Utah Blind Trust Agreement

Description

How to fill out Blind Trust Agreement?

US Legal Forms - one of the most prominent repositories of legal templates in the United States - offers a variety of legal document formats that you can download or print.

By utilizing the website, you will access thousands of forms for commercial and personal uses, organized by categories, states, or keywords. You can obtain the latest templates like the Utah Blind Trust Agreement in moments.

If you already possess a membership, Log In and download the Utah Blind Trust Agreement from the US Legal Forms library. The Download button will be visible on every document you view. You can access all previously saved forms from the My documents section of your account.

Complete the payment. Utilize a Visa or Mastercard or PayPal account to finalize the payment.

Select the format and download the document to your device. Make modifications. Fill out, edit, print, and sign the downloaded Utah Blind Trust Agreement. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print an additional copy, just navigate to the My documents section and select the document you need. Access the Utah Blind Trust Agreement with US Legal Forms, one of the largest collections of legal templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you intend to use US Legal Forms for the first time, here are straightforward guidelines to assist you in getting started.

- Ensure you have chosen the appropriate form for the city/state.

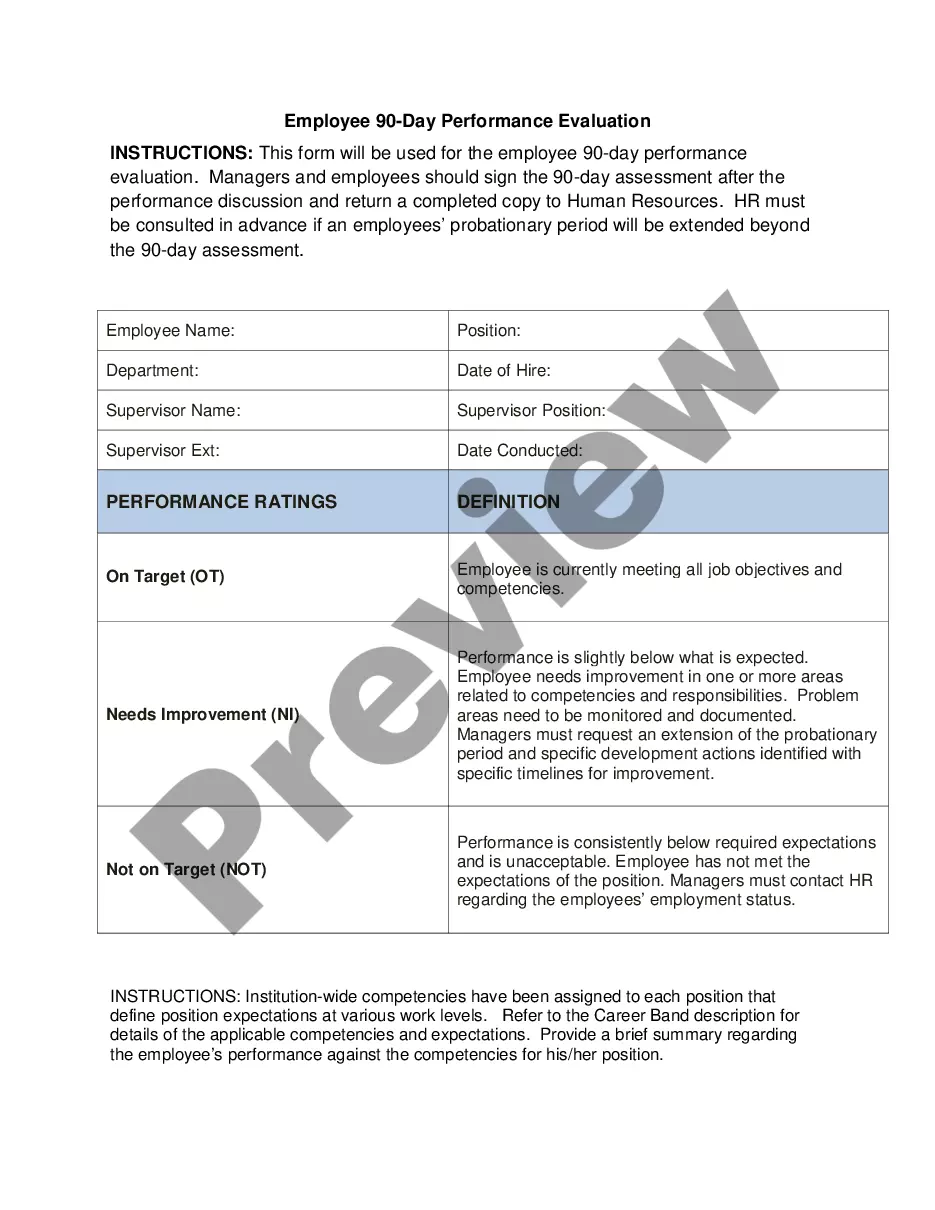

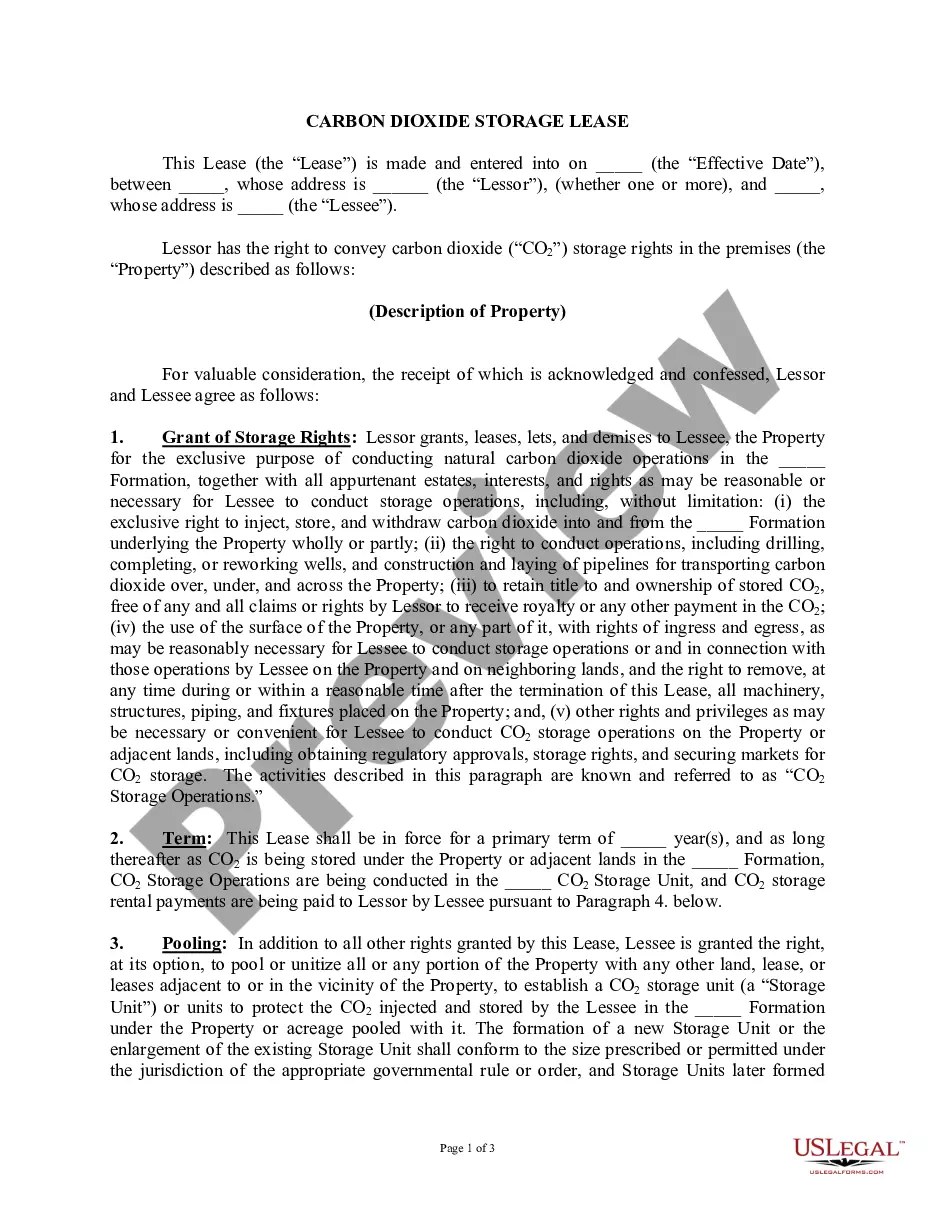

- Click the Preview button to review the document's content.

- Examine the document details to confirm that you have selected the appropriate form.

- If the form does not suit your requirements, use the Search section at the top of the screen to locate one that does.

- If you are content with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To set up a blind trust, begin by selecting a trustworthy trustee who will manage the assets without your input. After you find a trustee, draft a Utah Blind Trust Agreement outlining the terms and conditions of the trust. Following this, transfer the relevant assets into the trust and establish guidelines for how the trustee will operate. Utilizing platforms like USLegalForms can streamline this process and ensure that your trust is legally sound.

One of the biggest mistakes parents make is failing to communicate their intentions clearly. When establishing a trust fund, it is essential to have discussions with beneficiaries about the purpose of the trust and the expected outcomes. This communication helps prevent misunderstandings and ensures that everyone is on the same page regarding the Utah Blind Trust Agreement. Proper planning can set your family up for a successful future.

Starting a blind trust involves several straightforward steps. First, you need to define your assets and clarify the purpose of the trust. Next, you should consult with a legal expert to draft a Utah Blind Trust Agreement that meets your specific needs. Finally, transfer the designated assets into the trust, ensuring that you comply with all state regulations.

Filling out a trust form involves providing essential information about the trust's purpose, assets, and trustee. Begin by detailing the assets you want to place in the trust and identifying the beneficiaries. Next, ensure you clearly outline the terms of the trust in a Utah Blind Trust Agreement. For guidance, consider using platforms like uslegalforms, which offer ready-to-use templates and expert support in creating your trust.

An example of a blind trust could involve a public official who transfers stocks and real estate into a trust. The trustee manages these assets independently, without the official's knowledge about specific transactions. This arrangement ensures that the public official avoids any potential conflicts of interest while serving. It highlights the importance of a Utah Blind Trust Agreement in maintaining transparency and integrity.

A blind trust can offer significant privacy and asset management benefits. By placing your assets in a blind trust, you reduce conflicts of interest and ensure that your financial decisions remain separate from your personal involvement. This is especially useful for individuals in public service or high-profile positions. Ultimately, a well-drafted Utah Blind Trust Agreement helps safeguard your interests.

To form a blind trust, you need to draft a Utah Blind Trust Agreement, which outlines the trust's terms and conditions. First, select a reliable trustee who will manage the assets without your input. Next, specify the assets you wish to include in the trust. Finally, finalize the agreement with your trustee and ensure it complies with Utah laws to protect your privacy.

Yes, you can write your own trust in Utah, including a Utah Blind Trust Agreement. However, it is essential to understand the legal requirements to ensure your trust is valid and enforceable. While you can draft it yourself, consider using resources from platforms like US Legal Forms to guide you in creating a proper agreement. This approach can help prevent complications and secure your interests.

To establish a blind trust in Utah, begin by drafting a comprehensive Utah Blind Trust Agreement. This document outlines the terms and conditions of the trust, including the assets involved and the trustee's powers. After creating the agreement, you must fund the trust by transferring ownership of the assets to the trustee. It is advisable to consult a legal expert to ensure compliance with Utah laws and to address any specific needs you may have.

The four common types of trusts include revocable trusts, irrevocable trusts, testamentary trusts, and blind trusts. Revocable trusts allow changes during the grantor's lifetime, while irrevocable trusts cannot be altered easily once set up. Testamentary trusts are created through a will after the grantor's death, whereas blind trusts, like the Utah Blind Trust Agreement, prioritize confidentiality. Understanding these types can guide you in selecting the right trust for your needs.