Utah Bill of Sale by Corporation of all or Substantially all of its Assets

Description

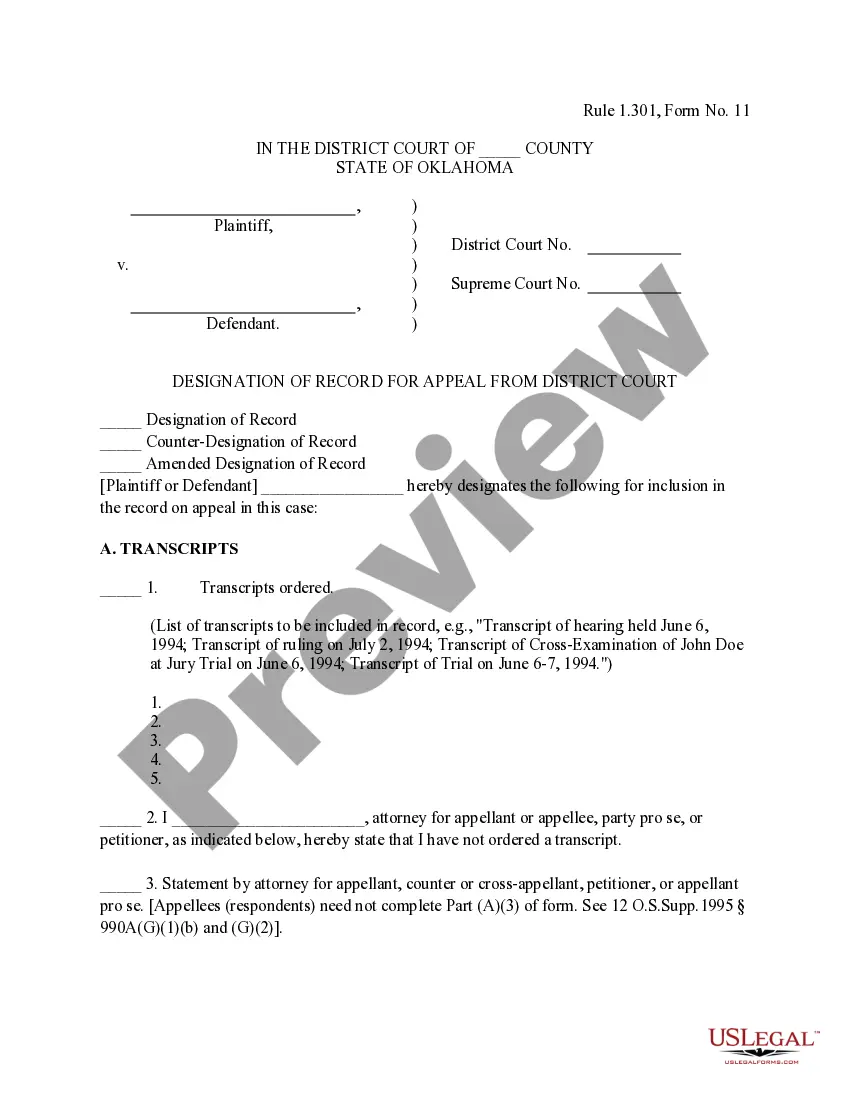

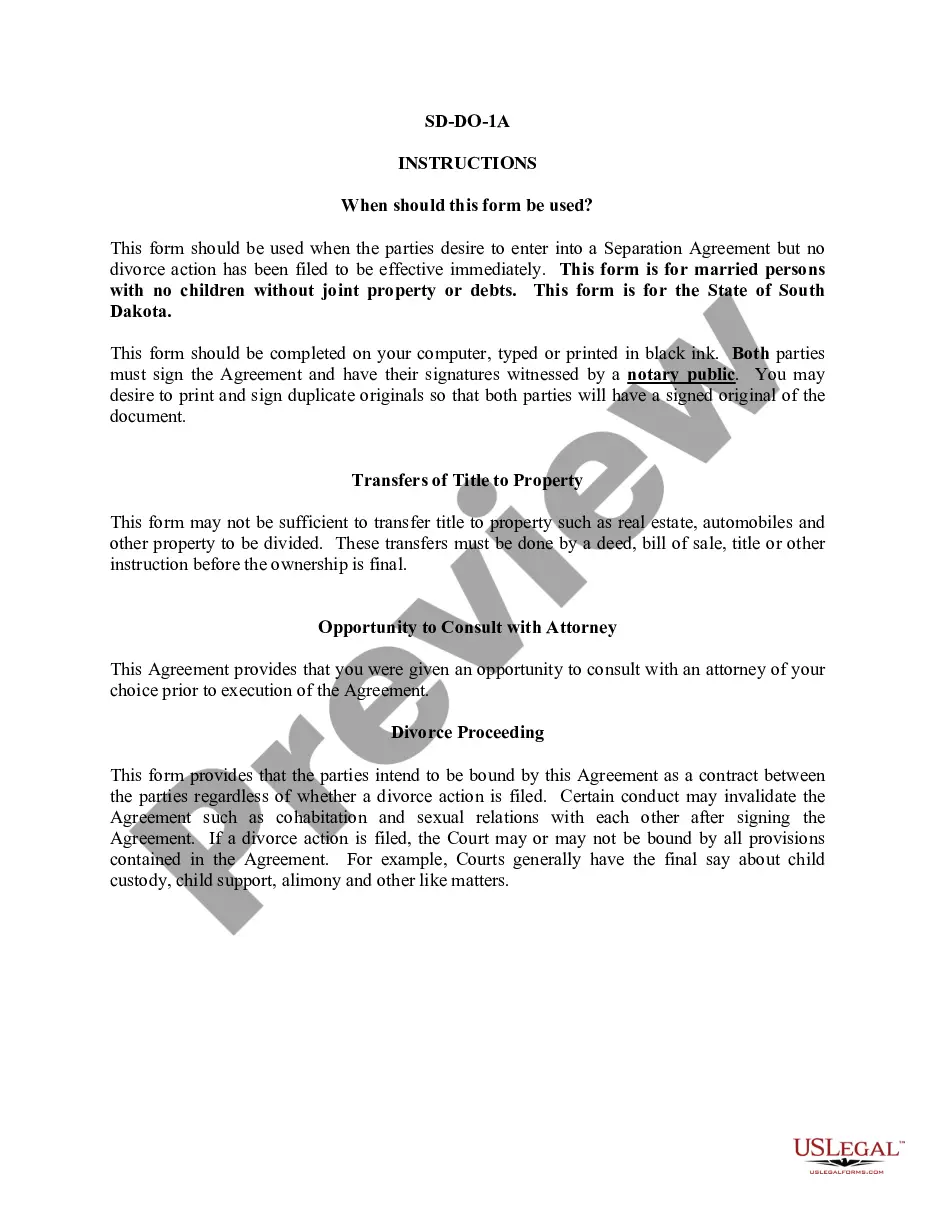

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

You can spend numerous hours online trying to locate the legal document format that fulfills the federal and state requirements you will need.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can effortlessly obtain or print the Utah Bill of Sale by Corporation of all or substantially all of its Assets using our service.

If available, utilize the Review button to verify the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Next, you can complete, edit, print, or sign the Utah Bill of Sale by Corporation of all or substantially all of its Assets.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Check the form description to ensure you have chosen the right form.

Form popularity

FAQ

Yes, in most cases, shareholder approval is required for an asset sale, especially when it involves a major transaction like the sale of all or substantially all of the corporate assets. The use of the Utah Bill of Sale by Corporation of all or Substantially all of its Assets can help facilitate this process. Ensuring that shareholders are informed and involved protects their interests and ensures compliance with corporate governance standards.

The sale of all or substantially all of the assets involves transferring ownership of the majority of a corporation's assets to another entity. This can include inventory, equipment, and property, and it often requires compliance with legal frameworks, such as the Utah Bill of Sale by Corporation of all or Substantially all of its Assets. Such sales can significantly impact the corporation's operations and finances, making proper documentation and adherence to regulations crucial.

When a corporation intends to sell all or a majority of its assets, the board of directors and shareholders generally need to approve the transaction. This requirement is highlighted in the Utah Bill of Sale by Corporation of all or Substantially all of its Assets, which outlines the necessary steps for a compliant sale. Proper approvals help protect both the company's interests and its shareholders.

The approval of a company sale typically falls to the board of directors, who must act in the best interests of the shareholders. Shareholders may also be involved in the approval process, especially when it involves the Utah Bill of Sale by Corporation of all or Substantially all of its Assets. This ensures that all parties understand the implications of the sale and that it meets legal requirements.

The sale of stock in a corporation is primarily regulated by state corporate laws, as well as federal securities laws. In Utah, the Utah Bill of Sale by Corporation of all or Substantially all of its Assets can help outline the terms of such transactions. Corporations must also comply with disclosure requirements and may need to file certain documents with regulatory bodies to ensure transparency.

As a result of the transaction, the buyer receives all of assets, including cash, of the selling company.

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...