Utah Cash Receipts Control Log is a document used by organizations in the state of Utah to track and manage cash receipts. It serves as a comprehensive record of all cash transactions received by the organization and plays a crucial role in maintaining financial integrity and internal control. The Utah Cash Receipts Control Log is designed to provide detailed information about every cash receipt, including the date of receipt, source or customer name, purpose of payment, amount received, and any additional notes or comments. This level of meticulous recording ensures accuracy and transparency in financial reporting, facilitates reconciliation processes, and enables timely identification of any discrepancies or irregularities. There are different types of Utah Cash Receipts Control Logs depending on the nature of the organization or business. Here are a few examples: 1. Small Business Cash Receipts Control Log: This log is tailored for small businesses operating in Utah, allowing them to track daily cash inflows effectively. It typically includes fields such as invoice number, customer details, payment method, and a brief description of the product or service provided. 2. Non-Profit Organization Cash Receipts Control Log: Non-profit organizations in Utah, such as charities or community service organizations, utilize this log to monitor donations, grants, and other financial contributions. In addition to the standard receipt details, it may include sections for donor information, donation type (cash, check, online), and specific programs or projects designated by the donor. 3. Government Agency Cash Receipts Control Log: Government entities at the state, county, or municipal level in Utah employ this log to track revenue generated from various sources, such as license fees, permits, fines, or taxes. This log may have additional fields to capture specific data required for governmental financial reporting, like account codes or revenue categories. Utilizing the Utah Cash Receipts Control Log is essential for regulatory compliance, internal audits, and ensuring proper cash management. It assists organizations in maintaining accurate financial records and protects against potential fraud or misappropriation of funds. Implementing a comprehensive control log contributes to the overall financial transparency and accountability of the organization, building trust with stakeholders and regulatory authorities. In conclusion, the Utah Cash Receipts Control Log is a vital tool for organizations operating in Utah to maintain meticulous records of cash receipts. Different versions of this log cater to the specific needs of various businesses and entities, facilitating efficient cash management and financial oversight.

Utah Cash Receipts Control Log

Description

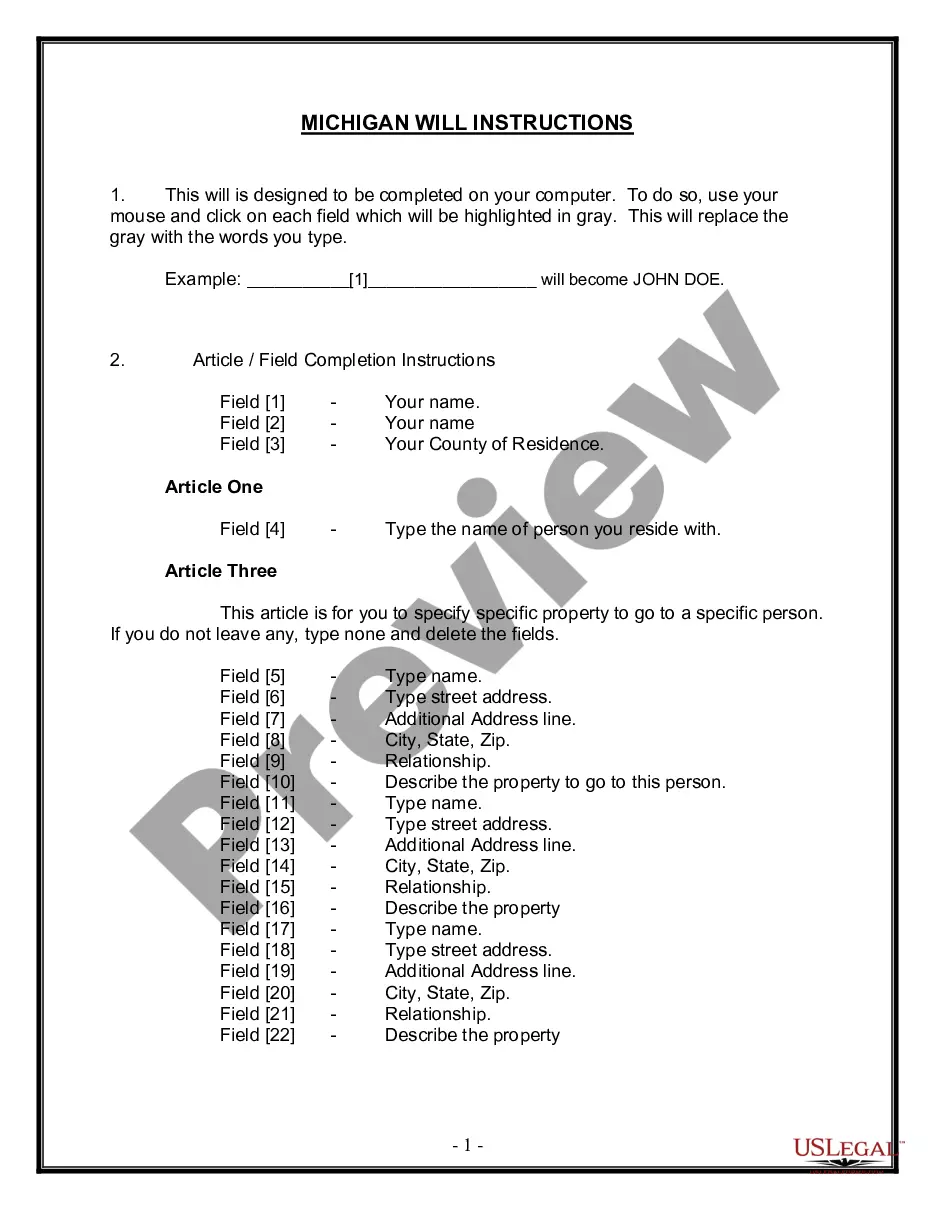

How to fill out Utah Cash Receipts Control Log?

If you wish to full, acquire, or print legitimate file themes, use US Legal Forms, the most important assortment of legitimate types, which can be found on the web. Use the site`s simple and practical lookup to get the documents you need. Various themes for organization and specific functions are sorted by groups and suggests, or key phrases. Use US Legal Forms to get the Utah Cash Receipts Control Log in a couple of mouse clicks.

In case you are currently a US Legal Forms buyer, log in in your profile and click on the Obtain key to obtain the Utah Cash Receipts Control Log. You can even gain access to types you in the past delivered electronically in the My Forms tab of your profile.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form to the correct town/region.

- Step 2. Make use of the Preview option to check out the form`s content. Don`t forget about to read through the information.

- Step 3. In case you are unsatisfied with all the form, utilize the Search field near the top of the monitor to get other versions from the legitimate form template.

- Step 4. Upon having discovered the form you need, click the Buy now key. Choose the pricing prepare you choose and add your credentials to sign up for an profile.

- Step 5. Procedure the financial transaction. You can use your bank card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the formatting from the legitimate form and acquire it on the device.

- Step 7. Complete, modify and print or indicator the Utah Cash Receipts Control Log.

Each legitimate file template you acquire is the one you have eternally. You have acces to every form you delivered electronically in your acccount. Go through the My Forms segment and decide on a form to print or acquire once again.

Contend and acquire, and print the Utah Cash Receipts Control Log with US Legal Forms. There are many professional and condition-specific types you can utilize to your organization or specific demands.

Form popularity

FAQ

Cash controls are internal systems used to prevent unapproved payments, theft, and fraud. These systems include procedures at predefined steps to create segmentation of duties and introduce checks in the process to identify and correct errors.

Examples of Cash ManagementA computer manufacturing company, Abc Limited, uses supplier Alpha & Co. to purchase raw materials. read more. Alpha & Co. has the policy of allowing credit of 30-days. Abc limited has $10 million in cash resources available and has to pay $2 million to Alpha & Co.

To control cash transactions, organizations should adopt some of the following practices: Require background checks for employees, establish segregation of duties, safeguard all cash and assets in secure locations, and use a lockbox to accept cash payments from customers.

Bank deposits and bank account reconciliations are examples of internal control and cash accounting. Retail companies with physical point-of-sale cash registers need to safeguard cash assets in the cash drawer. Ecommerce companies also need to implement adequate cash controls.

Objective. The objective of cash receipt controls is to ensure that all monies (checks, currency, coin, and credit cards) are properly accounted for and timely deposited.

A cash receipts log is used to track the cash receipts of a business. Although the format of the cash receipts log varies from business to business, the essential details presented on the form are the same and include the customer's name, amount of cash receipt and details related to the payment.

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

These top 10 best practices and procedures can help you handle cash the right way for your business.Organization Is Key to Effective Cash Handling.Keep an Eye on Your Cash.Enforce Policies and Procedures.Keep Less Cash on Site.Engage Your Staff.Maintain a Schedule.Have Enough Staff.Ask for Help.More items...?

Cash control is cash management and internal control over cash and cash-related policies within a company. Cash controlling receipts and cash disbursements reduces erroneous payments, theft, and fraud.

Best practices:Record cash receipts when received.Keep funds secured.Document transfers.Give receipts to each customer.Don't share passwords.Give each cashier a separate cash drawer.Supervisors verify cash deposits.Supervisors approve all voided refunded transactions.