Utah Angel Investor Agreement is a legal document that outlines the terms and conditions agreed upon between an angel investor and a startup company based in Utah. This agreement serves as a framework for the investment process, ensuring that both parties are protected and their rights and obligations are clearly defined. The main objective of a Utah Angel Investor Agreement is to facilitate the investment transaction while minimizing the associated risks. It includes various provisions that govern the relationship between the investor and the startup, such as the investment amount, ownership stake, rights and privileges, and exit strategies. In Utah, there are different types of Angel Investor Agreements that cater to specific needs and preferences. Some common types include: 1. Seed Investment Agreement: This type of agreement is suitable for early-stage startups seeking initial funding. It outlines the terms for an angel investor to provide seed money to the startup in exchange for an equity stake. 2. Convertible Note Agreement: This agreement is often used when the valuation of the startup is uncertain. Instead of directly investing in equity, the angel investor provides a loan in the form of a convertible note, which can be converted into equity at a later date. 3. Preferred Stock Purchase Agreement: In this type of agreement, the investor purchases preferred stock in the startup, which comes with certain preferential rights and privileges. It ensures that the investor receives a return on investment before the common stockholders in case of a liquidation event. 4. Stock Subscription Agreement: This agreement is used when the startup decides to issue new shares of stock to raise capital. The investor agrees to subscribe to a certain number of shares at a specified purchase price, along with any additional terms and conditions. Utah Angel Investor Agreements typically cover other important aspects as well, such as confidentiality and non-disclosure obligations, intellectual property rights, representations and warranties, and dispute resolution mechanisms. It is crucial for both the investor and the startup to thoroughly review and negotiate the terms of the agreement before signing. Consulting legal professionals with experience in angel investments is highly recommended ensuring compliance with Utah state laws and regulations, as well as to protect the interests of both parties involved.

Utah Angel Investor Agreement

Description

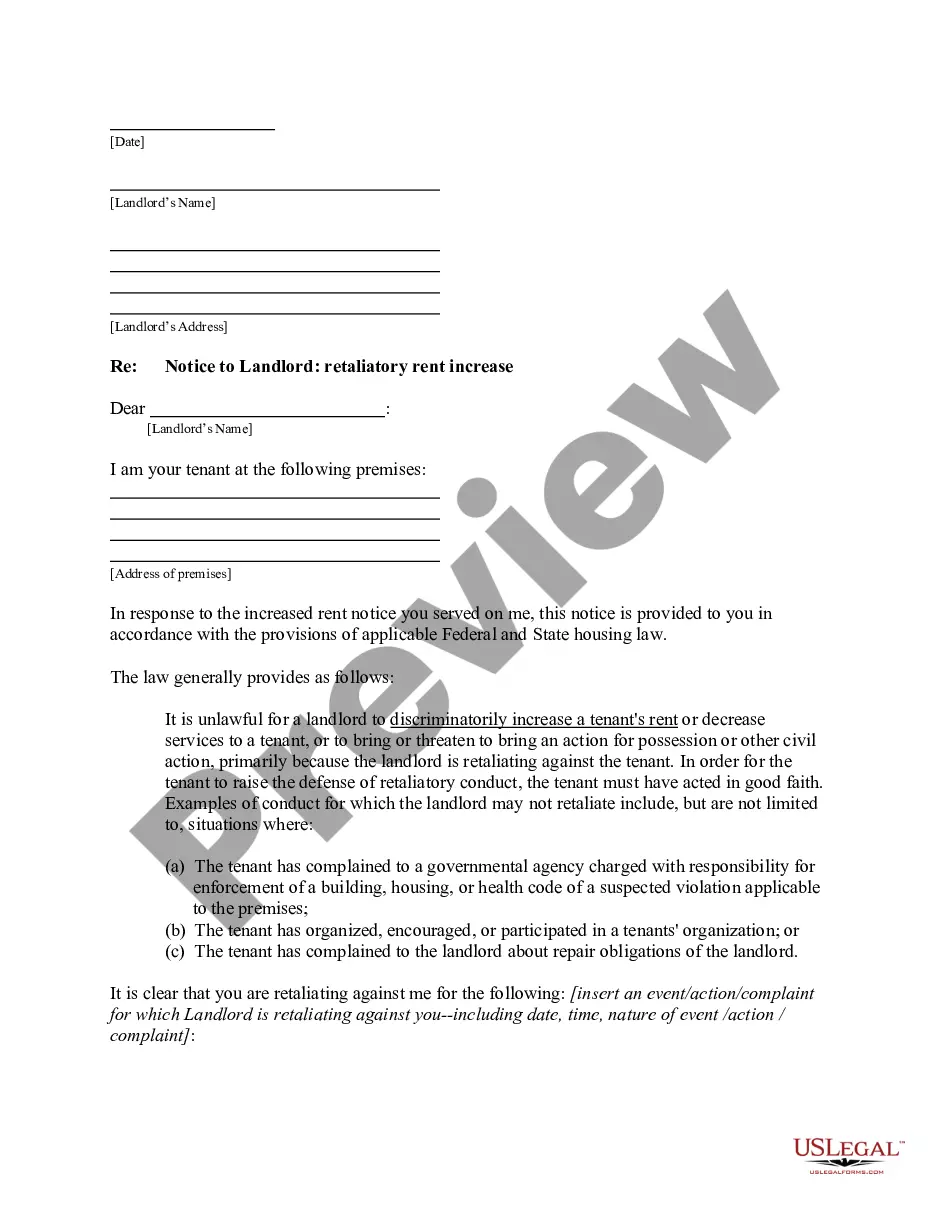

How to fill out Utah Angel Investor Agreement?

Are you within a position that you will need files for sometimes business or specific purposes almost every day? There are a lot of legal file themes available on the net, but discovering kinds you can trust is not effortless. US Legal Forms provides thousands of kind themes, such as the Utah Angel Investor Agreement, which are published in order to meet federal and state specifications.

In case you are previously familiar with US Legal Forms web site and have a free account, just log in. After that, it is possible to download the Utah Angel Investor Agreement web template.

If you do not have an account and want to begin to use US Legal Forms, adopt these measures:

- Get the kind you will need and make sure it is for your proper town/region.

- Take advantage of the Review button to check the shape.

- See the explanation to actually have selected the right kind.

- When the kind is not what you are searching for, make use of the Search area to get the kind that suits you and specifications.

- Once you get the proper kind, click Buy now.

- Pick the rates program you would like, submit the required information and facts to make your account, and pay for the transaction using your PayPal or charge card.

- Select a hassle-free data file structure and download your backup.

Get each of the file themes you might have bought in the My Forms food list. You can aquire a additional backup of Utah Angel Investor Agreement at any time, if necessary. Just select the required kind to download or print the file web template.

Use US Legal Forms, probably the most considerable collection of legal types, to conserve efforts and stay away from mistakes. The assistance provides professionally produced legal file themes that can be used for a selection of purposes. Make a free account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

To become an angel investor in Canada, one must typically meet specific financial thresholds set by the Canadian Securities Administrators. Engaging with investment groups or networks can provide insights and opportunities. Although this question pertains to Canada, understanding the principles of a Utah Angel Investor Agreement can still offer valuable guidance in structuring your investments internationally.

While it is possible to invest as a non-accredited investor, opportunities may be limited. Many investment deals are restricted to accredited investors for legal reasons. By utilizing a Utah Angel Investor Agreement, non-accredited individuals can explore alternative investment strategies under state regulations.

The amount of capital required varies, but many angel investors typically invest between $25,000 to $100,000 in startups. It's vital to assess your financial situation before making commitments. A well-crafted Utah Angel Investor Agreement will help you manage your investments and expectations effectively.

While anyone can aspire to be an angel investor, certain financial criteria apply. Most angel investors are accredited, meaning they meet specific income or wealth thresholds. Engaging with a Utah Angel Investor Agreement can help clarify your eligibility and provide the tools necessary for responsible investing.

Typically, you do not need a specific license to operate as an angel investor. However, it is crucial to comply with federal and state regulations regarding investments. Utilizing a Utah Angel Investor Agreement can guide you in adhering to these legal requirements without the hassle of navigating these regulations alone.

To become an angel investor, you generally need to have a high net worth and experience in investing. You should understand the market and have the ability to analyze business plans. In Utah, following the guidelines for a Utah Angel Investor Agreement will help you navigate this process, ensuring you meet the necessary criteria.

To write off an angel investment, first document the loss by gathering relevant financial records and any agreements tied to the investment. You can then claim the loss on your tax returns, provided you meet IRS regulations. For assistance in crafting proper documentation, including a Utah Angel Investor Agreement, consider exploring templates available on uslegalforms.

Angel investors usually acquire an equity stake ranging from 10% to 30% in the startup, influenced by various factors such as the business's valuation and perceived potential. This stake reflects their commitment and risk taken. Having this percentage clearly outlined in the Utah Angel Investor Agreement can save future disputes.

The percentage an angel investor receives can vary, commonly falling between 10% and 30%, based on negotiations and the funding round. This equity stake compensates for their investment and risk. To avoid confusion, documenting the agreed-upon percentage in your Utah Angel Investor Agreement is essential.

A fair percentage for an angel investor typically ranges from 10% to 30% equity in the startup, depending on the investment's size, the startup's stage, and the industry. This percentage reflects the investor's risk level and contribution to the business. Clearly stating this percentage in the Utah Angel Investor Agreement helps promote transparency.