy. US Legal Forms offers a large number of type web templates, like the Utah Credit Card Agreement and Disclosure Statement, which can be written to meet federal and state needs.

If you are already knowledgeable about US Legal Forms internet site and get your account, merely log in. Afterward, you may acquire the Utah Credit Card Agreement and Disclosure Statement design.

Unless you offer an account and want to begin using US Legal Forms, adopt these measures:

- Get the type you will need and make sure it is for your right metropolis/state.

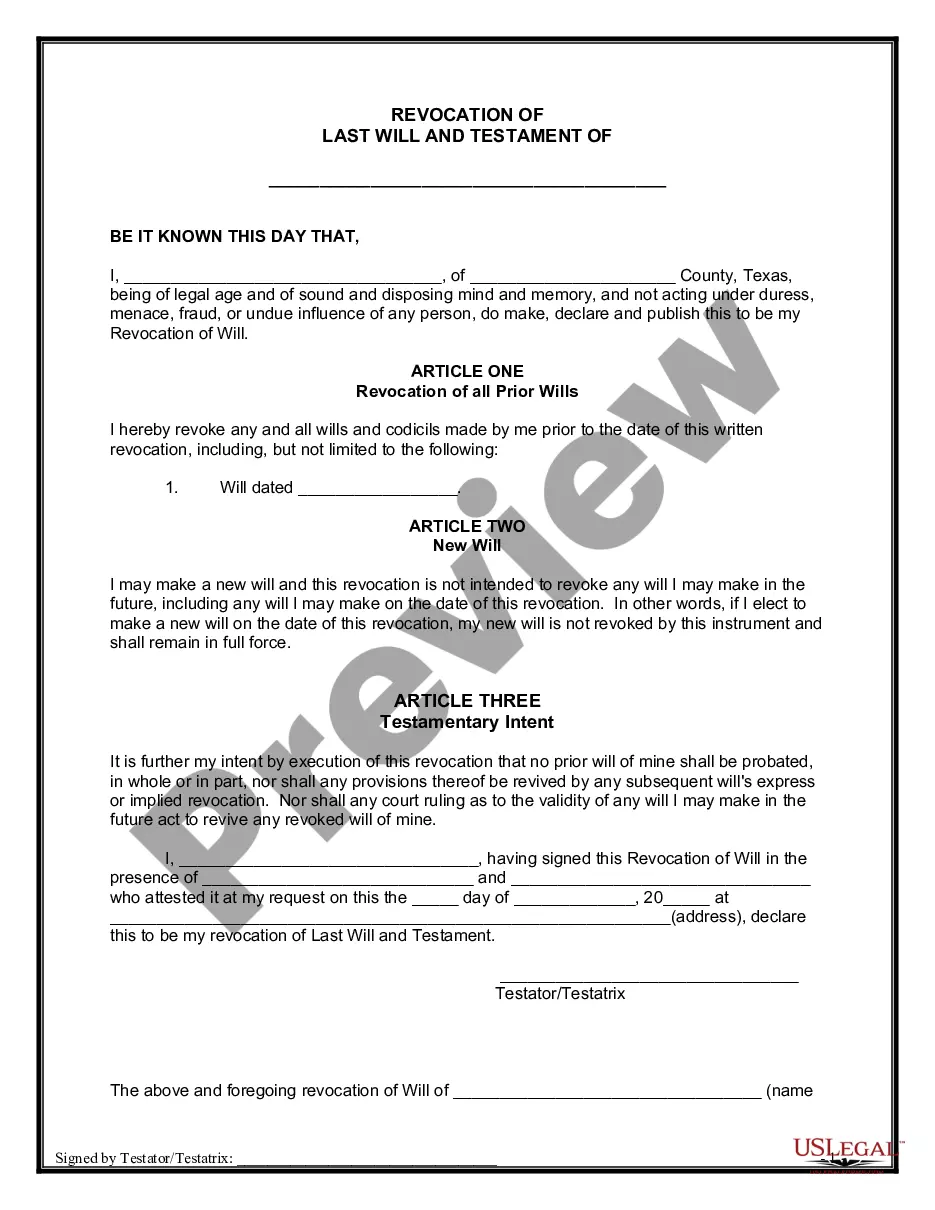

- Make use of the Preview switch to examine the form.

- Read the outline to actually have selected the right type.

- If the type isn`t what you are searching for, make use of the Research discipline to find the type that suits you and needs.

- Whenever you get the right type, click on Purchase now.

- Opt for the pricing strategy you desire, complete the specified details to make your account, and purchase an order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and acquire your copy.

Find all of the papers web templates you might have purchased in the My Forms food list. You can obtain a extra copy of Utah Credit Card Agreement and Disclosure Statement at any time, if necessary. Just click on the needed type to acquire or produce the papers design.

Use US Legal Forms, probably the most substantial variety of legitimate varieties, to save lots of time and steer clear of blunders. The assistance offers professionally made legitimate papers web templates which you can use for a selection of reasons. Make your account on US Legal Forms and start producing your lifestyle a little easier.