Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

Utah Partnership Agreement Between Accountants

Description

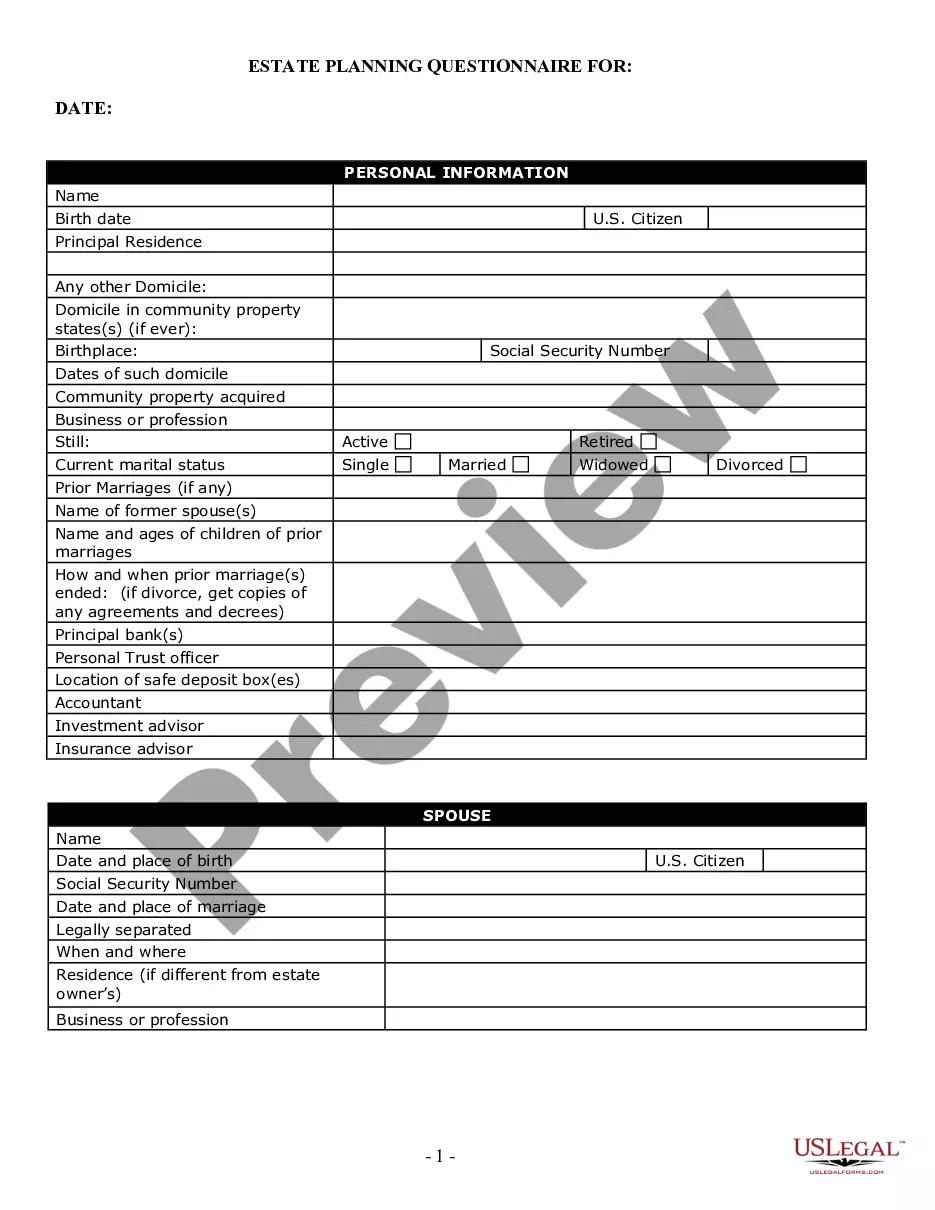

How to fill out Partnership Agreement Between Accountants?

US Legal Forms - one of the largest repositories of legal documents in the US - offers a vast selection of legal document templates that you can download or print.

By utilizing this website, you will find thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly access the latest forms, such as the Utah Partnership Agreement Between Accountants.

If you currently have an account, Log In and download the Utah Partnership Agreement Between Accountants from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms under the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Utah Partnership Agreement Between Accountants. Each template added to your account has no expiration date and belongs to you for an extended period. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Utah Partnership Agreement Between Accountants with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure that you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Check the form description to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, choose the payment option you prefer and provide your information to sign up for an account.

Form popularity

FAQ

To get a partnership agreement, gather information about your partnership's structure and decide on the roles of each partner. Then, utilize a reliable service like USLegalForms to access a Utah Partnership Agreement Between Accountants template. This allows you to craft a solid agreement efficiently, ensuring all necessary provisions are included for your particular business situation.

Obtaining a partnership agreement involves drafting a document that captures each partner's contributions and obligations. You can create a Utah Partnership Agreement Between Accountants by either writing one from scratch or using template services available online. USLegalForms offers various templates that you can customize to suit your partnership's specific needs, ensuring you cover all essential details.

Forming a partnership in Utah is straightforward. Start by choosing a partnership structure that fits your needs—general partnership, limited partnership, or limited liability partnership. Next, draft a Utah Partnership Agreement Between Accountants that outlines each partner's rights and responsibilities. You can use resources available through USLegalForms to simplify this process and ensure all legal requirements are met.

To obtain proof of partnership, you typically need a formal Utah Partnership Agreement Between Accountants. This agreement serves as legal documentation showing the partnership's formation and the roles of each partner. You can also gather supporting documents like tax filings and bank statements that list the partnership's name. If you use services like USLegalForms, they can guide you in drafting a comprehensive agreement.

To form a partnership, begin by discussing the structure with your potential partners and agreeing on key terms. Next, create and document a partnership agreement that outlines roles, contributions, and profit-sharing arrangements. After that, register your partnership with the appropriate state authorities. Utilizing a Utah Partnership Agreement Between Accountants can simplify these steps and ensure compliance with local regulations.

Drafting a partnership involves writing a document that clearly defines the terms of the partnership. Start with the basic information about your partnership, then describe each partner's capital contributions and roles. Detail how profits and losses will be distributed. For comprehensive guidance, refer to a Utah Partnership Agreement Between Accountants template to ensure nothing is overlooked.

Filling out a partnership agreement requires clear communication between all partners. Start by outlining the roles and responsibilities of each partner, along with their financial contributions. Be sure to include provisions for dispute resolution and termination of the partnership. Using a Utah Partnership Agreement Between Accountants can provide guidance and ensure you address all necessary clauses.

To fill out a partnership form, begin by gathering essential information about all partners involved. Each partner's name, address, and contribution should be included clearly. Ensure you specify the partnership's purpose and duration. Utilizing a professional resource, such as a Utah Partnership Agreement Between Accountants template, can streamline this process and ensure accuracy.

Forming a partnership in accounting requires a clear understanding of roles and responsibilities among partners. The first step involves drafting a Utah Partnership Agreement Between Accountants, which outlines each partner's contributions, profit-sharing, and decision-making processes. This agreement serves as a foundation for collaboration and helps prevent misunderstandings. Using a platform like USLegalForms can simplify this process by providing customizable templates and legal guidance tailored to your needs.

If you operate a business or earn income in Utah, you are likely required to file a state return. This includes partnerships, LLCs, and other forms of business entities. Consulting with professionals when creating a Utah Partnership Agreement Between Accountants ensures you understand your filing obligations and helps you remain compliant.