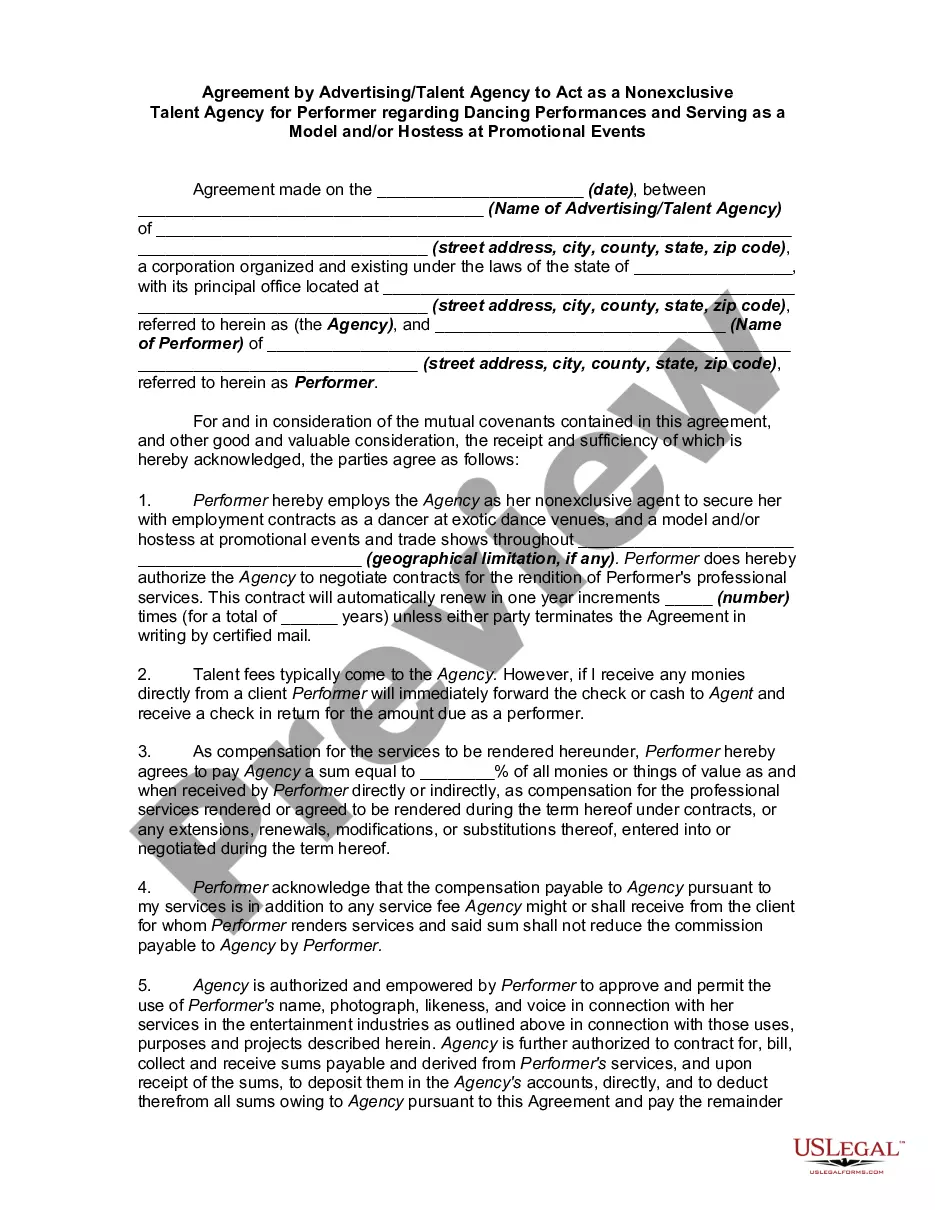

A Utah Line of Credit or Loan Agreement is a legal contract between a corporate or business borrower and a bank, specifying the terms and conditions of funding provided by the bank in the form of a line of credit or loan. This agreement outlines the responsibilities and obligations of both parties, including the amount borrowed, interest rates, repayment terms, collateral, and any other provisions governing the borrowing relationship. There are different types of Utah Line of Credit or Loan Agreements available, which can cater to the specific needs and circumstances of the borrower and the nature of their business. Some notable types include: 1. Revolving Line of Credit Agreement: This type of agreement grants the borrower the flexibility to borrow funds up to a predetermined credit limit as needed. The borrower has the ability to draw funds, repay the debt, and redraw up to the approved limit without having to reapply for credit each time. Interest is charged only on the outstanding balance. 2. Term Loan Agreement: Unlike a line of credit, a term loan provides a borrower with a lump sum amount that is payable over a fixed period. The repayment typically consists of both principal and interest, with the principal amount amortized into regular installments over the loan's term. 3. Secured Loan Agreement: This type of agreement requires the borrower to provide collateral to secure the loan. Collateral can include real estate, equipment, inventory, or other assets. In case of default, the lender has the right to seize the collateral as a means of repayment. 4. Unsecured Loan Agreement: Unlike a secured loan, an unsecured loan agreement does not require the borrower to pledge collateral. The approval and terms of an unsecured loan are often based on the borrower's creditworthiness, financial stability, and business plans. 5. Construction Loan Agreement: This agreement is specifically designed for funding construction projects. It provides the borrower with a predetermined amount to cover construction costs, materials, labor, and other expenses related to the project. Repayment is often structured in stages, based on the completion of specific milestones. 6. Equipment Financing Agreement: This type of agreement is used when a borrower requires funds to purchase or lease equipment for their business operations. The equipment itself serves as collateral for the loan, allowing the borrower to secure financing at reasonable interest rates. Utah Line of Credit or Loan Agreements are subject to relevant state and federal laws governing lending practices and must comply with regulations set forth by banking authorities. It is essential for both parties to carefully review the agreement terms, consult legal professionals if necessary, and ensure a clear understanding of their rights and obligations before entering into such an agreement.

Utah Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank

Description

How to fill out Utah Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Are you in the placement the place you will need papers for possibly business or specific functions almost every working day? There are plenty of legal papers web templates available online, but finding versions you can trust isn`t simple. US Legal Forms delivers thousands of type web templates, such as the Utah Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank, that happen to be published to fulfill state and federal specifications.

In case you are already knowledgeable about US Legal Forms website and also have your account, merely log in. Afterward, you can download the Utah Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank template.

Unless you offer an accounts and need to begin using US Legal Forms, follow these steps:

- Discover the type you want and ensure it is for the proper city/state.

- Use the Preview switch to check the shape.

- Browse the outline to ensure that you have chosen the appropriate type.

- If the type isn`t what you are looking for, use the Search industry to obtain the type that fits your needs and specifications.

- Once you obtain the proper type, simply click Purchase now.

- Select the rates prepare you desire, submit the specified info to create your account, and purchase the transaction using your PayPal or Visa or Mastercard.

- Select a convenient document file format and download your copy.

Find all of the papers web templates you may have bought in the My Forms menus. You may get a additional copy of Utah Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank any time, if needed. Just go through the necessary type to download or printing the papers template.

Use US Legal Forms, by far the most comprehensive collection of legal types, in order to save some time and stay away from faults. The assistance delivers professionally created legal papers web templates that can be used for a range of functions. Create your account on US Legal Forms and start producing your daily life easier.