The Uniform Commercial Code (UCC) has been adopted in whole or in part by the legislatures of all 50 states.

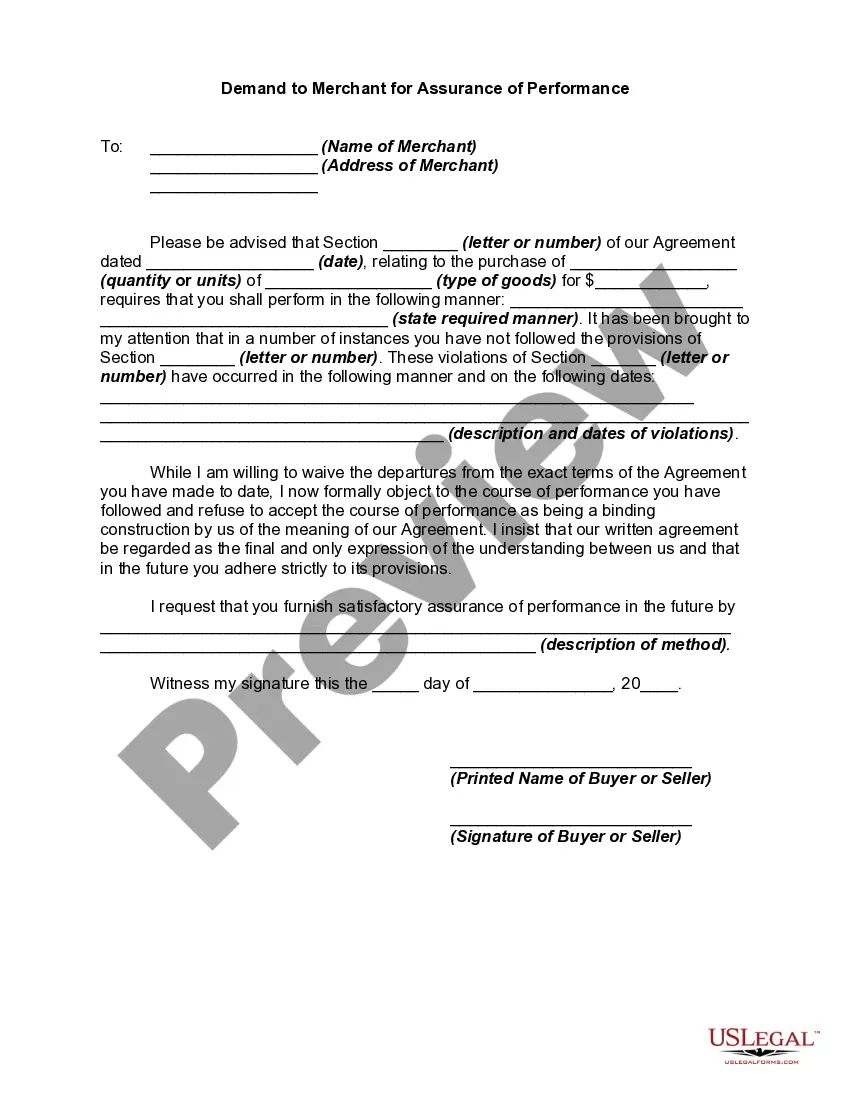

If a party has reasonable grounds to believe that another will not perform, he or she may demand in writing an assurance of performance. While waiting for a response, the party may suspend his or her own performance. If an assurance is not given within thirty days, this can be considered repudiation of the contract. This same rule applies if cooperation is needed and not given [UCC 2-311(3)(b)].

Title: Demanding Assurance of Performance in Utah: Exploring the Different Types of Utah Demand to Merchant Introduction: In the dynamic world of commerce and business transactions, ensuring the fulfillment of contractual obligations becomes crucial. In Utah, a Demand to Merchant for Assurance of Performance is a legal tool that allows parties to seek assurance regarding the fulfillment of obligations. This article provides a detailed description of what a Utah Demand to Merchant for Assurance of Performance entails, its purpose, and highlights the presence of different types of such demands in the state. Understanding a Utah Demand to Merchant for Assurance of Performance: A Utah Demand to Merchant for Assurance of Performance is a formal written notice issued by one party in a commercial transaction to another, seeking assurance that agreed-upon obligations will be fulfilled. It is a proactive measure that helps businesses prevent delays, mitigate risks, and protect their interests. Purpose of a Utah Demand to Merchant for Assurance of Performance: The primary purpose of a Utah Demand to Merchant for Assurance of Performance is to enable the demanding party to overcome any doubts or concerns regarding the other party's ability to fulfill contractual obligations. This demand serves as a preliminary step in resolving disputes and entitles the demanding party to suspend performance until reasonable assurance is provided. Different Types of Utah Demand to Merchant for Assurance of Performance: 1. Financial Assurance Demand: This type of demand is typically made when a party questions the other party's financial stability or doubts their ability to meet financial obligations. The demanding party may request financial statements, credit reports, or other relevant documentation to ensure the other party's financial capacity to perform as agreed. 2. Performance Assurance Demand: This type of demand is made when there are concerns about the ability of the other party to perform specific contractual obligations. The demanding party may request detailed plans, schedules, or proof of capabilities to ensure the smooth execution of agreed deliverables. 3. Quality Assurance Demand: If the demanding party has doubts or concerns about the quality of goods or services to be delivered, a quality assurance demand can be issued. This type of demand may involve requesting samples, prototypes, or certifications to ensure compliance with specified quality standards. 4. Delivery Assurance Demand: In cases where delays or logistical issues are anticipated, a delivery assurance demand is used. The demanding party may request detailed shipping or delivery plans, tracking mechanisms, or alternative arrangements to ensure timely receipt of goods or services. Conclusion: When entering into commercial contracts in Utah, Demand to Merchant for Assurance of Performance acts as a safeguard against potential breaches and uncertainties. By understanding and utilizing the different types of demands available, businesses can proactively address concerns, maintain transparency, and uphold the reliability of their business transactions.Title: Demanding Assurance of Performance in Utah: Exploring the Different Types of Utah Demand to Merchant Introduction: In the dynamic world of commerce and business transactions, ensuring the fulfillment of contractual obligations becomes crucial. In Utah, a Demand to Merchant for Assurance of Performance is a legal tool that allows parties to seek assurance regarding the fulfillment of obligations. This article provides a detailed description of what a Utah Demand to Merchant for Assurance of Performance entails, its purpose, and highlights the presence of different types of such demands in the state. Understanding a Utah Demand to Merchant for Assurance of Performance: A Utah Demand to Merchant for Assurance of Performance is a formal written notice issued by one party in a commercial transaction to another, seeking assurance that agreed-upon obligations will be fulfilled. It is a proactive measure that helps businesses prevent delays, mitigate risks, and protect their interests. Purpose of a Utah Demand to Merchant for Assurance of Performance: The primary purpose of a Utah Demand to Merchant for Assurance of Performance is to enable the demanding party to overcome any doubts or concerns regarding the other party's ability to fulfill contractual obligations. This demand serves as a preliminary step in resolving disputes and entitles the demanding party to suspend performance until reasonable assurance is provided. Different Types of Utah Demand to Merchant for Assurance of Performance: 1. Financial Assurance Demand: This type of demand is typically made when a party questions the other party's financial stability or doubts their ability to meet financial obligations. The demanding party may request financial statements, credit reports, or other relevant documentation to ensure the other party's financial capacity to perform as agreed. 2. Performance Assurance Demand: This type of demand is made when there are concerns about the ability of the other party to perform specific contractual obligations. The demanding party may request detailed plans, schedules, or proof of capabilities to ensure the smooth execution of agreed deliverables. 3. Quality Assurance Demand: If the demanding party has doubts or concerns about the quality of goods or services to be delivered, a quality assurance demand can be issued. This type of demand may involve requesting samples, prototypes, or certifications to ensure compliance with specified quality standards. 4. Delivery Assurance Demand: In cases where delays or logistical issues are anticipated, a delivery assurance demand is used. The demanding party may request detailed shipping or delivery plans, tracking mechanisms, or alternative arrangements to ensure timely receipt of goods or services. Conclusion: When entering into commercial contracts in Utah, Demand to Merchant for Assurance of Performance acts as a safeguard against potential breaches and uncertainties. By understanding and utilizing the different types of demands available, businesses can proactively address concerns, maintain transparency, and uphold the reliability of their business transactions.