Utah Credit Memo

Description

How to fill out Credit Memo?

Have you ever been in a situation where you need documents for either business or personal reasons almost continuously.

There are numerous reliable document templates available on the internet, but finding ones you can trust is challenging.

US Legal Forms offers thousands of document templates, including the Utah Credit Memo, designed to comply with state and federal regulations.

Once you find the appropriate document, click Buy now.

Select the payment plan you want, enter the necessary details to create your account, and purchase an order using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Credit Memo template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

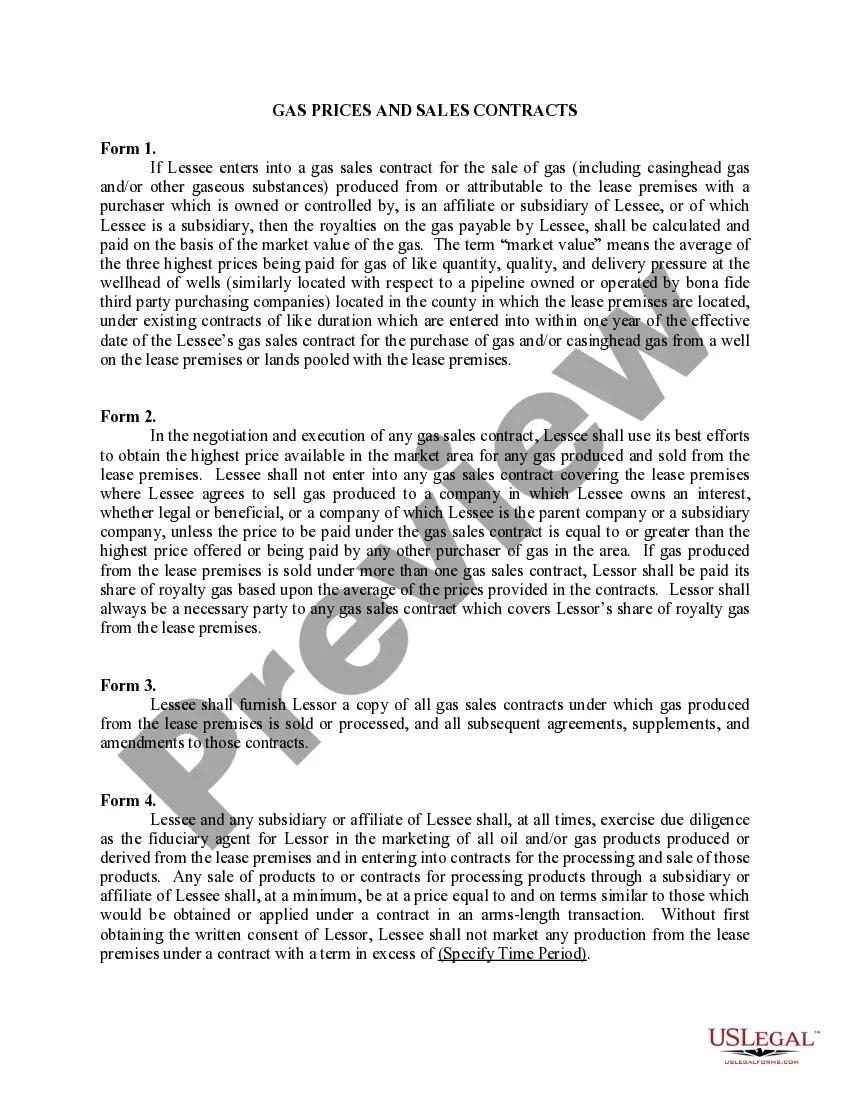

- Use the Review option to examine the document.

- Check the description to ensure that you have selected the right document.

- If the document is not what you’re looking for, use the Search field to find the document that meets your needs.

Form popularity

FAQ

Receiving a Utah Credit Memo from the bank usually indicates that there has been a change to your account, such as a correction of an error or a refund. Banks commonly issue these memos to adjust mistaken charges or to apply payment credits due to prior overpayments. Understanding why you receive this memo can aid you in managing your financial records. If you need assistance clarifying these details, uslegalforms can provide useful resources.

When you receive a Utah Credit Memo, you notice an adjustment on your bank statement that impacts your account balance. It's crucial to read the memo carefully, as it provides details on the nature of the adjustment made. This notice helps you keep track of your finances, ensuring clarity about your funds. You can also use uslegalforms to guide you through your financial records and keep everything organized.

Issuing a Utah Credit Memo means that a financial institution is correcting an entry in your account. This correction might relate to refunds, overpayments, or transaction errors. The memo serves as a formal acknowledgment of the adjustment made, ensuring transparency and accuracy in your financial dealings. It is essential to understand the implications of a credit memo on your overall account balance.

When a Utah Credit Memo is issued, it formally acknowledges a change in your account balance. This could mean a reduction in fees, corrections to billing errors, or adjustments to deposits. Essentially, the memo acts as a record of this change, providing clarity for both the bank and the account holder. It's important to keep a record of these memos for your financial documentation.

A bank may issue a Utah Credit Memo for various reasons, including correcting a previous transaction error or adjusting account balances. This process helps ensure that your financial records are accurate and up-to-date. Additionally, banks may issue credit memos to apply payments on fees or unexpected charges. Understanding these situations can help you manage your finances effectively.

A credit note is similar to a Utah Credit Memo but often used interchangeably in some contexts. For example, if a company mistakenly invoices a client for more items than delivered, they may issue a credit note to correct the error and adjust the client’s balance. Both documents serve to maintain accurate financial records and uphold customer satisfaction.

In bank reconciliation, a Utah Credit Memo might appear when your bank credits your account, often due to customer payments or overpayments. For instance, if a client pays more than their invoice, the bank may issue a credit memo reflecting that excess payment. This entry can help reconcile your books by matching what you expect to have in your account with your bank statement.

To effectively create a Utah Credit Memo, several key requirements must be met. First, a clear reference to the original invoice is necessary for tracking purposes. Additionally, the memo should provide a detailed description of the credit, including amounts and reasons for adjustments, to maintain transparency and understanding between you and your customer.

Entering a Utah Credit Memo into your accounting system is essential for accurate financial records. Start by locating the original invoice in your system. Then, create a new entry for the credit memo, linking it to the original invoice, and ensure the amount matches the credit issued. This process keeps your books balanced and reflects the accurate transaction history.

Writing a Utah Credit Memo involves a few straightforward steps. First, include your company's name, logo, and contact information at the top. Next, clearly identify the customer, provide the original invoice number, and describe the products or services being adjusted. Finally, state the reason for the credit and include the new balance to ensure clarity.