Utah Demand Promissory Note

Description

How to fill out Demand Promissory Note?

Are you currently in a position where you consistently require documents for either business or personal uses? There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the Utah Demand Promissory Note, designed to meet both state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Utah Demand Promissory Note template.

Choose a suitable file format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Utah Demand Promissory Note whenever needed. Simply click the relevant template to download or print the document. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and minimize errors. The service provides professionally crafted legal document templates for a variety of purposes. Create an account on US Legal Forms and begin making your life a bit simpler.

- If you do not have an account and wish to utilize US Legal Forms, follow these instructions.

- Obtain the template you need and ensure it is for the correct city/state.

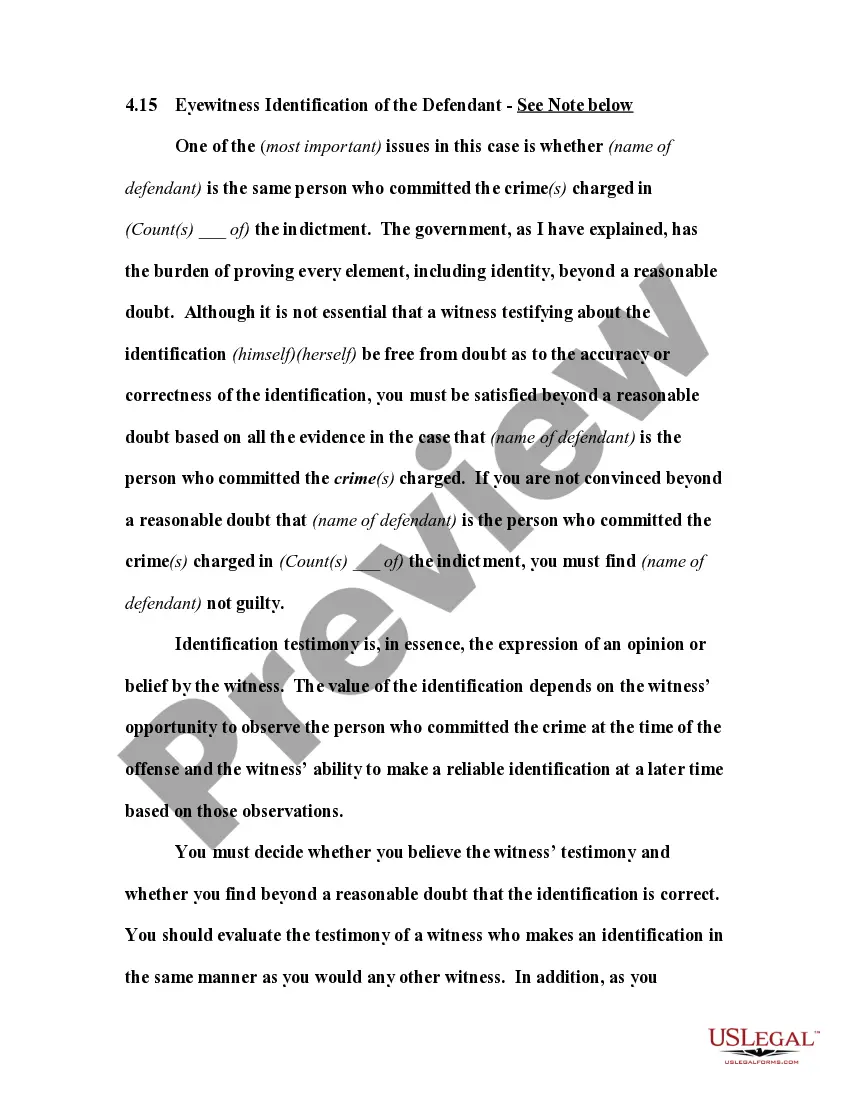

- Use the Review button to examine the form.

- Read the description to ensure you have selected the correct template.

- If the template is not what you are looking for, utilize the Research field to find the template that meets your requirements.

- Once you have the correct template, click Get now.

- Select the pricing plan you want, fill in the necessary information to set up your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

To obtain your Utah Demand Promissory Note, you can easily create one using our US Legal Forms platform. Simply select the appropriate template that fits your needs, fill in the necessary details, and customize it according to your requirements. Once completed, you can download, print, or save it for your use. This process ensures you have a legally sound document tailored to your situation.

The main difference between a promissory note and a demand promissory note lies in the repayment terms. A standard promissory note specifies a set repayment schedule, while a demand promissory note allows the lender to collect repayment at any time. Understanding these differences is crucial when creating a Utah Demand Promissory Note.

An example of an on demand promissory note could involve a family member lending $5,000 with an agreement that the borrower will repay the amount upon request. The note would detail the terms, like interest rate and payment method. Having a well-documented Utah Demand Promissory Note can prevent disputes between parties.

To write out a promissory note, include your contact information, the amount borrowed, and the terms of repayment. Specify the interest rate and any fees that may apply. It's crucial to use a clear structure to ensure that both parties understand the agreement. Utilizing a Utah Demand Promissory Note template can guide you in creating a legally binding document.

An on demand promissory note allows the lender to request repayment at any time. This type of note provides flexibility for the lender, as repayment is not tied to a specific schedule. Therefore, it’s essential for both parties to understand the terms outlined in a Utah Demand Promissory Note to prevent confusion.

A demand promissory note can become invalid for several reasons, such as lack of necessary signatures or if the terms are not clear. Additionally, if it does not comply with state laws, including those specific to Utah, it may also be deemed invalid. To ensure the legality and enforceability of your Utah Demand Promissory Note, using platforms like uslegalforms can guide you in drafting an appropriate document.

A promissory note is classified as a negotiable instrument, which means it can be transferred between parties for value. More specifically, the Utah Demand Promissory Note falls under the category of demand instruments, highlighting its feature that allows the lender to claim repayment at any moment. This classification offers flexibility, making it a valuable option in various financial transactions.

A promissory note can be payable on demand, depending on its terms. Specifically, a Utah Demand Promissory Note allows the lender to call for full repayment at their discretion, without needing to wait for a scheduled repayment date. This characteristic makes it a convenient option for those needing quick liquidity or uncertain about future repayment capabilities.

Yes, a promissory note can function as a demand instrument, especially in its demand form. In the case of a Utah Demand Promissory Note, it allows the lender to request repayment at any time, rather than waiting for a set maturity date. This feature can provide greater security to the lender, ensuring quicker access to funds.

Yes, a promissory note can be structured to be payable on demand, which allows the lender to request payment at any time. This flexibility benefits lenders seeking quick access to their funds. However, it is essential that the terms are explicitly stated within the note for clarity. For those interested in creating such legal documents, USLegalForms offers forms specifically designed for a Utah Demand Promissory Note.