Utah Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Revocable Trust Agreement With Corporate Trustee?

Are you currently in a situation where you require documents for both business and personal purposes frequently.

There are many legal document templates accessible on the internet, but finding reliable ones can be challenging.

US Legal Forms provides a vast selection of form templates, such as the Utah Revocable Trust Agreement with Corporate Trustee, designed to meet federal and state regulations.

Once you find the appropriate document, click Purchase now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and complete the transaction using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Utah Revocable Trust Agreement with Corporate Trustee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

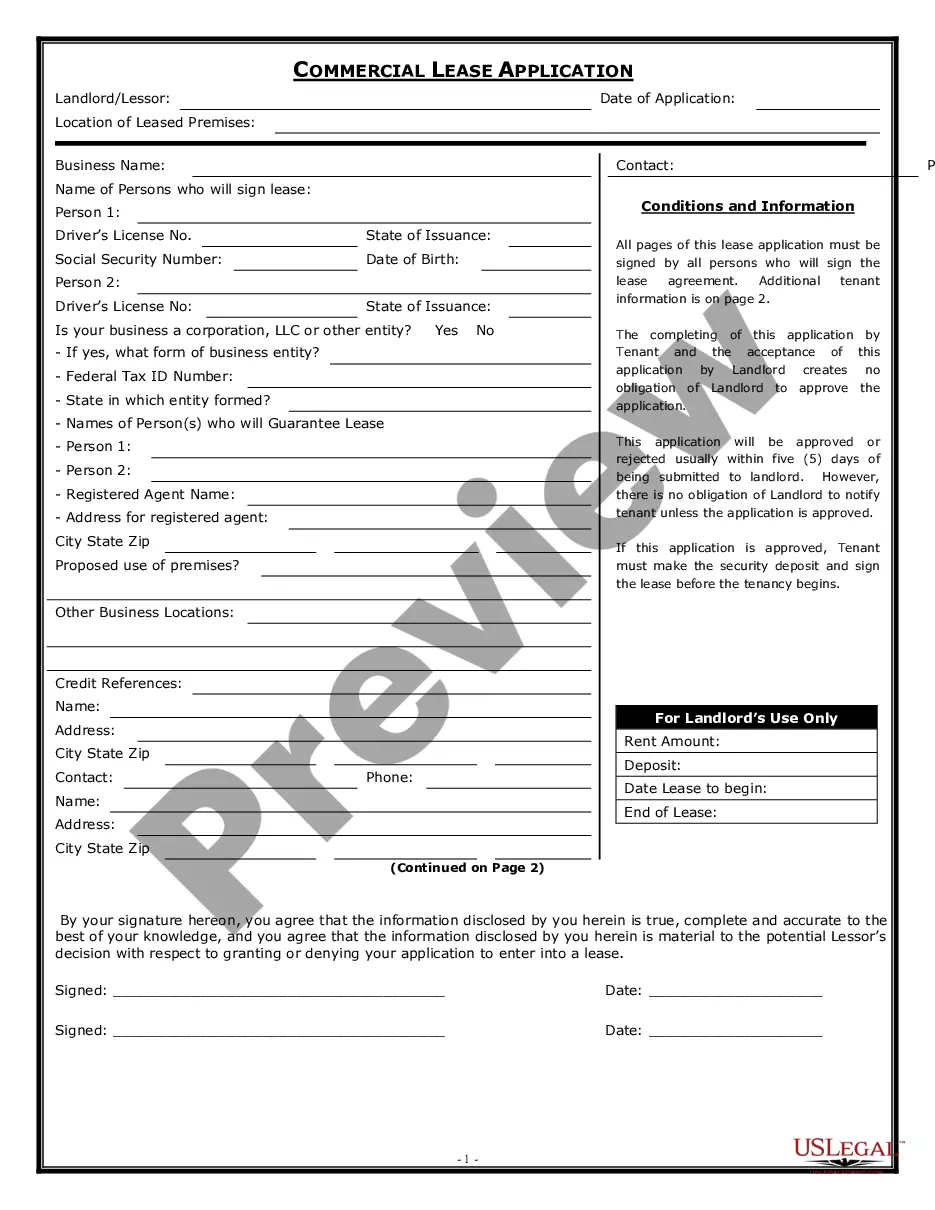

- Utilize the Review button to evaluate the form.

- Examine the summary to confirm you have chosen the right template.

- If the document does not meet your expectations, use the Search field to locate a template that suits your requirements.

Form popularity

FAQ

Whether a co-trustee can act alone depends on the terms set forth in the trust agreement. In a well-structured Utah Revocable Trust Agreement with Corporate Trustee, specific guidelines clarify this capability. If permitted, a co-trustee can make decisions independently to expedite processes, but they should still keep the other co-trustees informed. Legal protections outlined in the trust can help avoid potential disputes stemming from unilateral actions.

Yes, in Utah, co-trustees can act independently if the trust agreement allows for it. This flexibility is often beneficial in a Utah Revocable Trust Agreement with Corporate Trustee, as it helps streamline decisions. However, it's essential for co-trustees to communicate openly and ensure their actions align with the trust's best interests. Clear guidelines in the agreement can help facilitate independent actions while maintaining accountability.

An independent co-trustee is a trustee who shares management responsibilities for a trust without having familial ties to the trust creator. In a Utah Revocable Trust Agreement with Corporate Trustee, this role often enhances objectivity and impartiality in decision-making. Independent co-trustees can help avoid conflicts of interest and ensure that the trust assets are managed effectively. Utilizing an independent co-trustee can create a balanced approach to trust administration.

Corporate trustees are departments at banks or other investment firms hired to build and manage a trust. People hire corporate trustees for their professional experience in trust matters that a family member or friend may not have.

Yes, a trustee can own units in a unit trust - as long as you include the trustee's name and their capacity. For example: 'John Smith in his capacity as the trustee of the John Smith Family Trust'. In this case, the trustee holds the units in the unit trust on trust for the beneficiaries of the trustee's own trust.

A trust cannot own units in a unit trust because the law . says a trust is not a separate legal person. For example, the 'John Smith Family Trust' cannot own units or any other property.

Yes, a corporate trustee can be the beneficiary of the trust - as long as you include the trustee's name and their capacity.

In California, Trustees can also be beneficiaries of a Trust. Even if the Trust has multiple beneficiaries. That means one person can be both the Trust manager (Trustee) and benefit from the Trust (beneficiary). You may ask 'isn't this a conflict of interest?

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.