A Utah Purchase Agreement by a Corporation of Assets of a Partnership is a legally binding document that outlines the terms and conditions for the purchase of assets owned by a partnership by a corporation in the state of Utah. This agreement governs the transfer of tangible and intangible assets from one entity to another, ensuring a smooth and transparent transaction. The purchase agreement includes key elements such as the parties involved, the purchase price, payment terms, asset description, representations and warranties, and closing conditions. It is essential for both the corporation and partnership to carefully negotiate and draft this agreement to protect their respective interests and ensure a fair transaction. Utah recognizes different types of Purchase Agreements by a Corporation of Assets of a Partnership, which include: 1. Asset Purchase Agreement: This type of agreement involves the acquisition of specific assets of a partnership by a corporation, such as inventory, equipment, intellectual property rights, contracts, and customer lists. The agreement specifies the exact assets being purchased and any liabilities assumed by the corporation. 2. Stock Purchase Agreement: In this type of agreement, the corporation acquires the partnership's stock, which represents ownership in the partnership and all its assets. The agreement outlines the number of shares, purchase price per share, and any conditions or warranties associated with the share transfer. 3. Merger Agreement: A merger agreement involves the complete absorption of a partnership by a corporation. This agreement dictates the terms of merging the entities, including the transfer of all assets and liabilities of the partnership to the corporation. It also covers the exchange of partnership ownership interests in corporate stock or cash consideration. 4. Equity Purchase Agreement: This agreement involves the purchase of partnership ownership interests by a corporation. Instead of acquiring specific assets or stock, the corporation buys a percentage of the partnership's equity, entitling it to a proportional share of profits, losses, and governance rights. The agreement defines the equity percentage, purchase price, and any rights or restrictions associated with the acquired equity. In summary, a Utah Purchase Agreement by a Corporation of Assets of a Partnership is a vital legal document governing the purchase of partnership assets by a corporation. Depending on the nature of the transaction, different types of agreements, such as Asset Purchase, Stock Purchase, Merger, or Equity Purchase agreements, may be used to facilitate the transfer of assets and ensure a successful transaction.

Utah Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Utah Purchase Agreement By A Corporation Of Assets Of A Partnership?

US Legal Forms - one of many largest libraries of legitimate kinds in the USA - gives a wide array of legitimate document templates you can download or print. Using the website, you can get thousands of kinds for enterprise and person uses, sorted by groups, claims, or search phrases.You can get the most recent models of kinds such as the Utah Purchase Agreement by a Corporation of Assets of a Partnership within minutes.

If you already possess a registration, log in and download Utah Purchase Agreement by a Corporation of Assets of a Partnership from the US Legal Forms library. The Download option will appear on every single kind you perspective. You get access to all in the past delivered electronically kinds within the My Forms tab of your own accounts.

If you would like use US Legal Forms for the first time, listed here are simple directions to help you started off:

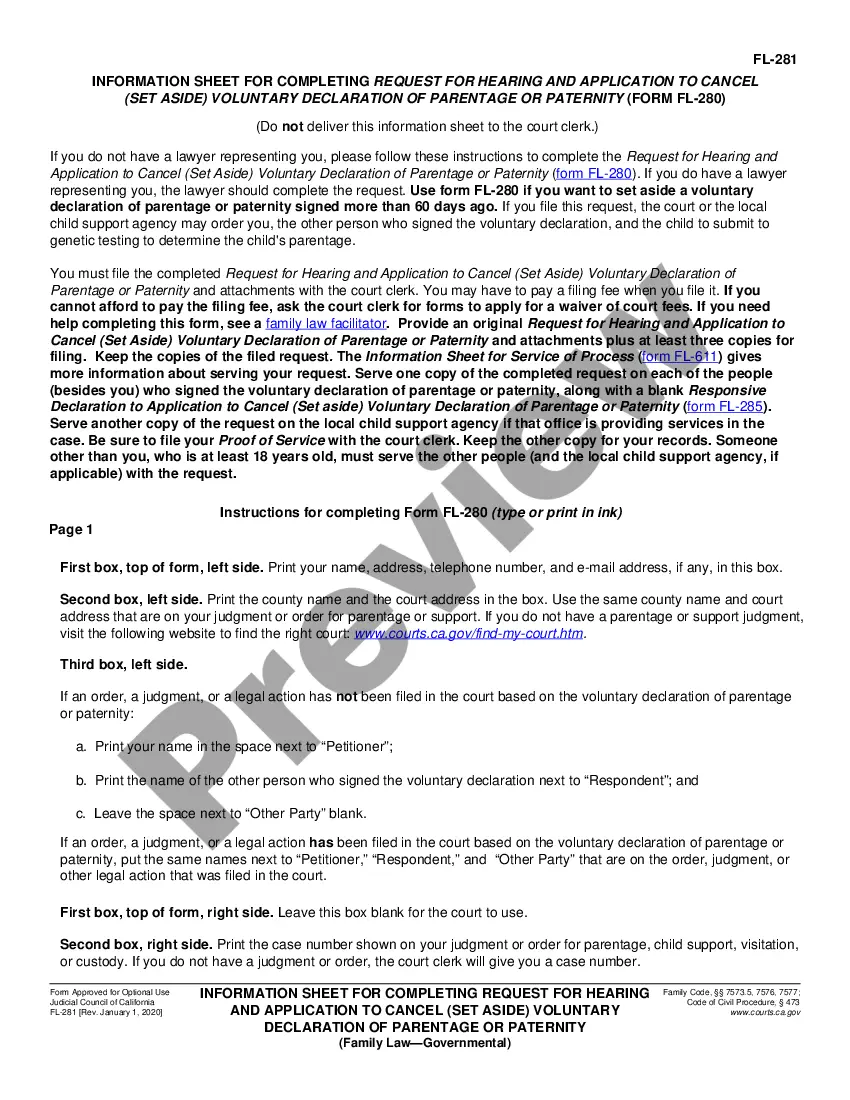

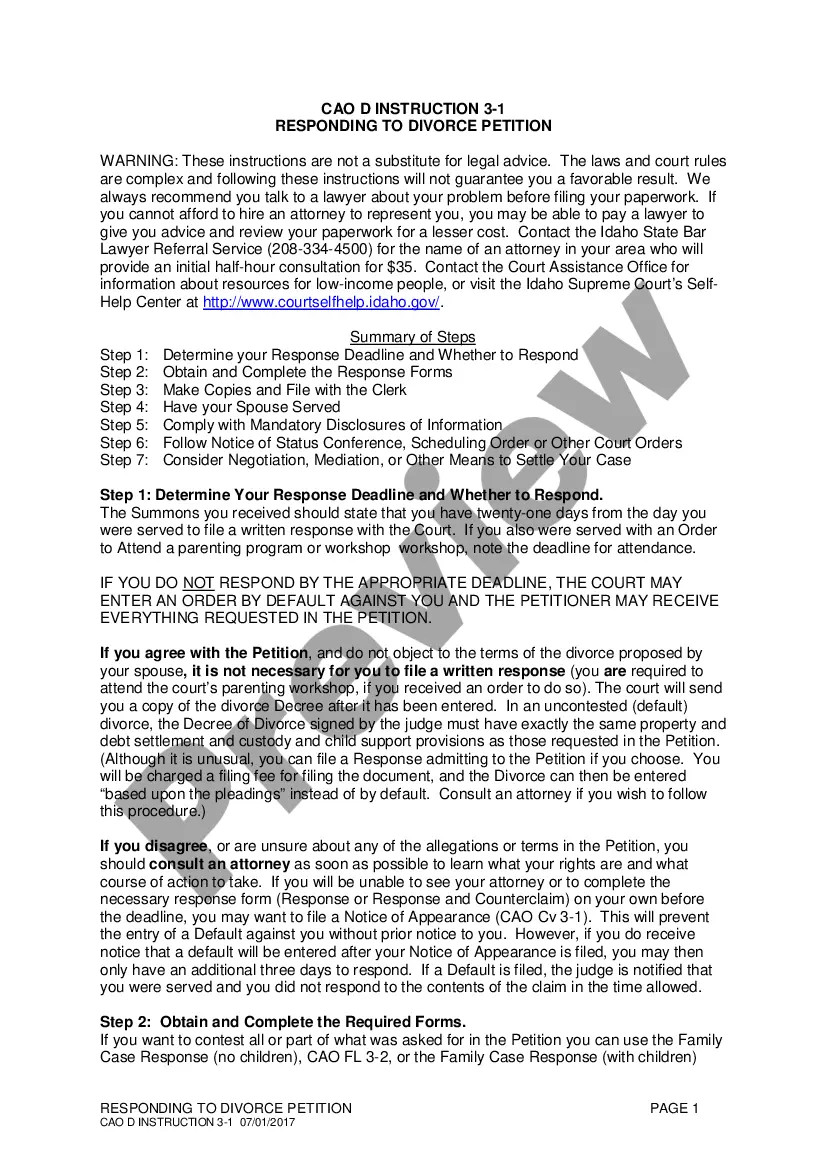

- Make sure you have selected the best kind for the metropolis/area. Select the Review option to examine the form`s information. Read the kind description to actually have chosen the correct kind.

- In case the kind doesn`t satisfy your requirements, utilize the Research area near the top of the display to get the one who does.

- When you are pleased with the shape, validate your option by clicking on the Get now option. Then, select the rates prepare you prefer and provide your qualifications to sign up for the accounts.

- Approach the purchase. Make use of charge card or PayPal accounts to perform the purchase.

- Find the format and download the shape in your product.

- Make changes. Fill up, edit and print and indicator the delivered electronically Utah Purchase Agreement by a Corporation of Assets of a Partnership.

Every template you put into your bank account lacks an expiry time and it is your own property forever. So, if you would like download or print one more copy, just go to the My Forms portion and click on in the kind you need.

Gain access to the Utah Purchase Agreement by a Corporation of Assets of a Partnership with US Legal Forms, one of the most extensive library of legitimate document templates. Use thousands of specialist and express-certain templates that meet up with your business or person requirements and requirements.

Form popularity

FAQ

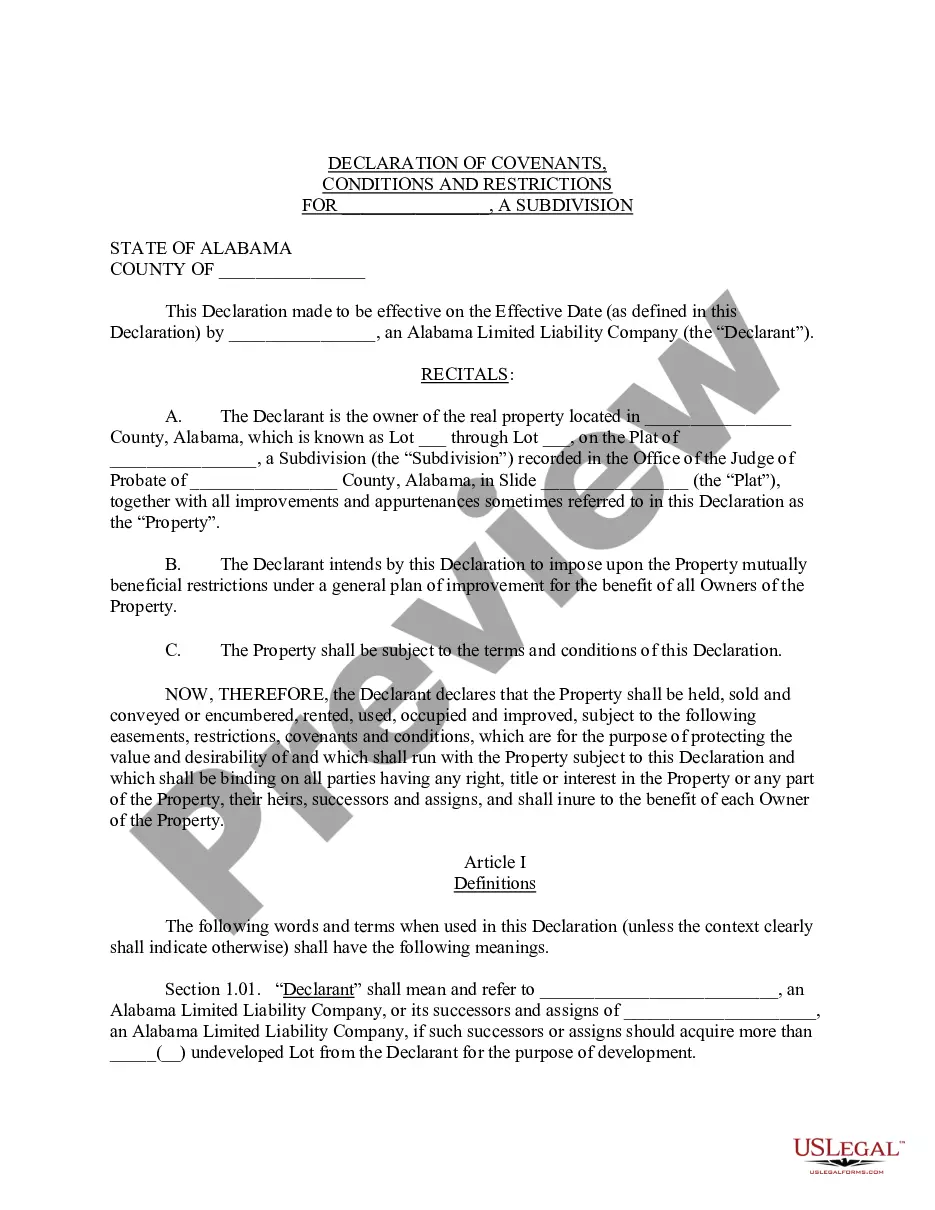

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

A contribution agreement, also known as a deed of contribution, is a legal document that provides for the transfer of an asset from one party to another party. It will express the conditions required including liability, indemnities and more.

This agreement sets out the terms and conditions by which a management equityholder rolls over exiting equity in the target portfolio company and receives equity in a newly-formed holding company in a tax beneficial exchange.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

What Is an Equity Contribution Agreement? An equity contribution agreement occurs between two parties that are agreeing to pool together cash, capital, and other assets into a company to conduct business. The capital is provided in exchange for a portion of the equity in the company venture.

By Practical Law Real Estate. Maintained 2022 USA (National/Federal) A form agreement favoring the investor member for the contribution of vacant land intended for development to a newly-formed joint venture (JV) between two parties, a developer and an investor.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

More info

Org — Updated: 04:53:06 | Last updated: 19:02:08.