Utah Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another In Utah, an installment sale and security agreement is a legally binding contract that outlines the terms and conditions of selling a vehicle from one individual to another in installments. This agreement serves to protect the rights and interests of both the buyer and the seller throughout the transaction process. Keywords: Utah, installment sale, security agreement, automobile, individual, buyer, seller, contract, terms and conditions, transaction process, rights, interests. Various types of Utah Installment Sale and Security Agreements regarding the sale of an automobile from one individual to another may include: 1. Traditional Installment Sale Agreement: This type of agreement is commonly used when the buyer pays for the vehicle in installments over a specific period of time. The agreement will detail the purchase price, down payment, monthly payment amount, interest rate, and any additional fees or charges. 2. Balloon Payment Agreement: In this type of installment sale, the buyer makes regular payments for a certain period, but a large "balloon" payment is due at the end of the term. The agreement specifies the terms of the regular payments, the balloon payment amount, and the consequences for failing to make the final payment. 3. Lease-to-Own Agreement: This agreement allows the buyer to lease the vehicle for a specified period, with an option to purchase it at the end of the lease term. The agreement will include lease terms, monthly payment amount, purchase price at the end of the lease, and conditions for exercising the purchase option. 4. Collateralized Security Agreement: This type of agreement is used when the buyer provides collateral, such as another vehicle or property, as security for the installment sale. The agreement outlines the details of the collateral, including its value, condition, and consequences for defaulting on the payment. 5. Subordination Agreement: If the seller still owes money to a third party for the vehicle being sold, a subordination agreement may be necessary. This agreement ensures that the buyer's interest in the vehicle is protected even if the seller defaults on their debt obligations. 6. Co-Signer Agreement: In some cases, a co-signer may be required to guarantee the buyer's payment obligations. This agreement involves a third party who agrees to be responsible for the payments in case the buyer defaults. Utah's Installment Sale and Security Agreement for the sale of an automobile from one individual to another is a crucial document that protects the rights and interests of both the buyer and the seller. It is strongly recommended that individuals seek legal advice or consult a qualified professional when creating or entering into any installment sale and security agreement.

Utah Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another

Description

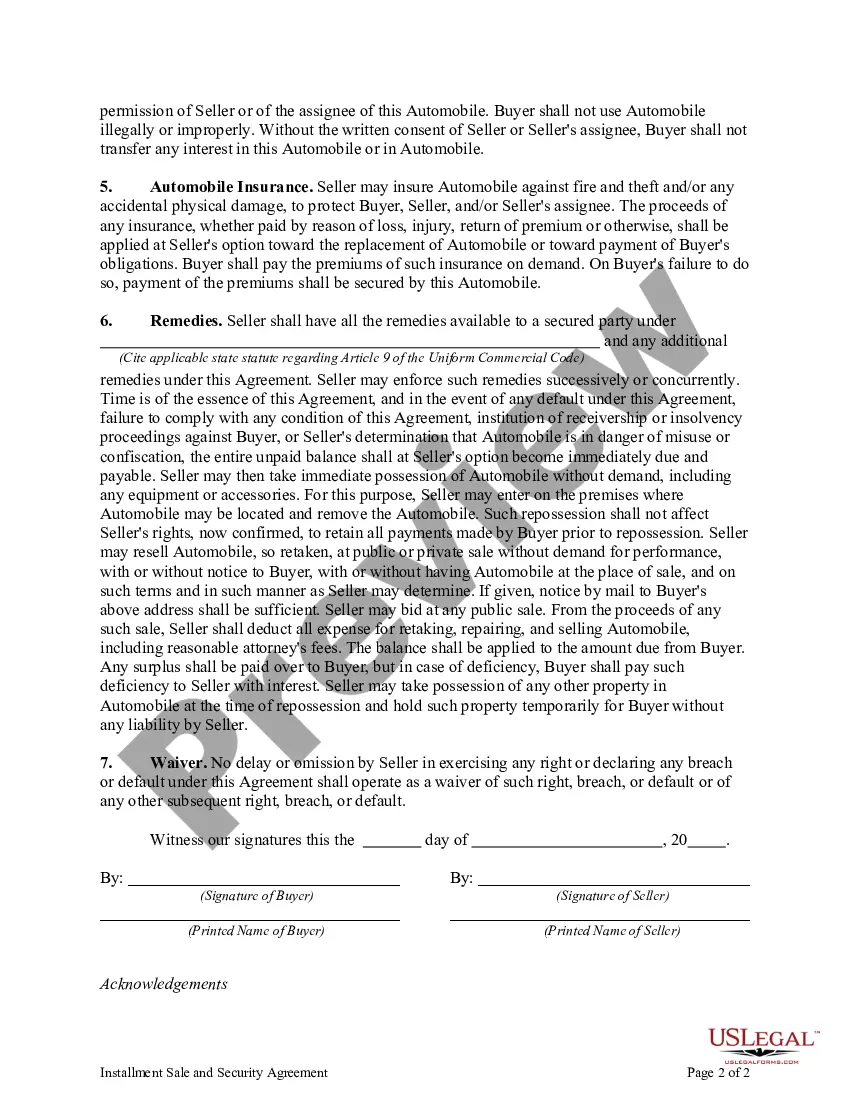

How to fill out Utah Installment Sale And Security Agreement Regarding Sale Of Automobile From One Individual To Another?

If you have to complete, obtain, or printing lawful record layouts, use US Legal Forms, the biggest variety of lawful forms, which can be found on the web. Use the site`s basic and hassle-free look for to find the paperwork you want. Various layouts for organization and personal purposes are sorted by groups and states, or key phrases. Use US Legal Forms to find the Utah Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another in just a number of mouse clicks.

Should you be already a US Legal Forms consumer, log in for your accounts and click on the Obtain key to have the Utah Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another. You can also accessibility forms you formerly acquired within the My Forms tab of your respective accounts.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the form for that right city/region.

- Step 2. Take advantage of the Preview choice to look through the form`s content. Don`t forget about to see the information.

- Step 3. Should you be not satisfied with all the develop, use the Lookup industry on top of the screen to find other models of the lawful develop format.

- Step 4. Once you have discovered the form you want, click on the Purchase now key. Select the pricing plan you prefer and add your qualifications to sign up for an accounts.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the file format of the lawful develop and obtain it on the product.

- Step 7. Full, edit and printing or signal the Utah Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another.

Every single lawful record format you get is yours permanently. You might have acces to each develop you acquired within your acccount. Click on the My Forms portion and choose a develop to printing or obtain yet again.

Contend and obtain, and printing the Utah Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another with US Legal Forms. There are millions of expert and state-distinct forms you can use for your organization or personal demands.